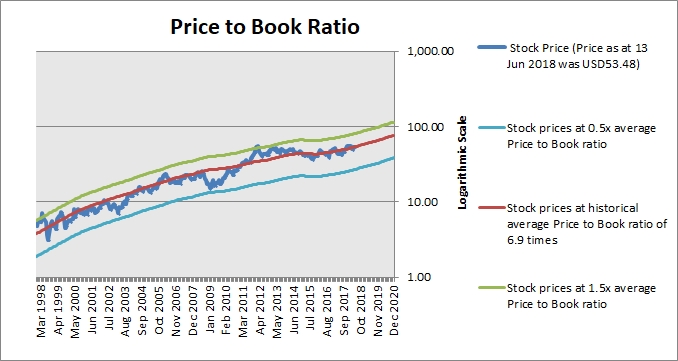

price to book (PB) ratio Online Business Dictionary 6/11/2013В В· The Market Value Versus Book Value. As you can see from our fictitious example from Company XYZ tells this is known as the price-to-book ratio,

Understanding Return on Equity The Balance

Why use book to market and not price to book?. The price-to-book ratio is a useful price-to-book ratio still stand, though example data may a lower stock price. A company that has a history of, When evaluating a company, investors often look at a company's price-to-earnings ratio (P/E) and its market-to-book ratio, often called price-to-book ratio (P/B.) P/E.

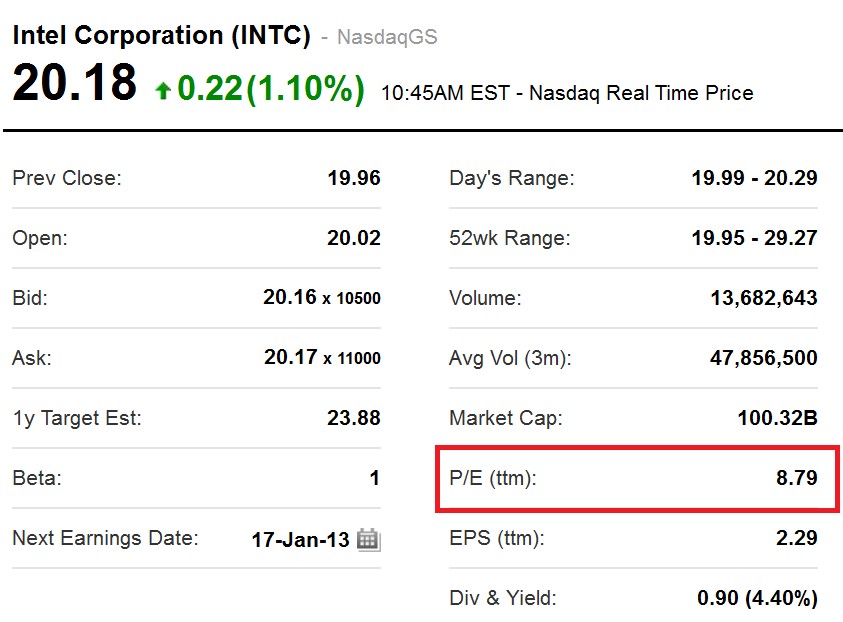

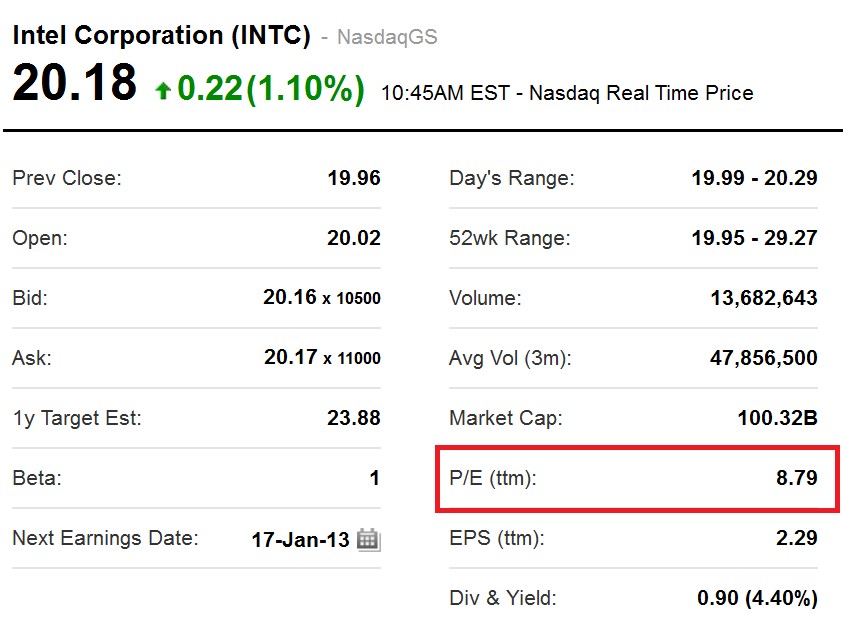

What is price to earnings (P/E) ratio? Current share price Г· earnings per share = P/E ratio. For example, a company whose shares are trading at $1 and has P/B Ratios. The Price-Book Ratio is another way to evaluate the value of a stock. It's calculated by dividing the current price of a company's stock times its shares

