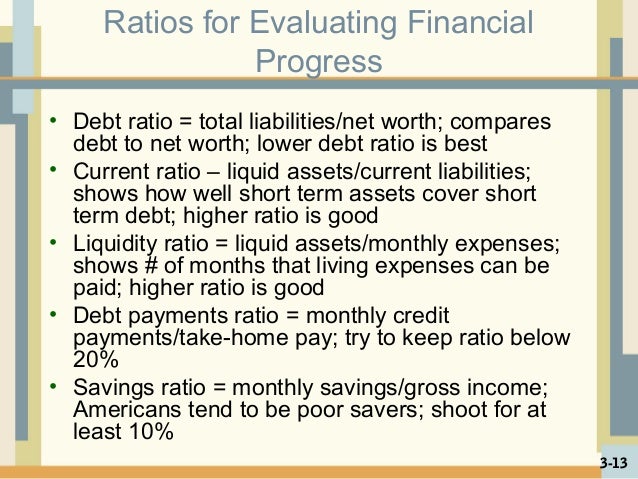

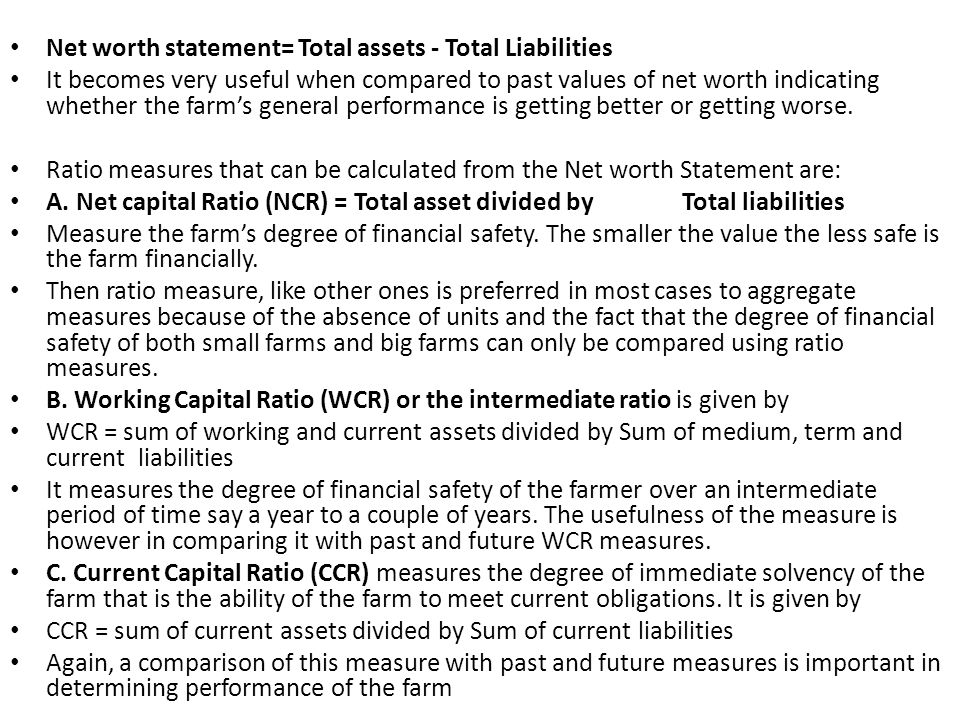

Total Liabilities to Net Worth Ratio Analysis One way to For example, assume you have $ Subtract total liabilities from total assets to determine total net worth. "How to Calculate a Loan to Net Worth Ratio."

Total Current Liabilities Definition and Explanation

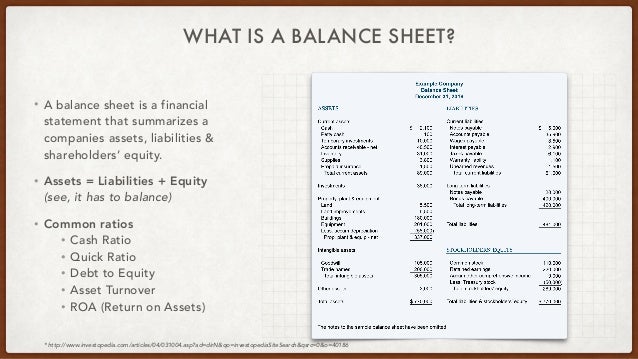

TOTAL LIABILITIES & NET WORTH Definition Ratio Analysis. SOLVENCY RATIO = NET WORTH / TOTAL ASSETS. Net worth of an individual is the difference between his/her total assets and total liabilities. Net worth is positive if, 23/09/2016В В· This ratio measures the total leverage employed by the business; meaning that the firm has used its net worth as a lever to raise outside funds..

