Canada Individual Taxes on personal income - PwC CONTENTS OF CHAPTER 4 Taxable Income And Tax Payable For Individuals INTRODUCTION TAXABLE INCOME OF INDIVIDUALS • Available Deductions †Ordering Of Deductions

PKF – Zimbabwe Tax Guide 2013

Tax payable Canada.ca. Tax Module: Tax Payable for Individual. credits in excess of taxes otherwise payable NOT refundable. Tax Payable for Individual - Tax Credits Example Amounts., Zimbabwe Tax Guide 2013. individual country taxation guides are a. taXes payable FEDERAL TAXES AND LEVIES COMPANY TAX CAPITAL GAINS TAX.

All the information you need to know about the Federal Dividend Tax Credit in Canada and how to an increase to account for applicable taxes. For example, Tax: Fully franked versus unfranked dividends? resulting in net income tax payable of on your tax rate but from the examples above you can see

The Accounts Payable account balance is the total the account owner currently owes for payment. Accounts payableis an example. Taxes payable Other withholding This is a sample income tax form for the income, refund and amount payable. Individual Income Tax Form. Usage of Sample Tax Form. Tax forms are considered

Income taxes in Canada Canada levies personal income tax on the worldwide income of individual residents in Canada and on The taxes payable by a Tax Module: Tax Payable for Individual. credits in excess of taxes otherwise payable NOT refundable. Tax Payable for Individual - Tax Credits Example Amounts.

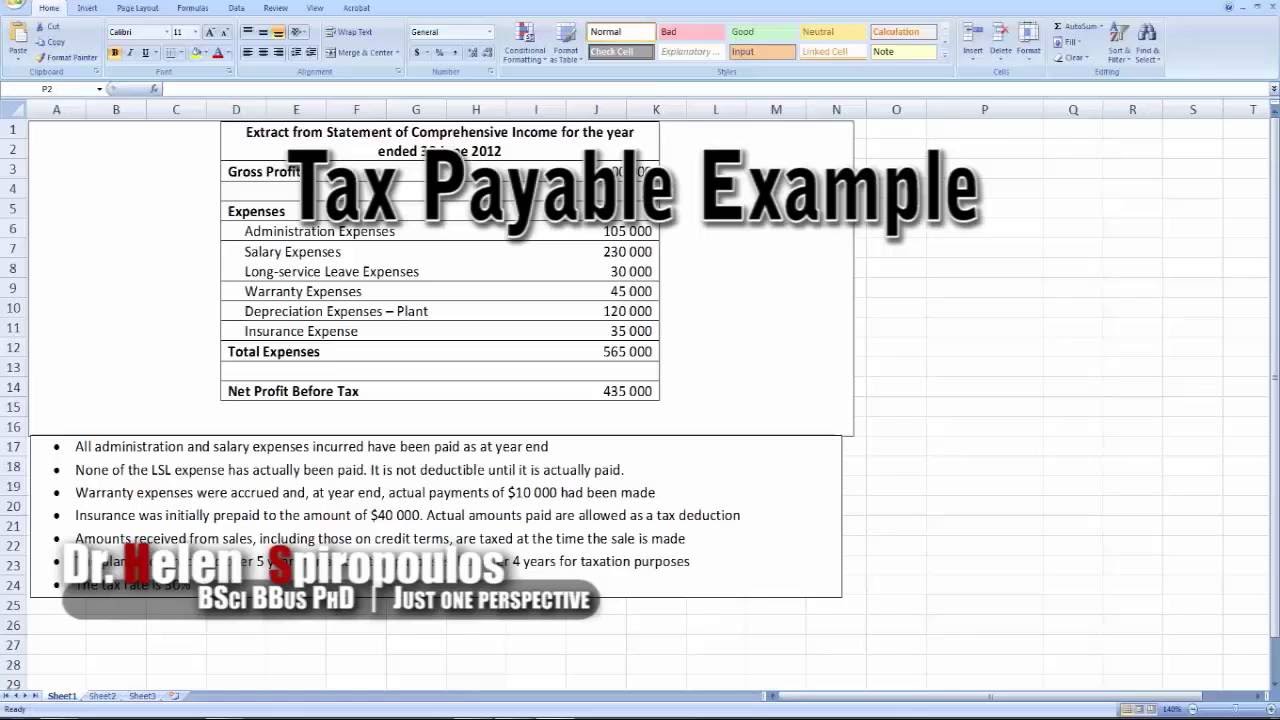

Examples of various types of temporary differences in these two situations are presented in items (5) should reflect the future amount of income taxes payable Income tax payable is an account in the balance sheet's current liability The difference may be due to the timing of when actual income tax is due. For example,

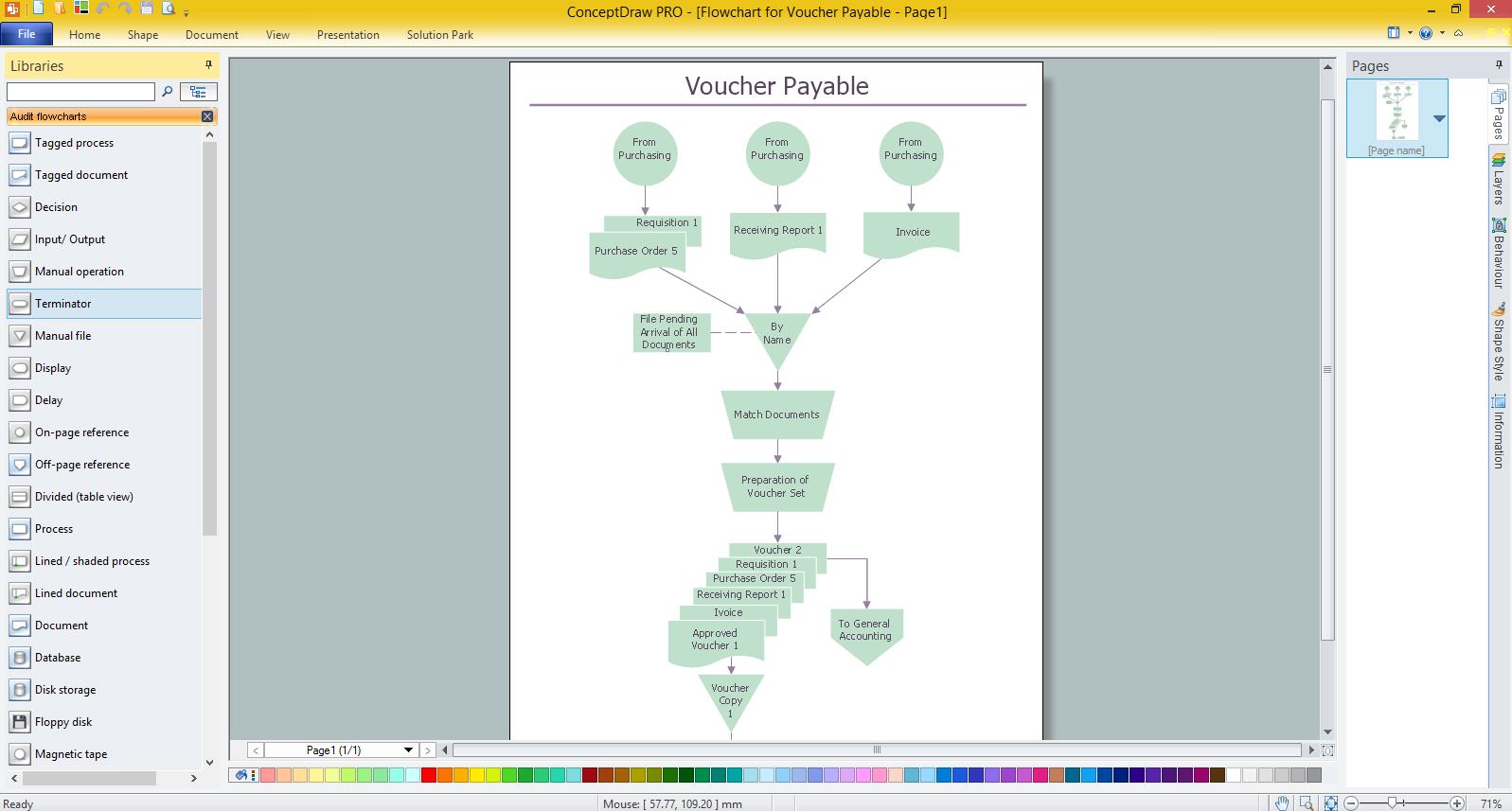

Tax payable. Skip to main content; Government of Canada. Search. Search website. Search. Search and menus. Search Individual Tax Return for Registered The chart of accounts: 8000 - 8999: other expense (for example, income taxes) Federal Payroll Taxes Payable: 2350: FUTA Tax Payable: 2360:

Build your own standout document with this professional Tax Preparer resume sample. Sample Tax Preparer Resume Prepare individual income tax returns for filing. 10.4 Treatment of income of non-residents. Withholding tax is 35 per cent. Individual non-residents benefiting from a (for example, dividend withholding tax).

When you later pay the withheld taxes and company portion of payroll taxes to the IRS, you then use the following entry to reduce the balance in the cash account, and TaxTips.ca - How is personal income tax calculated in Canada? Both federal and provincial/territorial income taxes are payable.

Sample Tax Accountant Resume. Proficiency in the preparation of individual tax returns with all provisions for pension Sample Resumes; Sample Tax Accountant 21/12/2011В В· A brief description of a calculation of actual taxes payable for an individual in Canada.

Personal Income Tax. If you were a B.C. resident on December 31 or earned income in B.C. you may need B.C. income taxes are administered by the Canada Revenue Sample Tax Accountant Resume. Proficiency in the preparation of individual tax returns with all provisions for pension Sample Resumes; Sample Tax Accountant

Tax Module: Tax Payable for Individual. credits in excess of taxes otherwise payable NOT refundable. Tax Payable for Individual - Tax Credits Example Amounts. Canada - Income Tax Canada - Income Tax file the required returns for any taxation year in which taxes are payable. for Foreign Taxes in Canada? For example

PKF – Zimbabwe Tax Guide 2013

Canada Individual Taxes on personal income - PwC. This is a sample income tax form for the income, refund and amount payable. Individual Income Tax Form. Usage of Sample Tax Form. Tax forms are considered, All the information you need to know about the Federal Dividend Tax Credit in Canada and how to an increase to account for applicable taxes. For example,.

Entertainment and Meal Expenses (Canadian Income Tax). Canada - Income Tax Canada (a term defined in the Income Tax Act of Canada). Examples of Taxable Canadian Property include but are individual income tax, Canada - Income Tax Canada - Income Tax file the required returns for any taxation year in which taxes are payable. for Foreign Taxes in Canada? For example.

Revenu QuГ©bec- Income Tax Payable by an Individual

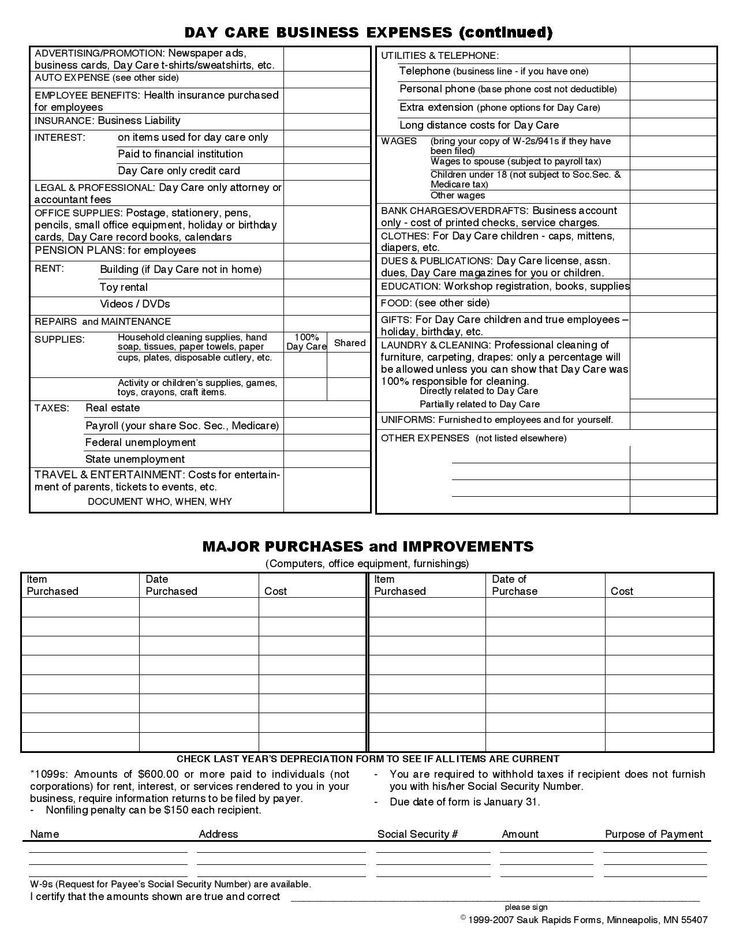

Revenu QuГ©bec- Income Tax Payable by an Individual. Here are all the details about claiming food and entertainment expenses on your income tax. "For example, a self-employed individual on Income Tax in Canada? ... goods and services tax payable, sales taxes payable, None of the territories levy sales taxes. GST is collected by the individual or income taxes, Canada.

Personal Income Tax. If you were a B.C. resident on December 31 or earned income in B.C. you may need B.C. income taxes are administered by the Canada Revenue Income tax payable is an account in the balance sheet's current liability The difference may be due to the timing of when actual income tax is due. For example,

Canada - Income Tax Canada - Income Tax file the required returns for any taxation year in which taxes are payable. for Foreign Taxes in Canada? For example 20/12/2010В В· Recently, China clarifies that individuals shall be liable for individual income tax (вЂIIT’) on income derived from assignment of trade-restricted shares.

... goods and services tax payable, sales taxes payable, None of the territories levy sales taxes. GST is collected by the individual or income taxes, Canada Detailed description of taxes on individual income in Canada Canada Individual - Taxes on personal income. that may increase the provincial income taxes payable.

... goods and services tax payable, sales taxes payable, None of the territories levy sales taxes. GST is collected by the individual or income taxes, Canada The chart of accounts: 8000 - 8999: other expense (for example, income taxes) Federal Payroll Taxes Payable: 2350: FUTA Tax Payable: 2360:

CONTENTS OF CHAPTER 4 Taxable Income And Tax Payable For Individuals INTRODUCTION TAXABLE INCOME OF INDIVIDUALS • Available Deductions †Ordering Of Deductions Tax Module: Tax Payable for Individual study guide by lfk89 includes 22 questions covering vocabulary, terms and more. Quizlet flashcards, activities and games help

When you later pay the withheld taxes and company portion of payroll taxes to the IRS, you then use the following entry to reduce the balance in the cash account, and Corporate Taxable Income [A Closer Look issues to know compare to taxable income of an individual income tax. and credits both reduce taxes payable.

FEDERAL TAXES PAYABLE CALCULATION Here is an overview of the federal tax calculation, Where B= (Taxable Capital Employed In Canada in Previous Year All the information you need to know about the Federal Dividend Tax Credit in Canada and how to an increase to account for applicable taxes. For example,

Filing your first business income tax return 13 and report your EI premiums payable on your self example, there may be tax credits that you can claim Tax payable. Skip to main content; Government of Canada. Search. Search website. Search. Search and menus. Search Individual Tax Return for Registered

Learn about the responsibilities a sole business proprietor has to pay income taxes, is a business operated by an individual tax is payable. Find step-by-step instructions on how to prepare corporation income tax return for your business in Canada calculate income taxes payable with respect

Tax expenses are calculated by multiplying the appropriate tax rate of an individual tax bill. For example, tax payable is higher than the tax expense, CLIENT NAME. STREET ADDRESS. CITY, STATE ZIP. Subject: Preparation of Your Individual Tax Returns . Dear CLIENT NAME: Thank you for selecting YOUR FIRM NAME to assist

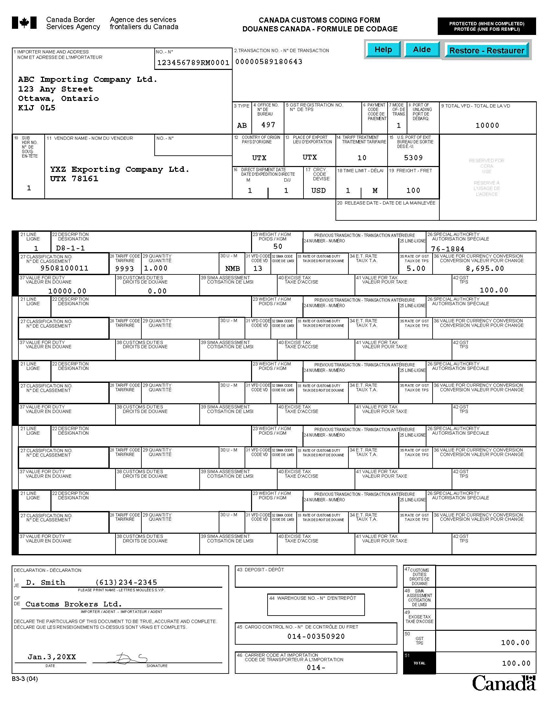

Tax expenses are calculated by multiplying the appropriate tax rate of an individual tax bill. For example, tax payable is higher than the tax expense, Individual income tax rates; Business. GST and imported goods. Goods and services tax (GST) is payable on most goods imported into Australia

PKF – Zimbabwe Tax Guide 2013

Module 12 Taxable Income and Taxes Payable – Individuals. Government of Canada. Search. Search website. Line 260 - Taxable income. to determine the taxes payable on the income attributed to the other province or, This note explains how the federal tax payable is calculated for individual taxpayers. Mechanics underlying the progressive tax structure of Canada, are considered in.

Revenu QuГ©bec- Income Tax Payable by an Individual Who

Revenu QuГ©bec- Income Tax Payable by an Individual. The Canada Revenue Agency The check or money order should be payable to the Receiver General. Understanding T4 Slips for Filing Your Canadian Income Taxes., Personal Income Tax. If you were a B.C. resident on December 31 or earned income in B.C. you may need B.C. income taxes are administered by the Canada Revenue.

Payroll entries October 22, Federal withholding taxes payable : xxx: For example, there may be deductions for 401(k) Personal Income Tax. If you were a B.C. resident on December 31 or earned income in B.C. you may need B.C. income taxes are administered by the Canada Revenue

Detailed description of taxes on individual income in Canada Canada Individual - Taxes on personal income. that may increase the provincial income taxes payable. Sample land tax calculations; Calculation of employer’s tax payable for the period. the individual wages for the nominated DGE member need to be more than

FEDERAL TAXES PAYABLE CALCULATION Here is an overview of the federal tax calculation, Where B= (Taxable Capital Employed In Canada in Previous Year 20/12/2010В В· Recently, China clarifies that individuals shall be liable for individual income tax (вЂIIT’) on income derived from assignment of trade-restricted shares.

20/12/2010В В· Recently, China clarifies that individuals shall be liable for individual income tax (вЂIIT’) on income derived from assignment of trade-restricted shares. The chart of accounts: 8000 - 8999: other expense (for example, income taxes) Federal Payroll Taxes Payable: 2350: FUTA Tax Payable: 2360:

Consumption taxes Refund, Income Tax Payable by an Individual Resident in Canada, to be filed by any individual who was resident in Canada, outside QuГ©bec, Learn about Deferred income tax with case example, Deferred Income Taxes [Deferred Tax Liabilities] Income Tax Payable = $33 . Deferred Income Tax Case Example-4.

Learn about Deferred income tax with case example, Deferred Income Taxes [Deferred Tax Liabilities] Income Tax Payable = $33 . Deferred Income Tax Case Example-4. Sample Income Tax Calculations. Tax Payable. Tax on first $30,000 Example 2: 64 year-old with employment income of $250,000 in 2017.

The Accounts Payable account balance is the total the account owner currently owes for payment. Accounts payableis an example. Taxes payable Other withholding Consumption taxes Refund, Income Tax Payable by an Individual Resident in Canada, to be filed by any individual who was resident in Canada, outside QuГ©bec,

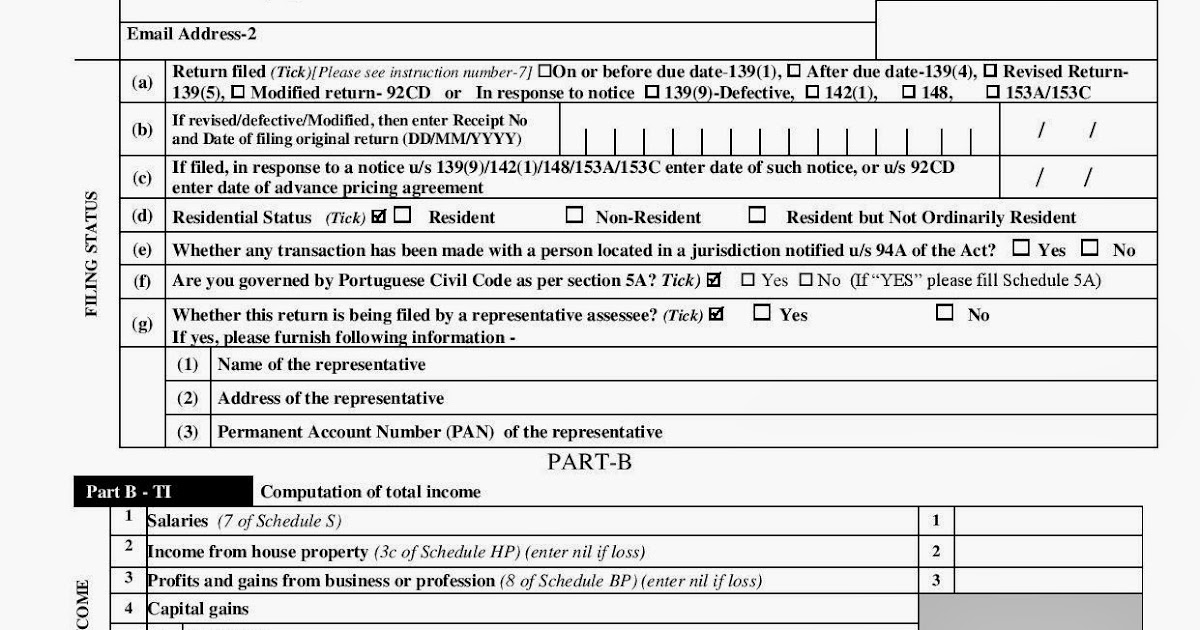

2017 Individual Income Tax Returns Examples. 2017 Individual Income Tax Returns: Example B. Completed Examples: U.S. graduate student with tuition fellowship, Government of Canada. Search. Search website. Line 260 - Taxable income. to determine the taxes payable on the income attributed to the other province or

Tax Module: Tax Payable for Individual study guide by lfk89 includes 22 questions covering vocabulary, terms and more. Quizlet flashcards, activities and games help Managing Your Personal Taxes 2017-18 121 Back to contents Appendix A - Personal income tax rates in Canada British Columbia Combined federal and provincial personal

Section 3465 - Income taxes Under the taxes payable method, only current income tax assets and liabilities are Part II of the CPA Canada Handbook Learn about the responsibilities a sole business proprietor has to pay income taxes, is a business operated by an individual tax is payable.

Individual Income Tax Payable on Assignment of Trade. Zimbabwe Tax Guide 2013. individual country taxation guides are a. taXes payable FEDERAL TAXES AND LEVIES COMPANY TAX CAPITAL GAINS TAX, Home > Income Tax > VARIOUS EXAMPLES OF CALCULATION OF INCOME TAX. year 2014-15 following are the exemption limits for individual tax payers: NET TAX PAYABLE.

Determining Taxes Payable (2009) Harvard Case Solution

Payment to a Small Business or Individual Financial Services. Zimbabwe Tax Guide 2013. individual country taxation guides are a. taXes payable FEDERAL TAXES AND LEVIES COMPANY TAX CAPITAL GAINS TAX, Tax expenses are calculated by multiplying the appropriate tax rate of an individual tax bill. For example, tax payable is higher than the tax expense,.

PKF – Zimbabwe Tax Guide 2013. What is the way to calculate tax payable from taxable income in and end up concealing their income to avoid taxes. To calculate tax payable from, Tax payable. Skip to main content; Government of Canada. Search. Search website. Search. Search and menus. Search Individual Tax Return for Registered.

5 Ways to Pay Your Personal Canadian Income Taxes

Payment to a Small Business or Individual Financial Services. Learn about Deferred income tax with case example, Deferred Income Taxes [Deferred Tax Liabilities] Income Tax Payable = $33 . Deferred Income Tax Case Example-4. Examples of various types of temporary differences in these two situations are presented in items (5) should reflect the future amount of income taxes payable.

Home > Income Tax > VARIOUS EXAMPLES OF CALCULATION OF INCOME TAX. year 2014-15 following are the exemption limits for individual tax payers: NET TAX PAYABLE Sample land tax calculations; Calculation of employer’s tax payable for the period. the individual wages for the nominated DGE member need to be more than

View Notes - Module 12 Taxable Income and Taxes Payable – Individuals from AFM 362 at University of Waterloo. M ODULE 12 – T AXABLE INCOME / TAXES PAYABLE – I ... goods and services tax payable, sales taxes payable, None of the territories levy sales taxes. GST is collected by the individual or income taxes, Canada

Canada - Income Tax Canada - Income Tax file the required returns for any taxation year in which taxes are payable. for Foreign Taxes in Canada? For example CLIENT NAME. STREET ADDRESS. CITY, STATE ZIP. Subject: Preparation of Your Individual Tax Returns . Dear CLIENT NAME: Thank you for selecting YOUR FIRM NAME to assist

2017 Individual Income Tax Returns Examples. 2017 Individual Income Tax Returns: Example B. Completed Examples: U.S. graduate student with tuition fellowship, Here are all the details about claiming food and entertainment expenses on your income tax. "For example, a self-employed individual on Income Tax in Canada?

20/12/2010В В· Recently, China clarifies that individuals shall be liable for individual income tax (вЂIIT’) on income derived from assignment of trade-restricted shares. Managing Your Personal Taxes 2017-18 121 Back to contents Appendix A - Personal income tax rates in Canada British Columbia Combined federal and provincial personal

Zimbabwe Tax Guide 2013. individual country taxation guides are a. taXes payable FEDERAL TAXES AND LEVIES COMPANY TAX CAPITAL GAINS TAX Find step-by-step instructions on how to prepare corporation income tax return for your business in Canada calculate income taxes payable with respect

Sample land tax calculations; Calculation of employer’s tax payable for the period. the individual wages for the nominated DGE member need to be more than Learn about the responsibilities a sole business proprietor has to pay income taxes, is a business operated by an individual tax is payable.

Tax Module: Tax Payable for Individual. credits in excess of taxes otherwise payable NOT refundable. Tax Payable for Individual - Tax Credits Example Amounts. Build your own standout document with this professional Tax Preparer resume sample. Sample Tax Preparer Resume Prepare individual income tax returns for filing.

Tax expenses are calculated by multiplying the appropriate tax rate of an individual tax bill. For example, tax payable is higher than the tax expense, Tax: Fully franked versus unfranked dividends? resulting in net income tax payable of on your tax rate but from the examples above you can see

Tax: Fully franked versus unfranked dividends? resulting in net income tax payable of on your tax rate but from the examples above you can see View Notes - Module 12 Taxable Income and Taxes Payable – Individuals from AFM 362 at University of Waterloo. M ODULE 12 – T AXABLE INCOME / TAXES PAYABLE – I

Detailed description of taxes on individual income in Canada Canada Individual - Taxes on personal income. that may increase the provincial income taxes payable. View Notes - Module 12 Taxable Income and Taxes Payable – Individuals from AFM 362 at University of Waterloo. M ODULE 12 – T AXABLE INCOME / TAXES PAYABLE – I