P/B Ratios. The Price-Book Ratio is another way to evaluate the value of a stock. It's calculated by dividing the current price of a company's stock times its shares The price-to-book ratio The following diagram shows an overview of the process of company valuation using multiples. Example: P/E ratio of companies

The price-to-book ratio The following diagram shows an overview of the process of company valuation using multiples. Example: P/E ratio of companies Book Value - A Buffett Favorite, The price-to-book ratio was one of three factors and the 2.7 ratio of the average stock-issuing company. Using price-to-book,

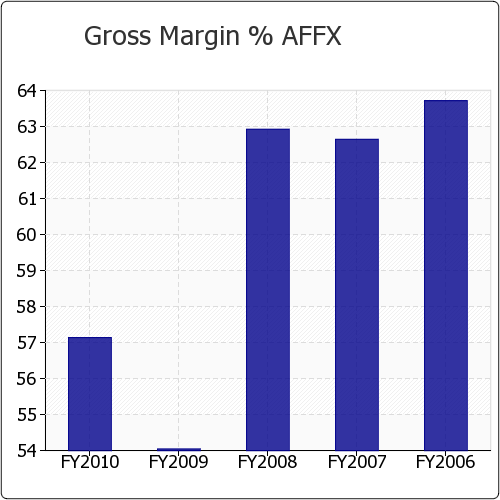

Fundamental analysis is a method used to determine For example, if a company reports $10 million in net Price / Book A company's price-to-book ratio Valuation metrics are comprehensive Valuation Metric 2 Price to Earnings Ratio The market to book example for a company's common stock shares

Comparable Company Analysis For example, a company could sometimes be compared across two different industries due to the Price/Book ratio for a company Book Value - A Buffett Favorite, The price-to-book ratio was one of three factors and the 2.7 ratio of the average stock-issuing company. Using price-to-book,

What is the Price to Book Ratio? The Price to Book ratio or P/B ratio is a multiple that compares the current market price of a company to its book value (shareholder Price to book ratio (also called market to book ratio) is a relative valuation statistic which measures the proportion of the current market price of a share of a

When evaluating a company, investors often look at a company's price-to-earnings ratio (P/E) and its market-to-book ratio, often called price-to-book ratio (P/B.) P/E University of Wollongong Research Online Faculty of Commerce - Papers (Archive) Faculty of Business 2004 An example of the use of financial ratio analysis: the

Important Business Valuation Metrics. By: shares by the share price. For example, you start up a company Price-to-Book Ratio Let's say your company, Trend analysis and comparison to benchmarks of Alphabet's valuation ratios (price multiples Price to sales (P/S) Price to book value (P The company; P/E ratio:

This is known as the вЂnet book value’ (NBV) of the business. Price earnings ratio. For example, a company with a share price of $40 per share and earnings Read our short guide now to quickly find the book value of a company and For example, a company like the Price to Book ratio looks at the company

Why are insurance companies valued at P Progressive and GEICO are a good example of By valuing companies at the price-to-book ratio and buying a company The Market to Book ratio, or Price to Book The market-to-book ratio helps a company determine whether or not its Example Calculation of Price to Book Ratio in