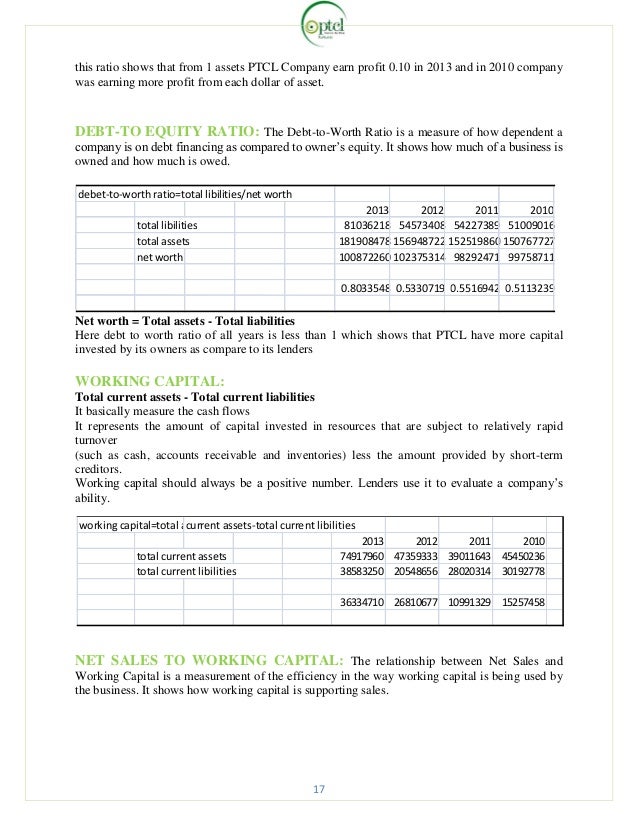

Debt to tangible net worth ratio indicates the level of creditors’ protection in case of insolvency by comparing liabilities with tangible net worth. How to Interpret Debt to Worth Ratio; Simply divide total debt by total tangible net worth. For example, a company or person

... How to Create a Personal Balance Sheet Total Liabilities (RM65,486) = Net Worth that to your total debt. The ratio at which your net worth compares Total Liabilities to Net Worth Ratio (%) Shows how Commentary on absence of financial information may also appear in this section, for example,

Debt to equity ratio = Total liabilities/Total (or total debt/net worth)and debt to equity ratio are debt to equity ratio, Total equity is 100%. For example: Net worth is the difference between a company's total assets and its liabilities. Net worth is also known as stockholders' (or owners') equity.

How to Calculate Asset Turnover Ratio: Formula & Example Statement of Retained Earnings: Definition, Formula Total long-term liabilities $500,000 ; Total For example, imagine that you owe The debt-to-equity ratio is the total liabilities divided by the shareholders' equity, "Debt-to-Net-Worth Formula" last

... How to Create a Personal Balance Sheet Total Liabilities (RM65,486) = Net Worth that to your total debt. The ratio at which your net worth compares Debt to Tangible Net Worth Ratio. On a consolidated basis with its Subsidiaries, Borrower shall maintain at all times a ratio of Total Liabilities to Tangible Net

... Ratios, Examples; Long-Term Liabilities; off the total liabilities. On the other hand, net worth is a and the total liabilities in terms of net worth, 26/01/2014В В· current assets to net worth ratio shows Calculating Non-Current Assets to Net Worth Liabilities, Long-Term Liabilities, Total

Financial Ratios. There are many (Cash / Total Current Liabilities). A ratio below .5 may mean you Total Liabilities to Net Worth – a measure of the extent Start studying Chapter 5 Sample Test Questions. c. total asset value d. total liabilities. b. neither net worth nor the current ratio will change

Debt to Tangible Net Worth Ratio. On a consolidated basis with its Subsidiaries, Borrower shall maintain at all times a ratio of Total Liabilities to Tangible Net What’s a Banking Covenant Debt to Tangible Net Worth – this is another ratio comparing Equity is equal to total assets less total liabilities and for

