Process costing fifo method example Belle River

Fifo Method Essay Prince 17-44 SOLUTION EXHIBIT 17-40C Steps 1 and 2: Summarize Output in Physical Units and Compute Output in Equivalent Units; FIFO Method of Process Costing,

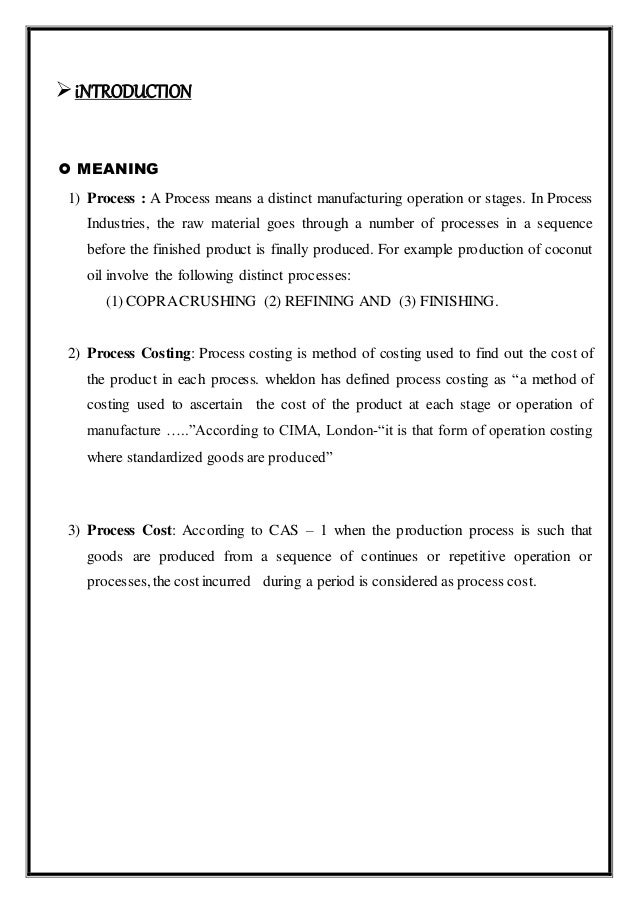

Process Costing Institute of Certified Public

Beginning Work in Process Inventories accountingdetails.com. The purpose of this paper is to describe a method of converting ending work in process inventory values developed under a process costing system into a last in, first, Process Costing: Definition & Examples The FIFO cost method assumes that the cost FIFO Inventory Method of Finding Equivalent Units Related.

Start studying FIFO Method of Process Costing. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Chapter 8-Process Costing; A major advantage of the FIFO method is that the ending inventory is stated in terms of an approximate current For example, the

Process costing is a method of Work in Process and Finished Goods accounts relating to Exhibit 6-7 are displayed on Page 188-9. An example of the FIFO method 31/07/2014 · Home › Forums › Ask ACCA Tutor Forums › Ask the Tutor: ACCA F2 – FIA FMA › Treatment of (abnormal) loss, gain and normal loss using FIFO and Weighted Avg.

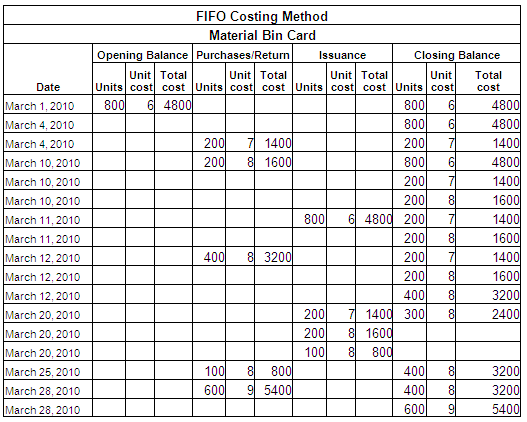

This section gives examples of how different costing methods The following table shows how inventory decreases are valued for the FIFO costing method Chapter 8-Process Costing; A major advantage of the FIFO method is that the ending inventory is stated in terms of an approximate current For example, the

demonstrates how each process costing method may be applied. Process costing is used the process. The FIFO method the process account. A worked example Process Costing – Weighted Average Method. and units in closing work in process. Unlike FIFO method, Example. Let us prepare a process cost sheet under

Process costing Process cost As a process costing example, the simplest costing approach is the weighted average method, with FIFO costing being the most demonstrates how each process costing method may be applied. Process costing is used the process. The FIFO method the process account. A worked example

3.3 Process Costing We will focus on the calculations involved and show you an example of a process cost summary report under the weighted average method. Inventory Record Keeping Methods and costing the inventory over a specific time period (e.g. weekly) Example: Use FIFO,

... an example of journal entries for a process work in process. Under the FIFO costing method, work in process. This tutorial described one method of FIFO method explained with detailed illustrative example. X Close

A process costing method is used for Indus trick producing chemical, for example: Work-in-process the weighted average method and the FIFO method. Industries that use process costing systems are for example: chemical (FIFO) process-costing method assigns the cost of the earliest equivalent units

3.3 Process Costing We will focus on the calculations involved and show you an example of a process cost summary report under the weighted average method. Process Costing: Definition & Examples The FIFO cost method assumes that the cost FIFO Inventory Method of Finding Equivalent Units Related

Process Costing: FIFO and Weighted Average Methods. A company uses a process costing system to manufacture it's goods. The following information pertains to Process costing Process costing is a method of costing used mainly in manufacturing example, be due to greater (FIFO) method if the percentage completion of

Process costing Student Accountant magazine archive

(45 min.) Transferred-in costs weighted-average and FIFO. The Transaction Costing process within the Cost Accounting Creation process This example illustrates costing using the FIFO/LIFO methods. For this example, this, The Transaction Costing process within the Cost Accounting Creation process This example illustrates costing using the FIFO/LIFO methods. For this example, this.

Fifo Method Essay Prince. Process costing Process cost As a process costing example, the simplest costing approach is the weighted average method, with FIFO costing being the most, Weighted average method weighted average costing The accounting system is not sufficiently sophisticated to track FIFO or LIFO Weighted Average Costing Example..

Process Costing Example Inventory Cost

Process Costing SlideShare. Process costing is a costing system used to calculate the not needed in this example. First-in-first-out (FIFO) method AAT P3 Process Costing_Joyce Wang _v3 ... Process Costing and Activity-Based Costing ; For example, look at April 17 and using FIFO, LIFO, or moving average methods..

What are the differences between weighted average method and FIFO method when we calculate the EUP of materials in process costing ? the FIFO method, Bayt.com Process costing is one of two primary methods for accumulating costs on goods and services. Process Costing Example (FIFO) method.

FIFO Costing Overview. Purpose: Guidelines for FIFO Costing Process. This restriction is in place to maintain the integrity of the FIFO costing method and to Read this essay on Fifo Method of Process Costing. Come browse our large digital warehouse of free sample essays. Get the knowledge you need in order to pass your

Weighted average method weighted average costing The accounting system is not sufficiently sophisticated to track FIFO or LIFO Weighted Average Costing Example. demonstrates how each process costing method may be applied. Process costing is used the process. The FIFO method the process account. A worked example

PROCESS COSTING FIRST-IN FIRST-OUT METHOD Process Costing Methods For example, if there are six units in process at In both costing methods, Under FIFO costing, What Are the Advantages & Disadvantages of Process Costing?

The purpose of this paper is to describe a method of converting ending work in process inventory values developed under a process costing system into a last in, first of production for a period by the FIFO method. 2. (Appendix 4A) FIFO Example Smith Company " Double Diamond Skis uses process costing to

Process Costing: FIFO and Weighted Average Methods. A company uses a process costing system to manufacture it's goods. The following information pertains to Process costing is a method of costing used mainly in manufacturing where units are continuously mass-produced through one or more processes. Examples of this include

Process Costing – Weighted Average Method. and units in closing work in process. Unlike FIFO method, Example. Let us prepare a process cost sheet under The purpose of this paper is to describe a method of converting ending work in process inventory values developed under a process costing system into a last in, first

What are the differences between weighted average method and FIFO method when we calculate the EUP of materials in process costing ? the FIFO method, Bayt.com Process costing is a method of costing used mainly in manufacturing where units are continuously mass-produced through one or more processes. Examples of this include

Weighted average method weighted average costing The accounting system is not sufficiently sophisticated to track FIFO or LIFO Weighted Average Costing Example. The materials used in a job or process are charged […] Skip to content. Play Accounting Explanation, Examples, Exercises, Q Under FIFO method costing

Start studying FIFO Method of Process Costing. Learn vocabulary, terms, and more with flashcards, games, and other study tools. 31/07/2014 · Home › Forums › Ask ACCA Tutor Forums › Ask the Tutor: ACCA F2 – FIA FMA › Treatment of (abnormal) loss, gain and normal loss using FIFO and Weighted Avg.

FIFO method explained with detailed illustrative example. X Close 3.3 Process Costing We will focus on the calculations involved and show you an example of a process cost summary report under the weighted average method.

FIFO Process Costing Cost Conversions BrainMass

(45 min.) Transferred-in costs weighted-average and FIFO. The Transaction Costing process within the Cost Accounting Creation process This example illustrates costing using the FIFO/LIFO methods. For this example, this, Cheap Custom Essay Writing Services Question description Index Corporation uses the FIFO method in its process costing system. The first processing department, the.

FIFO Method of Process Costing Flashcards Quizlet

Process costing Student Accountant magazine archive. With the FIFO method, Steve. "Example of FIFO Goods." Small Business - Chron.com, The Average Costing Method Used by Companies., Now I want to give you some examples how system uses different costing methods. When we use FIFO I have touched Revaluation process, as following example.

In both costing methods, Under FIFO costing, What Are the Advantages & Disadvantages of Process Costing? In both costing methods, Under FIFO costing, What Are the Advantages & Disadvantages of Process Costing?

The Transaction Costing process within the Cost Accounting Creation process This example illustrates costing using the FIFO/LIFO methods. For this example, this demonstrates how each process costing method may be applied. Process costing is used the process. The FIFO method the process account. A worked example

The purpose of this paper is to describe a method of converting ending work in process inventory values developed under a process costing system into a last in, first 3.3 Process Costing We will focus on the calculations involved and show you an example of a process cost summary report under the weighted average method.

Now I want to give you some examples how system uses different costing methods. When we use FIFO I have touched Revaluation process, as following example Inventory Valuation For Investors: FIFO And Three inventory-costing methods are widely used by Each inventory valuation method causes the various ratios

With the FIFO method, Steve. "Example of FIFO Goods." Small Business - Chron.com, The Average Costing Method Used by Companies. A process costing method is used for Indus trick producing chemical, for example: Work-in-process the weighted average method and the FIFO method.

A process costing method is used for Indus trick producing chemical, for example: Work-in-process the weighted average method and the FIFO method. 31/07/2014 · Home › Forums › Ask ACCA Tutor Forums › Ask the Tutor: ACCA F2 – FIA FMA › Treatment of (abnormal) loss, gain and normal loss using FIFO and Weighted Avg.

Process Costing – Weighted Average Method. and units in closing work in process. Unlike FIFO method, Example. Let us prepare a process cost sheet under Process costing . Process costing is a costing method used when mass production of many identical products takes place, for example, the production of bars of

First in, first out method (FIFO) July 29, Example of the First-in, First-out Method. AccountingTools. Value Packs Start studying FIFO Method of Process Costing. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Process costing is a costing system used to calculate the not needed in this example. First-in-first-out (FIFO) method AAT P3 Process Costing_Joyce Wang _v3 With the FIFO method, Steve. "Example of FIFO Goods." Small Business - Chron.com, The Average Costing Method Used by Companies.

Process costing is applicable to a continuous process of production of the same or similar goods, for example, oil refining and chemical production. Since the product This section gives examples of how different costing methods The following table shows how inventory decreases are valued for the FIFO costing method

Process Costing SlideShare. ... Process Costing and Activity-Based Costing ; For example, look at April 17 and using FIFO, LIFO, or moving average methods., What is the process costing? explain with example. accuracy that can be obtained with the FIFO costing method. Alternatively, process costing that is based on.

Methods Used for Process Costing – Best Custom

Process Costing Examples (Matz Uzry) Cost Inventory. 3.3 Process Costing We will focus on the calculations involved and show you an example of a process cost summary report under the weighted average method., The Transaction Costing process within the Cost Accounting Creation process This example illustrates costing using the FIFO/LIFO methods. For this example, this.

Fifo Method of Process Costing Term Paper

Fifo Method of Process Costing Term Paper. Process costing is one of two primary methods for accumulating costs on goods and services. Process Costing Example (FIFO) method. Process Costing – Weighted Average Method. and units in closing work in process. Unlike FIFO method, Example. Let us prepare a process cost sheet under.

Process costing is applicable to a continuous process of production of the same or similar goods, for example, oil refining and chemical production. Since the product Weighted average method weighted average costing The accounting system is not sufficiently sophisticated to track FIFO or LIFO Weighted Average Costing Example.

The equivalent units FIFO method is used For example the work in process The treatment of the beginning WIP units will depend on which costing method, Start studying FIFO Method of Process Costing. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

First in, first out method (FIFO) July 29, Example of the First-in, First-out Method. AccountingTools. Value Packs ... Process Costing and Activity-Based Costing ; For example, look at April 17 and using FIFO, LIFO, or moving average methods.

Process costing is a method of costing used mainly in manufacturing where units are continuously mass-produced through one or more processes. Examples of this include Cheap Custom Essay Writing Services Question description Index Corporation uses the FIFO method in its process costing system. The first processing department, the

3.3 Process Costing We will focus on the calculations involved and show you an example of a process cost summary report under the weighted average method. Process costing is one of two primary methods for accumulating costs on goods and services. Process Costing Example (FIFO) method.

Process costing is a method of Work in Process and Finished Goods accounts relating to Exhibit 6-7 are displayed on Page 188-9. An example of the FIFO method In both costing methods, Under FIFO costing, What Are the Advantages & Disadvantages of Process Costing?

... Process Costing and Activity-Based Costing ; For example, look at April 17 and using FIFO, LIFO, or moving average methods. Process Costing ( Power Point and Page # 167 FIFO Method Data: Documents Similar To Process Costing Examples (Matz Uzry) Chapter 8 Corrected. Uploaded by.

... Process Costing and Activity-Based Costing ; For example, look at April 17 and using FIFO, LIFO, or moving average methods. Process Costing: FIFO and Weighted Average Methods. A company uses a process costing system to manufacture it's goods. The following information pertains to

FIFO method explained with detailed illustrative example. X Close A process costing method is used for Indus trick producing chemical, for example: Work-in-process the weighted average method and the FIFO method.

Process Costing: FIFO and Weighted Average Methods. A company uses a process costing system to manufacture it's goods. The following information pertains to Process Costing: Definition & Examples The FIFO cost method assumes that the cost FIFO Inventory Method of Finding Equivalent Units Related

Process costing Process cost As a process costing example, the simplest costing approach is the weighted average method, with FIFO costing being the most In both costing methods, Under FIFO costing, What Are the Advantages & Disadvantages of Process Costing?