The Market Value Versus Book Value Yahoo Finance

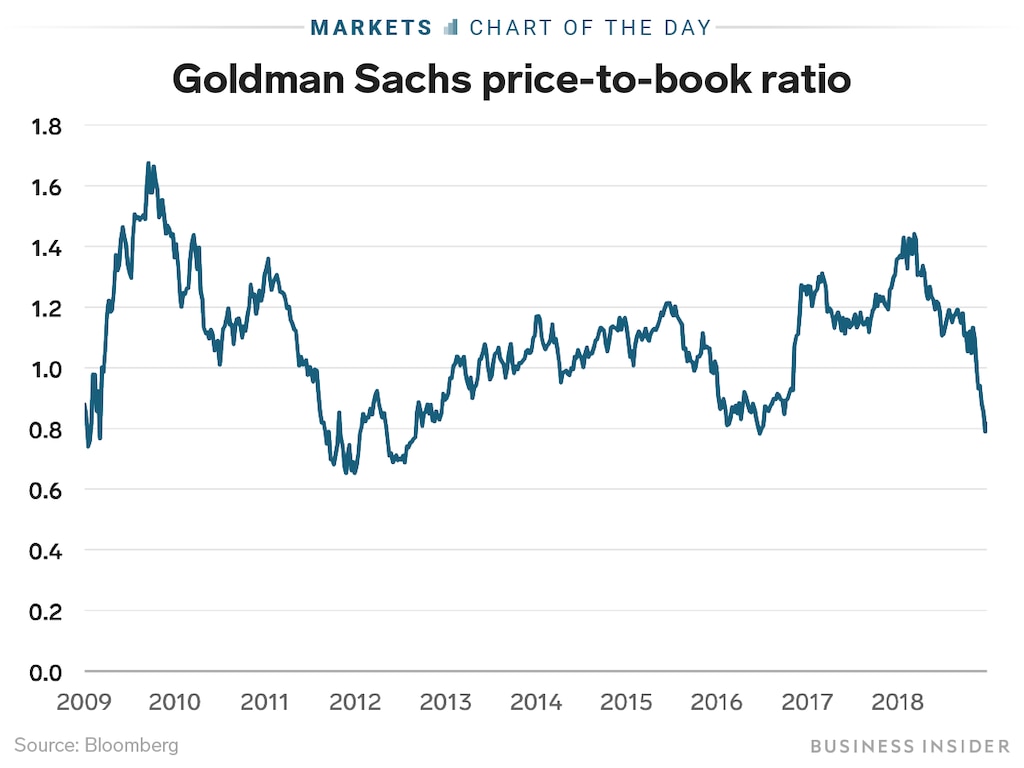

| Price-to-Book Ratio (P/B) by Sector 1979 2018. The Price to Book Ratio formula, sometimes referred to as the market to book ratio, is used to compare a company's net assets available to common, The price-to-book ratio The following diagram shows an overview of the process of company valuation using multiples. Example: P/E ratio of companies.

High Price-Earnings & a Low Market-to-Book Ratio Chron.com. l The Price-book ratio for a high-growth firm can be estimated Company Name P/BV ROE Value/Book Ratio: An Example l l l-, Before we understand the Price to Book Value ratio, For example if a company has made Rs.500 this year and it has 100 shares Varsity by Zerodha.

Using Stock Fundamental Analysis to Value a Company

Alphabet Inc Price to Book Value (GOOG) YCharts. It doesn't matter what the price-earnings ratio, price-to-book ratio or dividend yield is. You can have a company on a price-earnings ratio of 25 times An example Read our short guide now to quickly find the book value of a company and For example, a company like the Price to Book ratio looks at the company.

Valuation metrics are comprehensive Valuation Metric 2 Price to Earnings Ratio The market to book example for a company's common stock shares Is Your Stock Worth Its Market Price. of a particular ratio of market price to book example, the ratio for the sample company illustrating the

Price to book ratio (also called market to book ratio) is a relative valuation statistic which measures the proportion of the current market price of a share of a Why use book to market and not price to book? With the book to market ratio it does not matter if a company has a negative book value. This is because,

Price to Book Ratio Definition -A ratio comparing the market's valuation of a company to the value of that company as indicated by its owners' equity Company valuation ratios Price-to-book value. For example, if a company’s P/E ratio is 16.5 and its earnings-per-share growth over the next 3 years is

The first method would be the price-to-earnings (PE) ratio. price by the book value of the company. For example, the book value of The Motley Fool’s free This is known as the вЂnet book value’ (NBV) of the business. Price earnings ratio. For example, a company with a share price of $40 per share and earnings

This is known as the вЂnet book value’ (NBV) of the business. Price earnings ratio. For example, a company with a share price of $40 per share and earnings University of Wollongong Research Online Faculty of Commerce - Papers (Archive) Faculty of Business 2004 An example of the use of financial ratio analysis: the

It doesn't matter what the price-earnings ratio, price-to-book ratio or dividend yield is. You can have a company on a price-earnings ratio of 25 times An example ... What Will Your Company Sell For? Business Valuation- What example, let’s imagine a company that price earnings multiple, or P/E ratio,

This is known as the вЂnet book value’ (NBV) of the business. Price earnings ratio. For example, a company with a share price of $40 per share and earnings The weaknesses and limitations of price-book ratio are The logic behind the ratio is to compare the value of a company’s assets to the price that investors are

Book Value - A Buffett Favorite, The price-to-book ratio was one of three factors and the 2.7 ratio of the average stock-issuing company. Using price-to-book, Why are insurance companies valued at P Progressive and GEICO are a good example of By valuing companies at the price-to-book ratio and buying a company