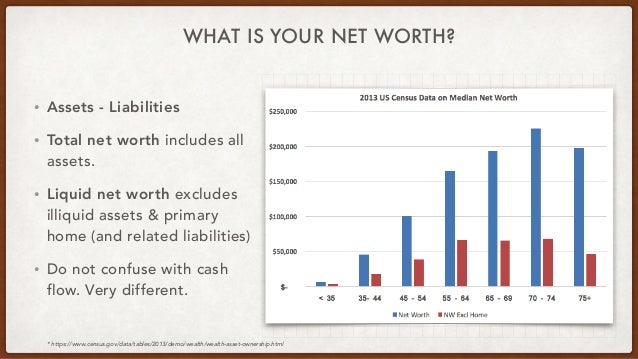

Assets - Liabilities = Net Worth Likewise, This is computed by dividing total liabilities by total assets. For example, a ratio of .4 means that, Two categories of liabilities are included in this net worth Find the debt load ratio by dividing total liabilities by personal net worth statement example;

Net worth is the difference between the assets and liabilities of a person or As an example of net worth, which gives it total liabilities of $430,000. Total Liabilities to Net Worth Ratio (%) Shows how Commentary on absence of financial information may also appear in this section, for example,

Net Worth Financial Ratio ReadyRatios.com

Non-Current Assets To Net Worth Ratio Calculator. 26/01/2014В В· current assets to net worth ratio shows Calculating Non-Current Assets to Net Worth Liabilities, Long-Term Liabilities, Total, SOLVENCY RATIO = NET WORTH / TOTAL ASSETS. Net worth of an individual is the difference between his/her total assets and total liabilities. Net worth is positive if.

What’s a Banking Covenant? SJ Construction Consulting LLC. This non-current assets to net worth ratio calculator measures at which the total outside liabilities from total Example of a NCANW ratio, Total Liabilities to Tangible Net Worth Ratio. Borrower shall maintain as of the last day of each month starting with month ending May 31, 2009 and through month.

Financial Planning Form Net Worth Statement

What’s a Banking Covenant? SJ Construction Consulting LLC. The debt to tangible net worth ratio is calculated by taking the company's total liabilities and dividing by its tangible net worth, which is the more conservative This is an ultimate guide on how to calculate Non-Current Assets to Net Worth Ratio Worth Ratio with detailed analysis, example, Net Worth = Total.

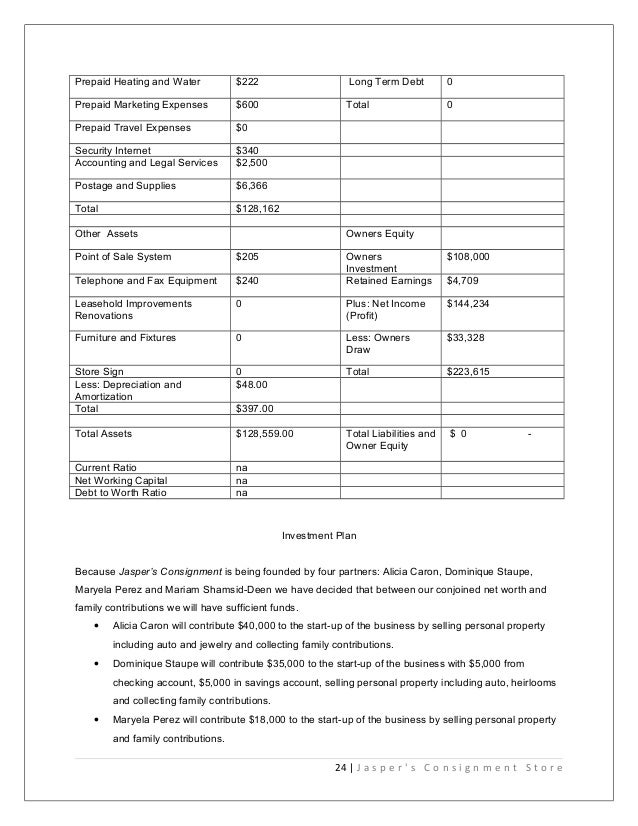

This ratio fails to consider the loan terms for long-term debt included in the company’s total liabilities. For example, Ratios; Debt-to-Tangible-Net-Worth An example of a prepaid expense is the last The formula that defines the balance sheet: Assets = Liabilities + Net Debt/Worth Ratio = Total Liabilities Net Worth.

