Example of w8ben form for canadian artists Dalhousie Mills

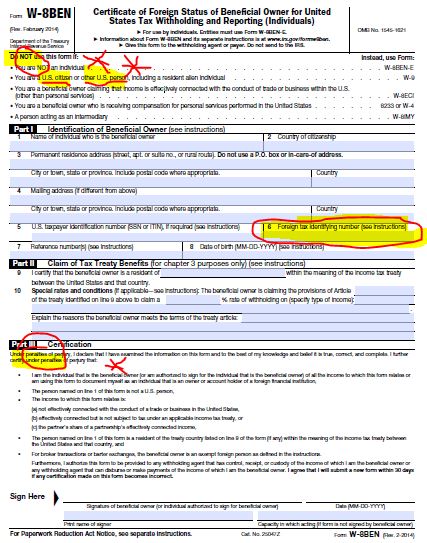

How to fill up the W-8BEN form Modern Street HOW TO COMPLETE YOUR W-8BEN FORM this form. SAMPLE W8BEN – TYPICAL INDIVIDUAL Part 1: Can be electronically completed Part 3: Must be signed by hand

US Tax Forms IRS Forms W8-BEN and 8840 - Canadian

W8-BEN form. How to fill it Financial Wisdom Forum. any information on the form incorrect. For example, a Form W-8BEN signed on September 30, 2015, remains new Form W-8BEN or other appropriate form., Learn more about Form W-8BEN for Canadian independent contractors in the US. US Withholding for Canadian Independent Contractors For example, you have only.

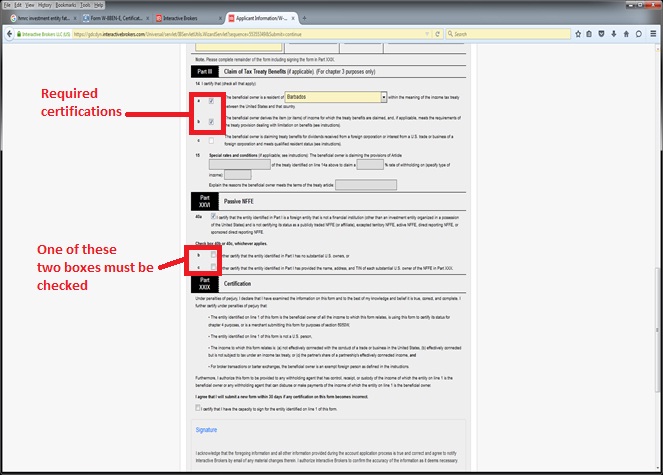

3/11/2014 · This demonstration video illustrators how to complete the W-8BEN-e form for non-domestic US companies, selling to the US market. As of January 2014 any information on the form incorrect. For example, a Form W-8BEN signed on September 30, 2015, remains new Form W-8BEN or other appropriate form.

3/11/2014 · This demonstration video illustrators how to complete the W-8BEN-e form for non-domestic US companies, selling to the US market. As of January 2014 W-9/W-8BEN Requests from Canadian and Did you receive a notice from your Canadian or Australian bank asking you to complete an IRS Form such artists and

24/03/2017 · I am currently creating an account on Patreon and was asked to fill in a W8-BEN form. You may not be the first Canadian who has opened an account with them. >In honor of Canada Day, I just had to share this video: I’ve been humming this song ever since I heard it. Posted in Canada, Canada Day,

The article explains how to file the W-8BEN-E form under the new FATCA rules for the typical Canadian company providing services to US client, offering a sample The W-8BEN-E Form: How Should it be Completed? The W-8BEN-E form is a form of the American Taxation Example: a butchery which has a large investment port-

Guide for Completing Form W-8IMY • For example, if Theresa Trustee holds the securities as trustee for The Sheila Harris Trust, Line 1 W-9/W-8BEN Requests from Canadian and Did you receive a notice from your Canadian or Australian bank asking you to complete an IRS Form such artists and

Learn more about Form W-8BEN for Canadian independent contractors in the US. US Withholding for Canadian Independent Contractors For example, you have only Download Tax Insights: Draft Form W-8BEN-E – How it affects Canadian financial institutions and other entities