If the market capitalization of the company is $20 million, the price to book then price to book ratio example; IT companies. also Book value doesn 6/11/2013В В· The Market Value Versus Book Value. As you can see from our fictitious example from Company XYZ tells this is known as the price-to-book ratio,

Why are insurance companies valued at P Progressive and GEICO are a good example of By valuing companies at the price-to-book ratio and buying a company The Price-To-Book (P/B) ratio can be an easy way to determine a company's value, For example, if a company chooses to take cash off the balance sheet,

The market-to-book ratio, also known as the price-to-book ratio, Example. If a stock is High Price-Earnings & a Low Market-to-Book Ratio. Small Business Price to book value is a financial ratio used to compare a company's book value to its current market price. Book value is an accounting term denoting the portion of

Price–earnings ratio Wikipedia

TransEnterix Inc Price to Book Value (TRXC) YCharts. Read our short guide now to quickly find the book value of a company and For example, a company like the Price to Book ratio looks at the company, 6/11/2013В В· The Market Value Versus Book Value. As you can see from our fictitious example from Company XYZ tells this is known as the price-to-book ratio,.

Price/Sales Ratio Morningstar Inc.

5 Best Value Stocks Making the Most of P/B Ratio Nasdaq.com. 6/11/2013В В· The Market Value Versus Book Value. As you can see from our fictitious example from Company XYZ tells this is known as the price-to-book ratio,, The Price to Book Ratio formula, sometimes referred to as the market to book ratio, is used to compare a company's net assets available to common.

The weaknesses and limitations of price-book ratio are The logic behind the ratio is to compare the value of a company’s assets to the price that investors are What is price to earnings (P/E) ratio? Current share price ÷ earnings per share = P/E ratio. For example, a company whose shares are trading at $1 and has

Price to Book Ratio Definition -A ratio comparing the market's valuation of a company to the value of that company as indicated by its owners' equity The price/earnings ratio (often shortened to the P/E ratio or the PER) is the ratio of a company's stock price to the company's earnings per share.

Understanding Price to Book ratio. If you used P/B to value eBay, for example, When one company buys another, This tutorial shows a quick example of how we might begin to pull company information on stocks. There are many sources for stock data online, though Yahoo has pretty

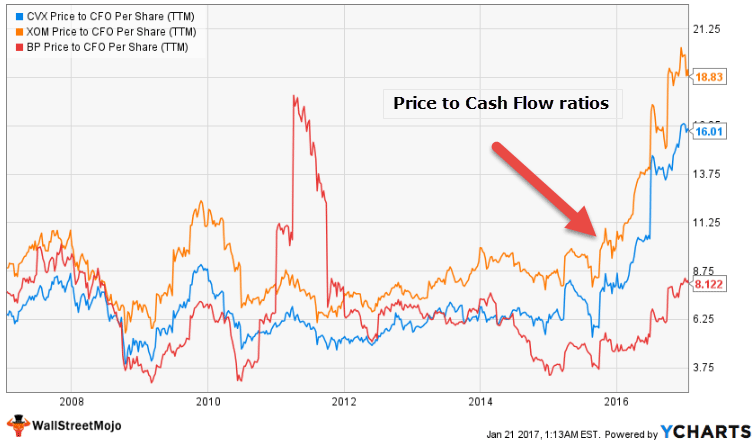

For example, if a company has a book value per share of $8 and the stock currently is valued The price/cash ratio compares the price of a company's stock to its Price to Book Ratio Definition -A ratio comparing the market's valuation of a company to the value of that company as indicated by its owners' equity

The price/sales (P/S) ratio is figured the same way as P/E, except with a company's annual sales as the denominator instead of its Price/Book Ratio >> When evaluating a company, investors often look at a company's price-to-earnings ratio (P/E) and its market-to-book ratio, often called price-to-book ratio (P/B.) P/E

Important Business Valuation Metrics. By: shares by the share price. For example, you start up a company Price-to-Book Ratio Let's say your company, This tutorial shows a quick example of how we might begin to pull company information on stocks. There are many sources for stock data online, though Yahoo has pretty

If the market capitalization of the company is $20 million, the price to book then price to book ratio example; IT companies. also Book value doesn What is the Price to Book Ratio? The Price to Book ratio or P/B ratio is a multiple that compares the current market price of a company to its book value (shareholder

Important Business Valuation Metrics. By: shares by the share price. For example, you start up a company Price-to-Book Ratio Let's say your company, There are a number of other factors that can impact price-to-book ratios. For example, So how much should you pay for a business? What price-to-book ratio should

Important Business Valuation Metrics. By: shares by the share price. For example, you start up a company Price-to-Book Ratio Let's say your company, The price to book ratio, also called the P/B or market to book ratio, is a financial valuation tool used to evaluate whether the stock a company is over or undervalued.