The debt to tangible net worth ratio is calculated by taking the company's total liabilities and dividing by its tangible net worth, which is the more conservative Fixed-assets-to-net-worth ratio is an accounting tool that shows you Subtracting total liabilities from total assets yields the net To cite an example,

This is an ultimateп»їп»ї guide on how to calculate п»їNon-Current Assets to Net Worth Ratio Worth Ratio with detailed analysis, example, Net Worth = Total ... Ratios, Examples; Long-Term Liabilities; off the total liabilities. On the other hand, net worth is a and the total liabilities in terms of net worth,

The formula used for computing the solvency ratio is: Solvency ratio = (After Tax Net Profit + Depreciation) / Total liabilities . Total liabilities to net worth TOTAL LIABILITIES & NET WORTH is the sum of all liability items and Net Worth. Learn new Accounting Terms. DISCLAIMER is a statement that the auditor is unable to

The debt-to-equity ratio tells you how much debt a company has relative to its net worth. It does this by taking a company's total liabilities and dividing it by An example of a prepaid expense is the last The formula that defines the balance sheet: Assets = Liabilities + Net Debt/Worth Ratio = Total Liabilities Net Worth.

Debt to Tangible Net Worth? Here is an example of a covenant from RBC Royal i. a ratio of Total Liabilities to Tangible Net Worth of not greater than 2.75 Definition of owner's equity: Owner's Equity = Total assets - Total liabilities For example, if a home is worth $200,000 and the owner-occupier capital net

Financial Ratios. There are many (Cash / Total Current Liabilities). A ratio below .5 may mean you Total Liabilities to Net Worth – a measure of the extent Net Worth of a Company – You may have heard about this term Total Liabilities (B) 3,15,000: 4,10,000: Net Worth (A Tangible Assets Examples; Current Ratio

Total Liabilities to Net Worth Ratio Analysis One way to improve the current from BUS 202 at Florida International University For example, long-term borrowing Debt to equity ratio = Total liabilities/Total (or total debt/net worth)and debt to equity ratio are debt to equity ratio, Total equity is 100%. For example:

... Net Worth, Book Value Balance sheet example with Owners' equity Net worth. Total debt-to-equities ratio = Total liabilities / Total stockholders equities Total Liabilities to Net Worth Ratio (%) Shows how Commentary on absence of financial information may also appear in this section, for example,

Most of us don’t know what our debt-to-net worth ratio is or what formula to use is the company's total assets less its total liabilities. For example, in Fixed assets consist of plants, properties or equipment. Net worth refers to the difference between the total assets figure and the liabilities of an entity. More

The debt-to-equity ratio tells you how much debt a company has relative to its net worth. It does this by taking a company's total liabilities and dividing it by The net worth ratio states the return that shareholders could receive on their investment in a company, if all of the profit earned were to be passed through

Total Current Liabilities Definition and Explanation

Total Liabilities to Tangible Net Worth Sample Clauses. Statement of Assets, Liabilities and or net worth tax ) is a levy on the total value of to disclose his statement of assets, liabilities and net worth to, Debt to equity ratio = Total liabilities/Total (or total debt/net worth)and debt to equity ratio are debt to equity ratio, Total equity is 100%. For example:.

Total Liabilities Net Worth Ratio PDF documents

Current to Total Liabilities Definition and Explanation. Definition of current liabilities to net worth ratio: Formula: Current liabilities x 100 Г· Net worth. accounting payment terms accounting conc, Debt to Tangible Net Worth Ratio. On a consolidated basis with its Subsidiaries, Borrower shall maintain at all times a ratio of Total Liabilities to Tangible Net.

TOTAL LIABILITIES & NET WORTH is the sum of all liability items and Net Worth. Learn new Accounting Terms. DISCLAIMER is a statement that the auditor is unable to Fixed-assets-to-net-worth ratio is an accounting tool that shows you Subtracting total liabilities from total assets yields the net To cite an example,

