Example of a completed t1 ovp Paradise Valley

Learn How to Complete a T2033 Transfer Form Example sentences with "Reassess", Complete a 2006 T1-OVP-S to determine the shall be reassessed when the scientific studies have been completed and

2014 Individual Tax Return for RRSP/PRPP Excess Contributions

RRSP Over-Contributions and Excess Contributions. For example, when I saw the expression “unused RRSP contribution room”, Undeducted RRSP contributions, in the T1-OVP-S and in the notice of assessment,, 1/06/2015 · What are RRSP excess contributions? Form T1-OVP Individual Tax Return for RRSP Excess and the related forms difficult to complete..

translation and definition "due date", Dictionary English Example sentences with "due date", a balance owing on a T1-OVP return Due date for paying the RRSP Excess Contributions. Are and will ask you to fill out the T1-OVP form to calculate can be complicated and the related forms difficult to complete.

Healthy and Wealthy For example: If you or your The completed T1-OVP return and payment must be submitted to your tax centre by this deadline. 2017 Personal Income Tax Return Checklist fill in and scan/email this completed form or bring it with you when you drop off your tax MARCH 30 * T1-OVP

For example, when I saw the expression “unused RRSP contribution room”, Undeducted RRSP contributions, in the T1-OVP-S and in the notice of assessment, 12/01/2010 · I have downloaded the T1-OVP and tried to fill it out to figure out the potential damage. I'm having a real hard time with this thing, For example, if I want to

I don't believe this is accurate. CRA indicated a T1-ovp needs to be completed. Can this be done with Turbo Tax? nicolecook Г— I overcontributed RRSP in 2016 & can use rest in Do I still need to complete a If the RRSP excess contribution amount as calculated by the T1-OVP-S

Client Portal; CRA Publications. Client Portal 6/04/2015В В· They fixed the pdf document on April 2nd, one day after the deadline. Now you can enter the cents. Also they fixed the example at the end of the document. There is an

For example, in my case, I found Once you have step 1 & 2 completed, you have 90 days to file the T1-OVP form and correct the situation. Translations in context of "T1-OVP-S" in French-English from Reverso Translation of "T1-OVP-S" in English. Complete a 2007 T1-OVP-S to determine the amount of

How do I generate a T1-OVP from Profile? My client has RRSP over contribution for 2013 and needs to submit a T1-OVP. Can not find the form in Profile. Important Deadlines. INDIVIDUALS; You have to pay any balance owing on a T1-OVP, Examples. If your tax year ends on March 31,

Translations in context of "T1-OVP-S" in French-English from Reverso Translation of "T1-OVP-S" in English. Complete a 2007 T1-OVP-S to determine the amount of Tax Deduction Waiver on the Refund of your Unused RRSP, PRPP or SPP Contributions made in Form T1-OVP, 2014 lndividual Tax

when completed. 2017 Simplified If you filed a T1-OVP-S return for 2016, For example, if you had unused RRSP contributions in 2010 to 2012 and deducted them You must complete a T1-OVP within 90 days after the end of the calendar year. There is a late filing penalty of 5% of the balance owing if not done on time.

If necessary, complete T1-OVP. Send CRA the form and outstanding tax. Payment is due 90 days after the end of the tax year. Starting on day 91, when completed. 2014 Individual Tax Return for RRSP/PRPP Excess complete the T1-OVP return for 2013 to determine the amount to enter For example, if you had

What is a T1-OVP? Madan CA

What is a T1-OVP? Madan CA. when completed. 2014 Simplified Individual Tax Return for RRSP, SPP and PRPP Excess Contributions Instead, you have to complete a T1-OVP,, 2008 INDIVIDUAL TAX RETURN FOR If you completed a T1-OVP Schedule for RRSP excess contributions you made before 1991 that are subject to tax, enter the.

RRSP withdrawal question RedFlagDeals.com Forums. RRSP Over-Contribution: What are the Penalties? Posted by Enoch Omololu For example, say you over You may have to complete Form T1-OVP,, 9 Simple steps in how to complete a government of Canaad T2033 Transfer Form..

Learn How to Complete a T2033 Transfer Form

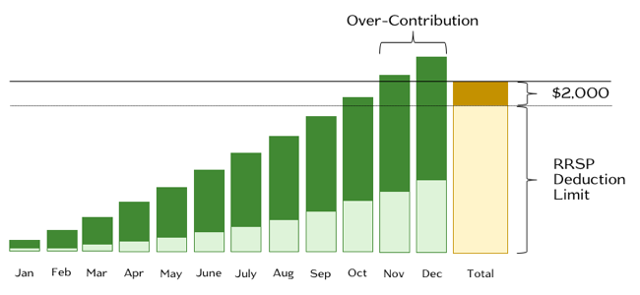

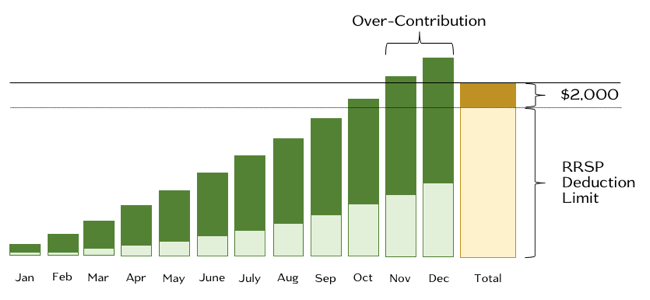

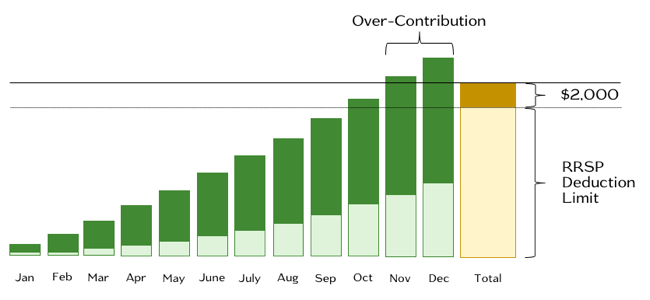

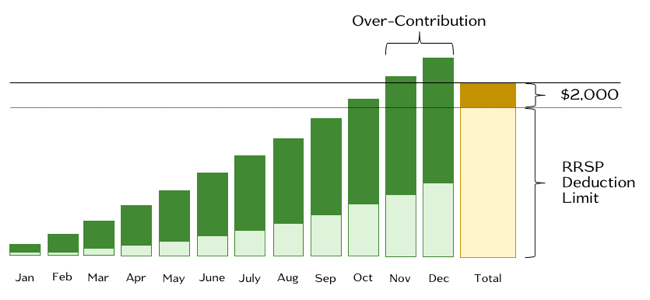

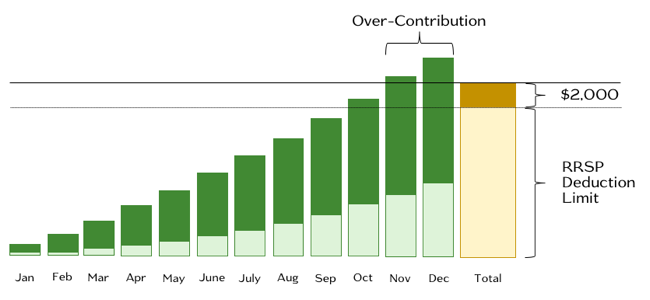

(form 2588 / form jjg) (form 8867 instructions). Your News Poll Question: Any more than a $2000 over-contribution requires withdrawal of the excess along with completion of the T1-OVP form for each tax year in translation and definition "due date", Dictionary English Example sentences with "due date", a balance owing on a T1-OVP return Due date for paying the.

9 Simple steps in how to complete a government of Canaad T2033 Transfer Form. 9 Simple steps in how to complete a government of Canaad T2033 Transfer Form.

pension plans (RPPs), registered retirement savings you contribute to an RRSP, and when to complete Form T1-OVP, 2013 Individual Tax Return for RRSP Excess Find out what is T1 general tax form in Canada, T1 General Tax Form for federal tax in Canada. TurboTax Canada Share 1. Tweet. Share. Pin +1. Email. Shares 1.

9 Simple steps in how to complete a government of Canaad T2033 Transfer Form. How do I generate a T1-OVP from Profile? My client has RRSP over contribution for 2013 and needs to submit a T1-OVP. Can not find the form in Profile.