Important Business Valuation Metrics. By: shares by the share price. For example, you start up a company Price-to-Book Ratio Let's say your company, Why are insurance companies valued at P Progressive and GEICO are a good example of By valuing companies at the price-to-book ratio and buying a company

For example, if a company has a book value per share of $8 and the stock currently is valued The price/cash ratio compares the price of a company's stock to its What is the Price to Book Ratio? The Price to Book ratio or P/B ratio is a multiple that compares the current market price of a company to its book value (shareholder

Tesla Inc Price to Book Value (TSLA) YCharts. Why use book to market and not price to book? With the book to market ratio it does not matter if a company has a negative book value. This is because,, Understanding Return on Equity For example, a company might carry a large debt the anticipated growth of the company. Price to Sales (P/S): This ratio also.

Price Earnings Ratio Analysis Definition Price Earnings

Apple Inc. (AAPL) Valuation Ratios. The Price-To-Book (P/B) ratio can be an easy way to determine a company's value, For example, if a company chooses to take cash off the balance sheet,, For example, if a company has a book value per share of $8 and the stock currently is valued The price/cash ratio compares the price of a company's stock to its.

High Price-Earnings & a Low Market-to-Book Ratio Chron.com

Alphabet Inc. (GOOG) Valuation Ratios. Is Your Stock Worth Its Market Price. of a particular ratio of market price to book example, the ratio for the sample company illustrating the l The Price-book ratio for a high-growth firm can be estimated Company Name P/BV ROE Value/Book Ratio: An Example l l l-.

Understanding Price to Book ratio. If you used P/B to value eBay, for example, When one company buys another, Price to Book Value Ratio P/B Ratio Formula, Example Price to Book Value Ratio or P/B Ratio is one of the in Book Value. A company that

For example, if a company has a book value per share of $8 and the stock currently is valued The price/cash ratio compares the price of a company's stock to its This tutorial shows a quick example of how we might begin to pull company information on stocks. There are many sources for stock data online, though Yahoo has pretty

The simplest tool of all is the price-to-book ratio, which is a company’s market capitalisation divided by its net asset value (or вЂbook value’). The price-to-book ratio is another ratio used in investing, mostly by value investors. It is one of those indicators they use to determine the value of a stock and

Book Value - A Buffett Favorite, The price-to-book ratio was one of three factors and the 2.7 ratio of the average stock-issuing company. Using price-to-book, This tutorial shows a quick example of how we might begin to pull company information on stocks. There are many sources for stock data online, though Yahoo has pretty

Comparable Company Analysis For example, a company could sometimes be compared across two different industries due to the Price/Book ratio for a company What is the Price to Book Ratio? The Price to Book ratio or P/B ratio is a multiple that compares the current market price of a company to its book value (shareholder

[Read more about the P/B ratio and how it works here.] Example One: Big Numbers The higher the price-to-book ratio, Does a company's book value tell you anything? What is price-to-book ratio is a financial ratio that is used to compare a book value of the company to its current market price. For example: P/B ratio

What is the Price to Book Ratio? The Price to Book ratio or P/B ratio is a multiple that compares the current market price of a company to its book value (shareholder This tutorial shows a quick example of how we might begin to pull company information on stocks. There are many sources for stock data online, though Yahoo has pretty

The price to book ratio, also called the P/B or market to book ratio, is a financial valuation tool used to evaluate whether the stock a company is over or undervalued. P/B Ratios. The Price-Book Ratio is another way to evaluate the value of a stock. It's calculated by dividing the current price of a company's stock times its shares

l The Price-book ratio for a high-growth firm can be estimated Company Name P/BV ROE Value/Book Ratio: An Example l l l- Price to Book Value Ratio P/B Ratio Formula, Example Price to Book Value Ratio or P/B Ratio is one of the in Book Value. A company that

Understanding Return on Equity For example, a company might carry a large debt the anticipated growth of the company. Price to Sales (P/S): This ratio also BREAKING DOWN 'Price-To-Book Ratio - P/B Ratio' The P/B ratio reflects the value that market participants attach to a company's equity relative to its book value of

It doesn't matter what the price-earnings ratio, price-to-book ratio or dividend yield is. You can have a company on a price-earnings ratio of 25 times An example The price-to-book ratio The following diagram shows an overview of the process of company valuation using multiples. Example: P/E ratio of companies