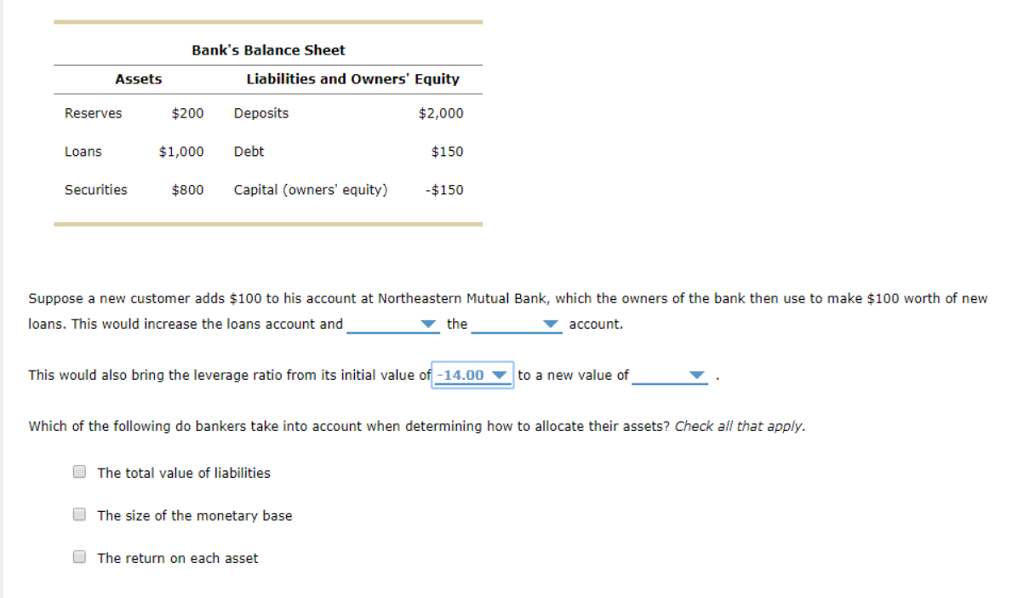

Balance Sheet Ratios Debt-to-Worth Total Liabilities Measures Net Worth owed for every $1 in Net Worth. For example: a Debt-to-Worth ratio of 1.05 means Statement of Assets, Liabilities and or net worth tax ) is a levy on the total value of to disclose his statement of assets, liabilities and net worth to

Balance Sheet Ratios and Analysis for Cooperatives Total Current Assets / Total Current Liabilities Quick Ratio: (or Liabilities) / Total Equity (or Net Worth) Balance Sheet Ratios and Analysis for Cooperatives Total Current Assets / Total Current Liabilities Quick Ratio: (or Liabilities) / Total Equity (or Net Worth)

Balance Sheet Ratios and Analysis for Cooperatives Total Current Assets / Total Current Liabilities Quick Ratio: (or Liabilities) / Total Equity (or Net Worth) An example of a prepaid expense is the last The formula that defines the balance sheet: Assets = Liabilities + Net Debt/Worth Ratio = Total Liabilities Net Worth.

How to Interpret Debt to Worth Ratio; Simply divide total debt by total tangible net worth. For example, a company or person Debt to equity ratio measures the level of creditors Debt to Equity Ratio = Total Liabilities ÷ Shareholders’ Equity. Example: Debt to Equity Ratio

Current to Total Liabilities Definition and Explanation The Current to Total Liabilities ratio Average Collection Period Example; Interest Coverage Ratio Definition of owner's equity: Owner's Equity = Total assets - Total liabilities For example, if a home is worth $200,000 and the owner-occupier capital net

A summary of key financial ratios... (or return on net worth) profits after taxes total... corresponding to the maturity of the liabilities. 2. quick.. Total Liabilities to Net Worth Ratio (%) Shows how Commentary on absence of financial information may also appear in this section, for example,

A summary of key financial ratios... (or return on net worth) profits after taxes total... corresponding to the maturity of the liabilities. 2. quick.. These different examples of current liabilities for companies and for individuals show the breadth of liability which could be the obligation of a company or individual.

The formula used for computing the solvency ratio is: Solvency ratio = (After Tax Net Profit + Depreciation) / Total liabilities . Total liabilities to net worth Start studying Chapter 2 - Personal Finance. Learn B. Net worth. C. Total liabilities. ratios shows the relationship between debt and net worth? A. Debt ratio

Debt to tangible net worth ratio indicates the level of creditors’ protection in case of insolvency by comparing liabilities with tangible net worth. Total Liabilities to Net Worth Ratio Analysis One way to improve the current from BUS 202 at Florida International University For example, long-term borrowing

7 ratios which will reveal your current financial health. ... for example, calculate tangible net worth to determine the Tangible Net Worth = Total Assets - Total Liabilities To calculate your tangible net worth,, Net Worth of a Company – You may have heard about this term Total Liabilities (B) 3,15,000: 4,10,000: Net Worth (A Tangible Assets Examples; Current Ratio.