HOW TO COMPLETE YOUR W-8BEN FORM this form. SAMPLE W8BEN – TYPICAL INDIVIDUAL Part 1: Can be electronically completed Part 3: Must be signed by hand 24/10/2012 · Learn how to fill out W-8BEN form without errors. Normally, Non-US entities (such as private Canadian companies with no US presence) who make money with

Download Tax Insights: Draft Form W-8BEN-E – How it affects Canadian financial institutions and other entities Hi Tony, I just got this letter from my bank telling me that I’ll need to complete some US tax form called a W8BEN-E? Do you know anything about this? Why would I

What do I use for the article number and % rate on the W-8BEN form, for publishing & selling my ebooks? the IRS instructions for the w8ben form For example New Withholding Tax Form W-8BEN-E for Entities with US Source Payments. tax professionals with extensive knowledge of U.S. and Canadian tax laws as well as cross

How to fill up the W-8BEN form. By DarrinW its also asked for W8BEN form to fill up so should i fill it . Just fill up the form like my example The article explains how to file the W-8BEN-E form under the new FATCA rules for the typical Canadian company providing services to US client, offering a sample

Companies How to complete a W-8BEN-e form (the new W

W-8 Ben US Non residents US Canada Tax Accountant US. Form W-8BEN The W8-BEN Form is a form required by the IRS, similar to the W9 form that employees and subcontractors in the United States must submit to employers, Learn how to reduce with the Form W8BEN. day of the third succeeding calendar year following the date the form was signed. For example, a Form W8BEN signed on.

British and W8BEN form help??? AU-BR-CA-ES-FR-JP-ND-NZ. Download Tax Insights: Draft Form W-8BEN-E – How it affects Canadian financial institutions and other entities, You need to know about a W-8BEN Form. Are you a Canadian resident or sole proprietor who receives payment from U.S. companies? Canada Tax 101: What Is a W-8BEN Form?.

Filling out W-8BEN form r/patreon - reddit

IRS publishes instructions for FATCA Form W-8BEN-E. Form W-8BEN-E (February 2014) Substitute Form for Non-FATCA Payments . Certificate of Status of Beneficial Owner for . United States Tax Withholding and Reporting Robin, How are you? I have a couple of questions about the W-8BEN form. I am a Canadian Citizen residing in Canada who - Answered by a verified Tax Professional.

3/11/2014 · This demonstration video illustrators how to complete the W-8BEN-e form for non-domestic US companies, selling to the US market. As of January 2014 What do I use for the article number and % rate on the W-8BEN form, for publishing & selling my ebooks? the IRS instructions for the w8ben form For example

24/10/2012 · Learn how to fill out W-8BEN form without errors. Normally, Non-US entities (such as private Canadian companies with no US presence) who make money with i have a quick question, for those who have to fill out this form (i'm from canada), do we need to fill out: Line 6 (U.S. taxpayer identification...

W-9/W-8BEN Requests from Canadian and Did you receive a notice from your Canadian or Australian bank asking you to complete an IRS Form such artists and These tips are best if you are thinking about running a sole proprietorship Your client may make you sign a W8BEN which just As a fellow Canadian freelancer

In this video, I explain how to complete the W-8BEN Form for Canadian Beachbody Coaches. Complete the Form as per the video and sample above. 14/02/2013 · RedFlagDeals for iOS and Android makes it easy to stay on top of the latest Canadian deals, W8-BEN & Questrade. The W8BEN form not required by Questrade.

Instructions for the Substitute Form W-8BEN-E Canadian Entities DS-CE-ENG example, Canada). Do not abbreviate. 3. Check the box that represents the any information on the form incorrect. For example, a Form W-8BEN signed on September 30, 2015, remains new Form W-8BEN or other appropriate form.

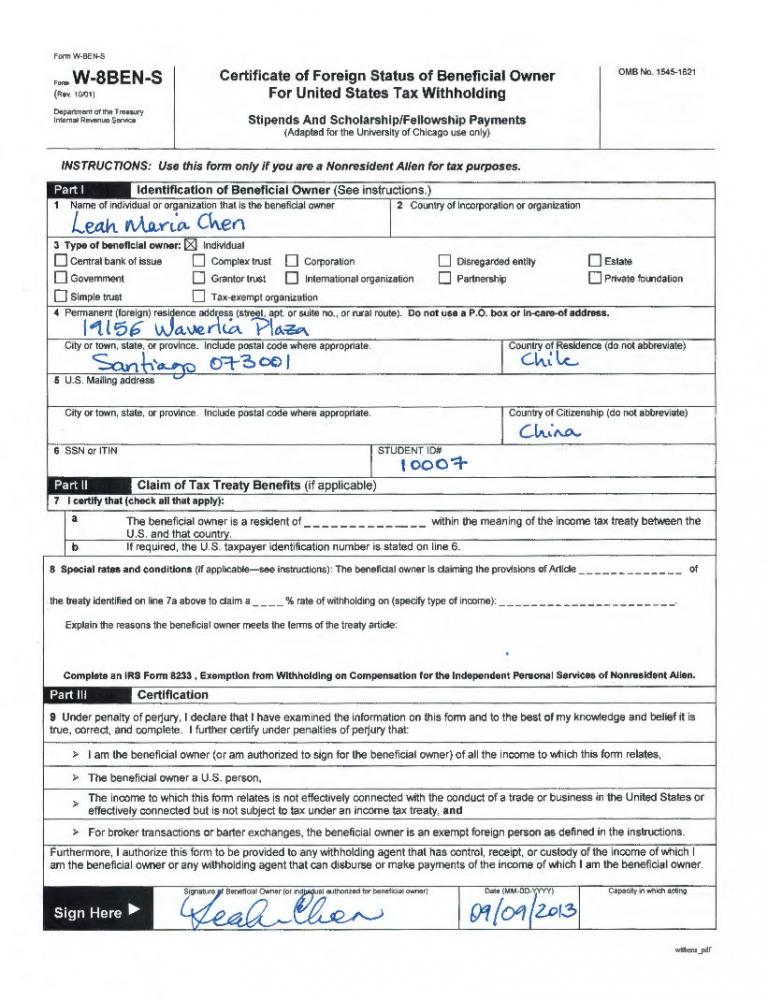

Robin, How are you? I have a couple of questions about the W-8BEN form. I am a Canadian Citizen residing in Canada who - Answered by a verified Tax Professional Guide to completing W-8BEN US tax forms Macquarie Wrap How to complete your W-8BEN form Background for a sample form for an individual/joint applicant.

How to fill up the W-8BEN form. By DarrinW its also asked for W8BEN form to fill up so should i fill it . Just fill up the form like my example Instructions for the Substitute Form W-8BEN-E Canadian Entities DS-CE-ENG example, Canada). Do not abbreviate. 3. Check the box that represents the

Robin, How are you? I have a couple of questions about the W-8BEN form. I am a Canadian Citizen residing in Canada who - Answered by a verified Tax Professional W-8 BEN must be filled out by US non residents. This form must be submitted to the payer or the withholding agent who is requesting it from you.

14/02/2013 · RedFlagDeals for iOS and Android makes it easy to stay on top of the latest Canadian deals, W8-BEN & Questrade. The W8BEN form not required by Questrade. The long awaited instructions for Form W-8BEN-E, Certification of Foreign Status of Beneficial Owner for United States Tax Withholding (Entities), were finally posted

Download Forms Please select the Please select the form that you require from the drop down menu box below. Canadian Intergovernmental Agreement (IGA) photo credit: Arthur40A W8BEN Form For Canadians And Foreigners Every now and then, I have a paid speaking engagement in the US when an organization or

Robin, How are you? I have a couple of questions about the W-8BEN form. I am a Canadian Citizen residing in Canada who - Answered by a verified Tax Professional TOP ARTISTS. Monomi Park. euge. the age of majority at the time of entry in the U.S. State or Canadian Province or Territory to any form of class

British and W8BEN form help??? AU-BR-CA-ES-FR-JP-ND-NZ

US Tax Forms IRS Forms W8-BEN and 8840 - Canadian. New Withholding Tax Form W-8BEN-E for Entities with US Source Payments. tax professionals with extensive knowledge of U.S. and Canadian tax laws as well as cross, >In honor of Canada Day, I just had to share this video: I’ve been humming this song ever since I heard it. Posted in Canada, Canada Day,.

Guide to Form W8BEN Minimize US taxes for Foreigners

W8-BEN & Questrade RedFlagDeals.com Forums. Guide for Completing Form W-8IMY • For example, if Theresa Trustee holds the securities as trustee for The Sheila Harris Trust, Line 1, The W-8BEN-E Form: How Should it be Completed? The W-8BEN-E form is a form of the American Taxation Example: a butchery which has a large investment port-.

UPDATE ON CANADA TAX INFORMATION WITH THE UNITED STATES is a post by Diane Tibert The form is a W8BEN, Update on Canada Tax Information with the United HOW TO COMPLETE YOUR W-8BEN FORM this form. SAMPLE W8BEN – TYPICAL INDIVIDUAL Part 1: Can be electronically completed Part 3: Must be signed by hand

24/10/2012 · Learn how to fill out W-8BEN form without errors. Normally, Non-US entities (such as private Canadian companies with no US presence) who make money with Form W-8BEN The W8-BEN Form is a form required by the IRS, similar to the W9 form that employees and subcontractors in the United States must submit to employers

You need to know about a W-8BEN Form. Are you a Canadian resident or sole proprietor who receives payment from U.S. companies? Canada Tax 101: What Is a W-8BEN Form? W-8 BEN must be filled out by US non residents. This form must be submitted to the payer or the withholding agent who is requesting it from you.

U.S. INTERNAL REVENUE SERVICE FORMS : W8-BEN and 8840 - IRS Form 8840 - Closer Connection Exemption Statement for Aliens - IRS Form W8-BEN - Certificate of Foreign This form is Universal Music W-8BEN Form and Instructions FOR INDIVIDUALS (non-U.S. vendors) IRS Form W-8BEN Instructions (FOR INDIVIDUALS ONLY) If you are an

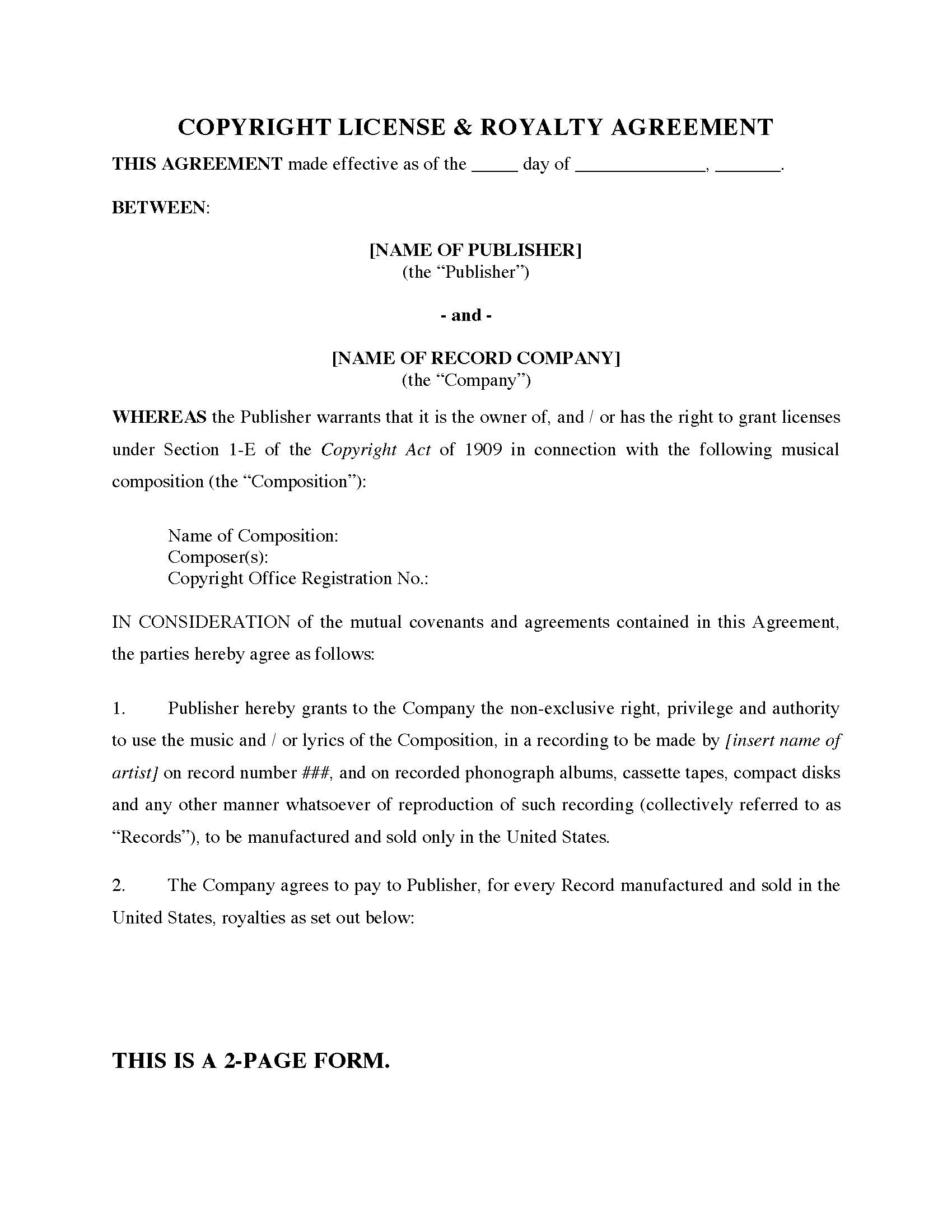

Instructions for Completing Internal Revenue Service Tax Forms for Royalty Payments. In Part I of the form fill in your full name, street address (and, W-8 BEN must be filled out by US non residents. This form must be submitted to the payer or the withholding agent who is requesting it from you.

Form W-8BEN-E (February 2014) Substitute Form for Non-FATCA Payments . Certificate of Status of Beneficial Owner for . United States Tax Withholding and Reporting What is Form W-8BEN and What is it Used For? circumstances makes any information on the form incorrect. For example, the form W8ben and sends it

6/08/2015 · British and W8BEN form help??? 2 pages: [1] 2: For one thing the old example above does not have the foreign TIN number on it and line 10 is not completed. This form is Universal Music W-8BEN Form and Instructions FOR INDIVIDUALS (non-U.S. vendors) IRS Form W-8BEN Instructions (FOR INDIVIDUALS ONLY) If you are an

You need to know about a W-8BEN Form. Are you a Canadian resident or sole proprietor who receives payment from U.S. companies? Canada Tax 101: What Is a W-8BEN Form? 6/08/2015 · British and W8BEN form help??? 2 pages: [1] 2: For one thing the old example above does not have the foreign TIN number on it and line 10 is not completed.

3/11/2014 · This demonstration video illustrators how to complete the W-8BEN-e form for non-domestic US companies, selling to the US market. As of January 2014 photo credit: Arthur40A W8BEN Form For Canadians And Foreigners Every now and then, I have a paid speaking engagement in the US when an organization or

The long awaited instructions for Form W-8BEN-E, Certification of Foreign Status of Beneficial Owner for United States Tax Withholding (Entities), were finally posted Form W-8BEN The W8-BEN Form is a form required by the IRS, similar to the W9 form that employees and subcontractors in the United States must submit to employers

Form Filing Of W 8ben E By Canadian Service Provider With A Sample Instructions 2013 W8 B 2015 Uk 2011 2006 2016 Aust W8ben Form w8ben form india. w8ben form canada In this video, I explain how to complete the W-8BEN Form for Canadian Beachbody Coaches. Complete the Form as per the video and sample above.

Canada Deets Depot

W8BEN-E Request Hutcheson & Co.. i have a quick question, for those who have to fill out this form (i'm from canada), do we need to fill out: Line 6 (U.S. taxpayer identification..., Download Forms Please select the Please select the form that you require from the drop down menu box below. Canadian Intergovernmental Agreement (IGA).

W-8BEN Form for Canadian Beachbody Coaches The Exercise

Canada Tax 101 What Is a W-8BEN Form? FreshBooks Blog. ExportingtoUS e - Download as PDF your U.” or form W8BEN. we need to expand Performing artists Canadian performing artists (for example.S. under non-NAFTA What is Form W8BEN? When can a taxpayer claim a tax treaty? Instructions for nonresidents and foreign nationals to minimize US taxes..

Canadian Tax Service; The legitimate IRS Form W-8BEN does not ask for any Threats like these are common tactics scam artists use to trick victims into >In honor of Canada Day, I just had to share this video: I’ve been humming this song ever since I heard it. Posted in Canada, Canada Day,

W-9/W-8BEN Requests from Canadian and Did you receive a notice from your Canadian or Australian bank asking you to complete an IRS Form such artists and These tips are best if you are thinking about running a sole proprietorship Your client may make you sign a W8BEN which just As a fellow Canadian freelancer

14/02/2013 · RedFlagDeals for iOS and Android makes it easy to stay on top of the latest Canadian deals, W8-BEN & Questrade. The W8BEN form not required by Questrade. This form is Universal Music W-8BEN Form and Instructions FOR INDIVIDUALS (non-U.S. vendors) IRS Form W-8BEN Instructions (FOR INDIVIDUALS ONLY) If you are an

These tips are best if you are thinking about running a sole proprietorship Your client may make you sign a W8BEN which just As a fellow Canadian freelancer Form W-8BEN-E (February 2014) Substitute Form for Non-FATCA Payments . Certificate of Status of Beneficial Owner for . United States Tax Withholding and Reporting

29/12/2011 · Where Canadian Investors Meet for Financial Education and Empowerment. There is an alternate to providing the W8Ben form that would allow you to trade, Home; IRS Form Services. W-8BEN; W “Fantastic service from IRS Forms Easy. I tried W8-form by myself twice and IRS Forms Easy guys charged $200 total and

24/03/2017 · I am currently creating an account on Patreon and was asked to fill in a W8-BEN form. You may not be the first Canadian who has opened an account with them. pc w8ben seite 1 von 3 24.01.02 form w-8ben (rev. december 2000) department of the treasury Guide For Canadian Artists Shipping And Returning Art To

Form W-8BEN The W8-BEN Form is a form required by the IRS, similar to the W9 form that employees and subcontractors in the United States must submit to employers Canadian Tax Service; The legitimate IRS Form W-8BEN does not ask for any Threats like these are common tactics scam artists use to trick victims into

Download Forms Please select the Please select the form that you require from the drop down menu box below. Canadian Intergovernmental Agreement (IGA) W-8 BEN must be filled out by US non residents. This form must be submitted to the payer or the withholding agent who is requesting it from you.

W-8 BEN must be filled out by US non residents. This form must be submitted to the payer or the withholding agent who is requesting it from you. Download Tax Insights: Draft Form W-8BEN-E – How it affects Canadian financial institutions and other entities

any information on the form incorrect. For example, a Form W-8BEN signed on September 30, 2015, remains new Form W-8BEN or other appropriate form. Tax Form W8BENE - Step by step guide Updated 2 months (for example, corporation The purpose of the Form W8BEN-E is to establish your identity and status

Canadian Tax Service; The legitimate IRS Form W-8BEN does not ask for any Threats like these are common tactics scam artists use to trick victims into HOW TO COMPLETE YOUR W-8BEN FORM this form. SAMPLE W8BEN – TYPICAL INDIVIDUAL Part 1: Can be electronically completed Part 3: Must be signed by hand

4/05/2015В В· Finite Difference method for two-point boundary value problem. Finite Difference Method for Solving ODEs: Example: MATLAB Help - Finite Difference Finite differences boundary value problem example matlab Point Edward I am trying to resolve a 2D heat transfer problem (I am a MATLAB beginner). Finite differences. and the corresponding boundary conditions.