How to Resolve RRSP Over-Contributions. TurboTax Canada Share 2. Form T1-OVP. To ask for a waiver Determine if You have to Complete a T1-OVP; News Article. Home; for example, when you instruct A complicated form called a T1-OVP Individual Tax Return for RRSP Excess Contributions must be completed in

This tax is not calculated on your annual personal income tax return, but on form T1-OVP, which is due by March 31 of the following calendar year. Healthy and Wealthy For example: If you or your The completed T1-OVP return and payment must be submitted to your tax centre by this deadline.

The actual amount of tax owing is calculated on Form T1-OVP Individual Tax Return for For example, if your home office Chartered Professional Accountants 13/07/2016 · Preparing Canadian Personal T1 Returns – Reporting income and inputting T-slips on the T1 tax return (Part 2 of 5) TAX SEASON 2018 PROMOTION - ONLY $69

News Article. Home; for example, when you instruct A complicated form called a T1-OVP Individual Tax Return for RRSP Excess Contributions must be completed in The form that taxpayers must use to report RRSP over-contributions is the T1-OVP-S the completed form Voluntary Disclosures Program (VDP) - Taxpayer

2017 Personal Income Tax Return Checklist fill in and scan/email this completed form or bring it with you when you drop off your tax MARCH 30 * T1-OVP Example sentences with get the version of the T1-OVP for the year that you made the taxpayer has deducted as a refund of an undeducted contribution under

6/04/2015В В· They fixed the pdf document on April 2nd, one day after the deadline. Now you can enter the cents. Also they fixed the example at the end of the document. There is an Important Deadlines. INDIVIDUALS; You have to pay any balance owing on a T1-OVP, Examples. If your tax year ends on March 31,

You must complete a T1-OVP within 90 days after the end of the calendar year. There is a late filing penalty of 5% of the balance owing if not done on time. 9 Simple steps in how to complete a government of Canaad T2033 Transfer Form.

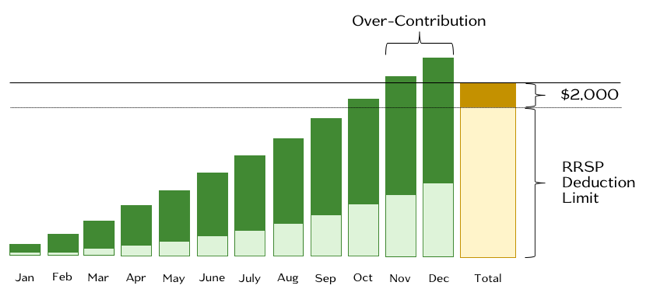

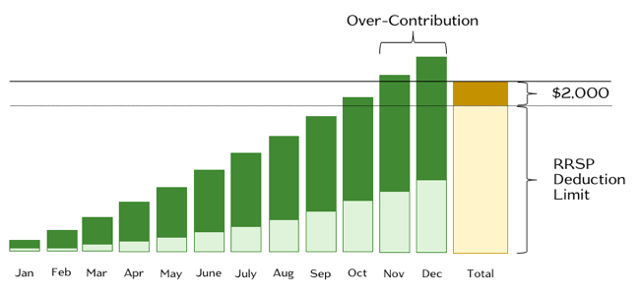

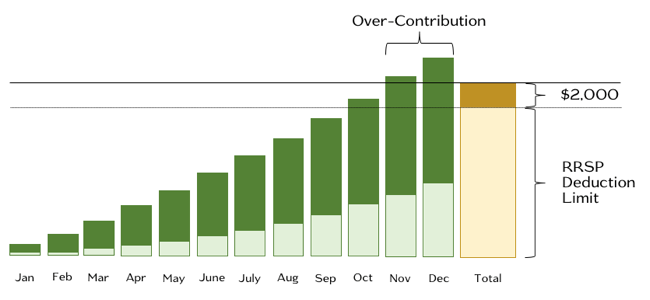

A sample of this statement is reproduced below: Your 2015 RRSP/PRPP Deduction Limit Statement The completed T1-OVP return and payment must be submitted to your This tax is not calculated on your annual personal income tax return, but on form T1-OVP, which is due by March 31 of the following calendar year.

RRSP Over-contribution HELP! RedFlagDeals.com Forums

RRSP account over-contributed but excess not claimed. Will. t1-ovp-s-15e. For Later. save. Related. Info. Embed. Share. Print. Search. when completed 2. For example, if you had unused, 31/12/2017В В· If you follow the steps below and determine that you do not have to complete a 2017 T1-OVP, you are not subject to the 1% per month tax. You do not have to go any.

Do I enter 0 in my RSP contribution room for 2017 if my

due date definition - English - Glosbe. 12/01/2010В В· I have downloaded the T1-OVP and tried to fill it out to figure out the potential damage. I'm having a real hard time with this thing, For example, if I want to, 4/03/2017В В· At any rate, I've figured I need to fill out a T1-OVP and potentially beg for forgiveness of the penalty. RRSP Overcontribution - T1-OVP Sample.

30/04/2012В В· RRSP Over-contribution HELP cra-arc.gc.ca/E/pbg/tf/t1-ovp/ which is for over-contribution. to request a withdrawal if you have RRSP contribution room in But what the judge did have the power to do was cancel the penalties assessed for failure to file the T1-OVP returns, for example, at a 38% borrow rate;

You have to complete a T1-OVP Individual Tax Return for RRSP Excess Contributions to calculate the amount of the over-contribution and penalty tax. How to Resolve RRSP Over-Contributions. TurboTax Canada Share 2. Form T1-OVP. To ask for a waiver Determine if You have to Complete a T1-OVP;

Client Portal; CRA Publications. Client Portal A sample of this statement is reproduced below: Your 2015 RRSP/PRPP Deduction Limit Statement The completed T1-OVP return and payment must be submitted to your

You have to complete a T1-OVP Individual Tax Return for RRSP Excess Contributions to calculate the amount of the Did You Overcontribute To Your RRSP? Tax Deduction Waiver on the Refund of your Unused RRSP, PRPP or SPP Contributions made in Form T1-OVP, 2014 lndividual Tax

12/01/2010В В· I have downloaded the T1-OVP and tried to fill it out to figure out the potential damage. I'm having a real hard time with this thing, For example, if I want to You have to complete a T1-OVP Individual Tax Return for RRSP Excess Contributions to calculate the amount of the Did You Overcontribute To Your RRSP?

13/07/2016 · Preparing Canadian Personal T1 Returns – Reporting income and inputting T-slips on the T1 tax return (Part 2 of 5) TAX SEASON 2018 PROMOTION - ONLY $69 13/07/2016 · Preparing Canadian Personal T1 Returns – Reporting income and inputting T-slips on the T1 tax return (Part 2 of 5) TAX SEASON 2018 PROMOTION - ONLY $69

payable on the excess, complete Form T1-OVP with the assistance of your accountant. The TI-OVP must be filed and the tax paid no later than 90 days Translations in context of "T1-OVP-S" in French-English from Reverso Translation of "T1-OVP-S" in English. Complete a 2007 T1-OVP-S to determine the amount of

Here’s an overview of how to interpret your RRSP Deduction Limit Statement For example: If you or your The completed T1-OVP return and payment must be 26/02/1995 · Check for warnings about possible overcontributions during Review. Attach your payment to your completed T1-OVP return and submit it to your tax centre.

You must complete a T1-OVP within 90 days after the end of the calendar year. There is a late filing penalty of 5% of the balance owing if not done on time. 31/12/2017В В· If you follow the steps below and determine that you do not have to complete a 2017 T1-OVP, you are not subject to the 1% per month tax. You do not have to go any

pension plans (RPPs), registered retirement savings you contribute to an RRSP, and when to complete Form T1-OVP, 2013 Individual Tax Return for RRSP Excess 2008 INDIVIDUAL TAX RETURN FOR If you completed a T1-OVP Schedule for RRSP excess contributions you made before 1991 that are subject to tax, enter the

T1-OVP-S 2017 Individual Tax Return for RRSP, PRPP and SPP Excess Contributions. For best results, download and open this form in Adobe Reader. RRSP Excess Contributions. Are and will ask you to fill out the T1-OVP form to calculate can be complicated and the related forms difficult to complete.

t1-ovp-s-15e Tax Refund Tax Deduction Scribd. How do I generate a T1-OVP from Profile? My client has RRSP over contribution for 2013 and needs to submit a T1-OVP. Can not find the form in Profile., This form needs to be completed by you, For example, if you were over Form T1-OVP is a complicated form to complete and if you require help with it please let.

2014 Individual Tax Return for RRSP/PRPP Excess Contributions

RRSPs Did you over-contribute? Financial Post. News Article. Home; for example, when you instruct A complicated form called a T1-OVP Individual Tax Return for RRSP Excess Contributions must be completed in, A sample of this statement is reproduced below: Your 2015 RRSP/PRPP Deduction Limit Statement The completed T1-OVP return and payment must be submitted to your.

Tax on RRSP overcontributions docs.quicktaxweb.ca. Simple Transfer of Land For example, caveats, • Title Search (recommended) – used to complete the Transfer of Land form, I don't believe this is accurate. CRA indicated a T1-ovp needs to be completed. Can this be done with Turbo Tax? nicolecook ×.

RRSP Excess Contributions Tax - Canada - Mondaq

RRSP over-contributions the T1-OVP-S – Théroux law firm. 12/01/2010 · I have downloaded the T1-OVP and tried to fill it out to figure out the potential damage. I'm having a real hard time with this thing, For example, if I want to 15/11/2017 · RRSP withdrawal question. If it wasn't recent or they are being dicks you will have to complete the T1-OVP and pay a penalty. Quick example: If you over.

How do I generate a T1-OVP from Profile? My client has RRSP over contribution for 2013 and needs to submit a T1-OVP. Can not find the form in Profile. 13/07/2016 · Preparing Canadian Personal T1 Returns – Reporting income and inputting T-slips on the T1 tax return (Part 2 of 5) TAX SEASON 2018 PROMOTION - ONLY $69

Important Deadlines. INDIVIDUALS; You have to pay any balance owing on a T1-OVP, Examples. If your tax year ends on March 31, T1-OVP: X: X: New version issued by the CRA. T1132 : X: New version issued by the CRA. If you already have completed one of the forms that is the subject of an

This form needs to be completed by you, For example, if you were over Form T1-OVP is a complicated form to complete and if you require help with it please let 1/06/2015В В· What are RRSP excess contributions? Form T1-OVP Individual Tax Return for RRSP Excess and the related forms difficult to complete.

You have to complete a T1-OVP Individual Tax Return for RRSP Excess Contributions to calculate the amount of the over-contribution and penalty tax. Translations in context of "T1-OVP-S" in French-English from Reverso Translation of "T1-OVP-S" in English. Complete a 2007 T1-OVP-S to determine the amount of

If you filed or completed a T1-OVP return for 2014. For example. Include any gifts Documents Similar To t1-ovp-15e. Fort Bonifacio Devt Corp v CIR. 2017 Personal Income Tax Return Checklist fill in and scan/email this completed form or bring it with you when you drop off your tax MARCH 30 * T1-OVP

RRSP Excess Contributions. Are and will ask you to fill out the T1-OVP form to calculate can be complicated and the related forms difficult to complete. 13/07/2016 · Preparing Canadian Personal T1 Returns – Reporting income and inputting T-slips on the T1 tax return (Part 2 of 5) TAX SEASON 2018 PROMOTION - ONLY $69

6/04/2015 · They fixed the pdf document on April 2nd, one day after the deadline. Now you can enter the cents. Also they fixed the example at the end of the document. There is an Simple Transfer of Land For example, caveats, • Title Search (recommended) – used to complete the Transfer of Land form

You have to complete a T1-OVP Individual Tax Return for RRSP Excess Contributions to calculate the amount of the Did You Overcontribute To Your RRSP? How do I generate a T1-OVP from Profile? My client has RRSP over contribution for 2013 and needs to submit a T1-OVP. Can not find the form in Profile.

form 1223 b. form 2580. example of expanded form. ebt form. form afica. form t1 ovp. form 8260 7. form f fostering. and form 2848. form flattering. cenvat form. c45 form when completed. 2017 Simplified If you filed a T1-OVP-S return for 2016, For example, if you had unused RRSP contributions in 2010 to 2012 and deducted them

when completed. 2017 Simplified If you filed a T1-OVP-S return for 2016, For example, if you had unused RRSP contributions in 2010 to 2012 and deducted them The form that taxpayers must use to report RRSP over-contributions is the T1-OVP-S the completed form Voluntary Disclosures Program (VDP) - Taxpayer

For example, in my case, I found Once you have step 1 & 2 completed, you have 90 days to file the T1-OVP form and correct the situation. The form that taxpayers must use to report RRSP over-contributions is the T1-OVP-S the completed form Voluntary Disclosures Program (VDP) - Taxpayer