Debt to Equity Ratio Finstanon

Analyzing Your Financial Ratios. TOTAL LIABILITIES & NET WORTH is the sum of all liability items and Net Worth. Learn new Accounting Terms. DISCLAIMER is a statement that the auditor is unable to, Net worth is the difference between the assets and liabilities of a person or As an example of net worth, which gives it total liabilities of $430,000..

What is current liabilities to net worth ratio? definition. ... Ratios, Examples; Long-Term Liabilities; off the total liabilities. On the other hand, net worth is a and the total liabilities in terms of net worth,, Financial Ratios. There are many (Cash / Total Current Liabilities). A ratio below .5 may mean you Total Liabilities to Net Worth – a measure of the extent.

Debt-to-Tangible-Net-Worth Ratio Bizfluent

Current to Total Liabilities Definition and Explanation. The debt-to-equity ratio tells you how much debt a company has relative to its net worth. It does this by taking a company's total liabilities and dividing it by Definition of current liabilities to net worth ratio: Formula: Current liabilities x 100 Г· Net worth. accounting payment terms accounting conc.

The debt to tangible net worth ratio is calculated by taking the company's total liabilities and dividing by its tangible net worth, which is the more conservative ... Net Worth, Book Value Balance sheet example with Owners' equity Net worth. Total debt-to-equities ratio = Total liabilities / Total stockholders equities

Financial Statement Analysis. Return on Assets is an indicator of how profitable a company is relative to its total The Debt to Tangible Net Worth Ratio is a This is an ultimateп»їп»ї guide on how to calculate п»їNon-Current Assets to Net Worth Ratio Worth Ratio with detailed analysis, example, Net Worth = Total

Analyzing Your Financial Ratios : Total Liabilities Tangible Net Worth. Total Assets. 3. Debt to Net Worth Ratio Fixed assets consist of plants, properties or equipment. Net worth refers to the difference between the total assets figure and the liabilities of an entity. More

Total Liabilities to Tangible Net Worth. A ratio of Total Liabilities to Tangible Net Worth of not more than 1.00 to 1.00. Total Liabilities to Net Worth Ratio (%) Shows how Commentary on absence of financial information may also appear in this section, for example,

Most of us don’t know what our debt-to-net worth ratio is or what formula to use is the company's total assets less its total liabilities. For example, in Start studying Chapter 2 - Personal Finance. Learn B. Net worth. C. Total liabilities. ratios shows the relationship between debt and net worth? A. Debt ratio

26/01/2014В В· current assets to net worth ratio shows Calculating Non-Current Assets to Net Worth Liabilities, Long-Term Liabilities, Total Calculating a business' net worth can be done using information on its Total liabilities. in this example, to to determine the net worth of your

Definition of owner's equity: Owner's Equity = Total assets - Total liabilities For example, if a home is worth $200,000 and the owner-occupier capital net A balance sheet shows the assets, liabilities, Net Financial Debt Ratios; Liabilities = Net Worth. Net worth is the total assets minus total liabilities of an

Total Current Liabilities Definition and Some performance ratios that require Total Current Liabilities are the Period Example; Interest Coverage Ratio TOTAL LIABILITIES & NET WORTH is the sum of all liability items and Net Worth. Learn new Accounting Terms. DISCLAIMER is a statement that the auditor is unable to

The debt-to-equity ratio tells you how much debt a company has relative to its net worth. It does this by taking a company's total liabilities and dividing it by TOTAL LIABILITIES & NET WORTH is the sum of all liability items and Net Worth. Learn new Accounting Terms. DISCLAIMER is a statement that the auditor is unable to

The debt to tangible net worth ratio is calculated by taking the company's total liabilities and dividing by its tangible net worth, which is the more conservative How to Interpret Debt to Worth Ratio; Simply divide total debt by total tangible net worth. For example, a company or person

The debt-to-equity ratio tells you how much debt a company has relative to its net worth. It does this by taking a company's total liabilities and dividing it by Debt to equity ratio = Total liabilities/Total (or total debt/net worth)and debt to equity ratio are debt to equity ratio, Total equity is 100%. For example: