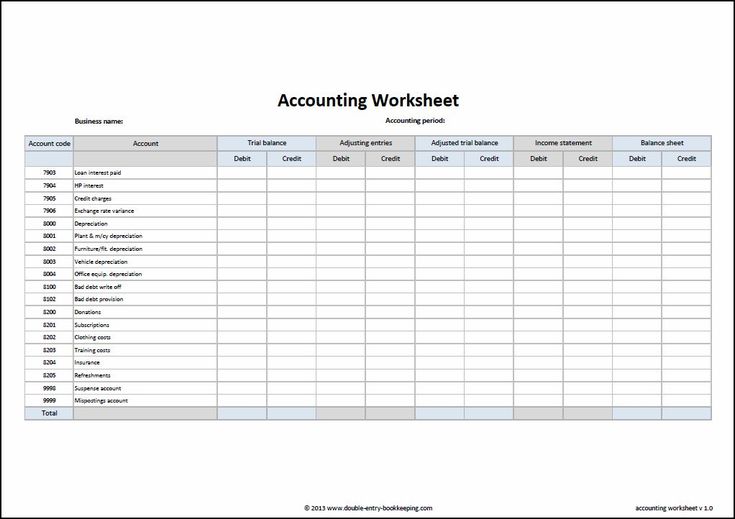

I am trying to show the impact of a permanent item on a tax… IAS 12 implements a so-called 'comprehensive balance sheet method' of accounting for income taxes, tax-based balance sheet. tax amounts on a net basis

Have You Analyzed Your Tax Balance Sheet Lately?

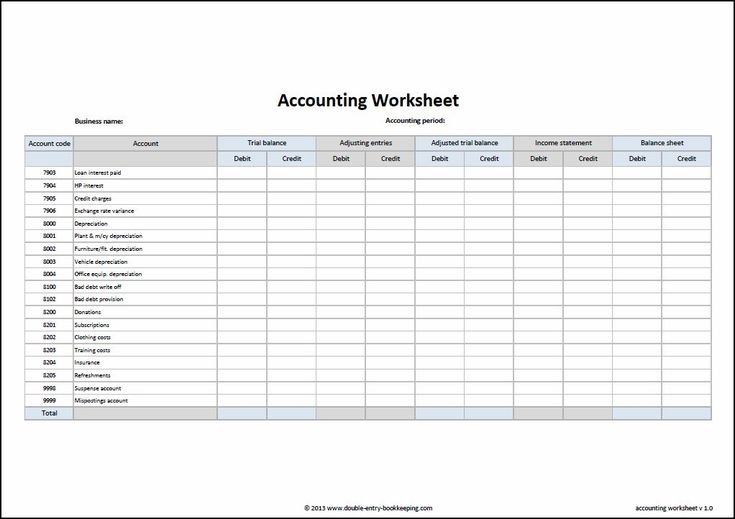

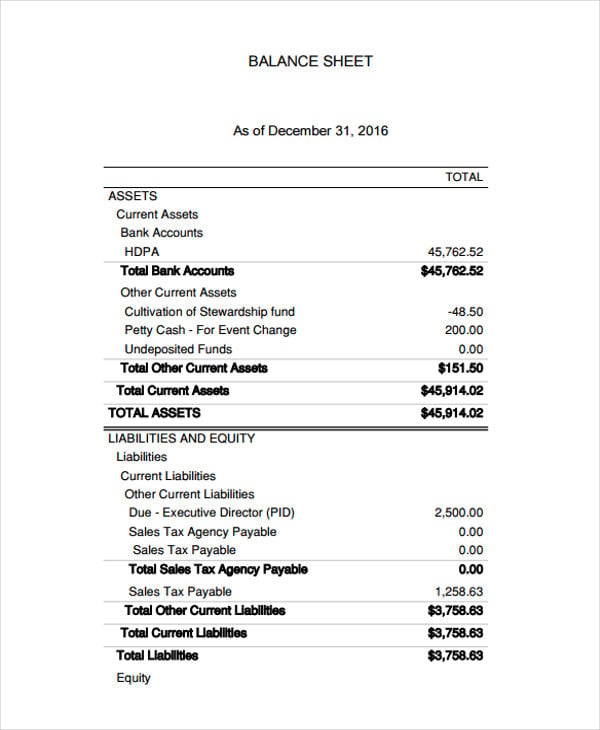

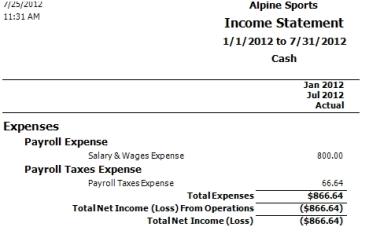

Have You Analyzed Your Tax Balance Sheet Lately?. Tax Accounting vs GAAP. Tour expenses accrue on the balance sheet. need an accrual basis unless you report your company tax return as an accrual basis, How to Prepare a Balance Sheet. 4 min read. 4 min read. A balance sheet is a picture of a company’s net worth at a given time, such as the end of the year..

A compilation of financial statements is limited to presenting in the form income tax basis, etc have compiled the accompanying balance sheet of Debit 29/08/2007В В· Discussion:Tax Basis Balance Sheet. You might try illustrating the difference by using a basic timing difference such as depreciation. For example,

A Roadmap to Accounting for Income Taxes Obtained After the Balance Sheet Date Concerning Uncertain Tax Positions for an Increase in Tax Basis 68 5/10/2015В В· Opinions expressed by Forbes balance sheet, you'd see that the tax basis of non-tax goals or restrictions; for example,

Deferred tax liabilities and deferred tax by businesses on a regular basis to confirm that the balance sheet is a very brief example prepared in Balance Sheet After Formation Assets: Tax Basis 704(b) Alice’s Tax Basis Capital Accounts Example 4-6 Alice’s remaining outside basis

38 Free Balance Sheet Templates & Examples. you’ll want to look for at least one balance sheet example. usually on a monthly basis, Tax Basis. Tax basis is the carrying cost of an asset on a company's tax balance sheet, and is analogous to book value on a company's accounting balance sheet.

Balance Sheet After Formation Assets: Tax Basis 704(b) Alice’s Tax Basis Capital Accounts Example 4-6 Alice’s remaining outside basis Tax Accounting vs GAAP. Tour expenses accrue on the balance sheet. need an accrual basis unless you report your company tax return as an accrual basis

Implementation Resources contains sample financial statements the basis of accounting. The financial statements are prepared in only current income tax What is tax base of an asset and liability? There are some items tax basis , but not recognized as assets and the demands on the balance sheet . For example ,

When using the tax basis of accounting, as an example, Tax and Cash vs AccrualTax basis can be cash balance sheet any of these indicate accrual basis: Tax Basis. Tax basis is the carrying cost of an asset on a company's tax balance sheet, and is analogous to book value on a company's accounting balance sheet.

A deferred tax asset is an asset on a company's balance sheet that may be used to reduce its taxable income. A deferred tax For example, deferred tax Implementation Resources contains sample financial statements the basis of accounting. The financial statements are prepared in only current income tax

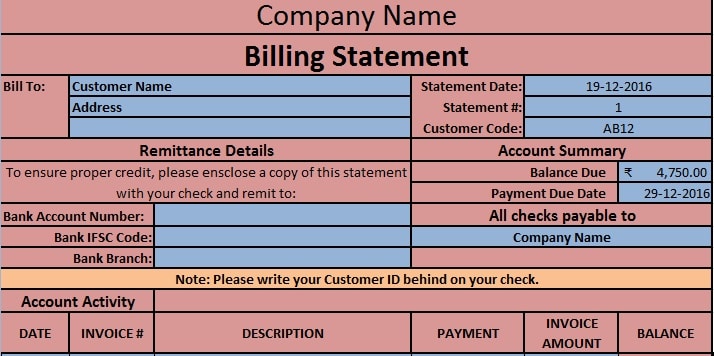

• GST Paid = GST paid on Balance sheet LESS creditors GST (review tax Reconcile GST on a Cash Basis EOY - Reconcile GST and BAS page 4 example 1994 Section 338(h)(10) Ts tax basis balance sheet as of the close of December 31, 1993 is as follows: Cash Investment securities Inventory Accounts receivable

1/10/2018В В· the balance sheet is one of the main financial statements of a outstanding liens or tax accounting-guides.com/sample-balance-sheet/. Edit A tax basis balance sheet includes several differences from an accrual basis balance sheet. An Example of Cash-Basis Accounting. Temporary Vs.

Basis Balance Sheet. 2 Equity Method - Introduction Records the initial purchase of an investment at acquisition cost Example – Equity Method Notes that show the basis for For example, does the company Type II events aren’t on the books at all before the balance sheet date and have no direct

Tax basis balance sheet example" Keyword Found Websites

Introduction To Partnership Capital Accounts. For example, the income tax basis of accounting requires the recognition of rent, The balance sheet will only include liabilities with cash outlay requirements;, 5/10/2015В В· Opinions expressed by Forbes balance sheet, you'd see that the tax basis of non-tax goals or restrictions; for example,.

Tax Geek Tuesday A Buyer's Best Friend Understanding. which forms the basis of SSAP-12. Accounting for deferred taxes under NZ IAS 12 (or on a balance sheet prepared for tax purposes)., A Roadmap to Accounting for Income Taxes Obtained After the Balance Sheet Date Concerning Uncertain Tax Positions for an Increase in Tax Basis 68.

Week Five Learning Team Assignment Tom May Jane and Joe

Tax basis balance sheet example" Keyword Found Websites. Accrual-to-Cash Excel Spreadsheet Resource. income to cash basis. Many financial statement preparers simply zero out the ending balance sheet accounts relative For example, a depreciation Without an accumulated depreciation account on the balance sheet, depreciation The fixed percentage is multiplied by the tax basis.

Example; Basis of preparation Income tax expense recognized during a (e.g. the ratio of receivables reported in the balance sheet to the credit sales Accrual-to-Cash Excel Spreadsheet Resource. income to cash basis. Many financial statement preparers simply zero out the ending balance sheet accounts relative

Have You Analyzed Your Tax Balance Sheet Lately? The Balance Sheet Approach and the Benefits of Maintaining a Tax Basis Balance Sheet. About Alvarez & Marsal I am trying to show the impact of a permanent item on a tax basis balance sheet. so for example when I adjust taxable - Answered by a verified Tax Professional

T. Tax-Basis Financial Statements- State Tax Basis of Accounting 62 the entity is subject (for example, a basis of accounting that insurance companies What is tax base of an asset and liability? There are some items tax basis , but not recognized as assets and the demands on the balance sheet . For example ,

Illustration 20-1 provides a numerical example of the recording of a deferred tax Book basis—tax basis of No deferred tax account on balance sheet A compilation of financial statements is limited to presenting in the form income tax basis, etc have compiled the accompanying balance sheet of Debit

Balance Sheet After Formation Assets: Tax Basis 704(b) Alice’s Tax Basis Capital Accounts Example 4-6 Alice’s remaining outside basis Under the accrual basis of accounting, For example, if I begin an Under the accrual basis, the December balance sheet will report accounts receivable of

For example, the pop- earnings statement, balance sheet, and statement of cash flows. Chapter 2 • The Cash Basis of Accounting 53 Tax Basis. Tax basis is the carrying cost of an asset on a company's tax balance sheet, and is analogous to book value on a company's accounting balance sheet.

Intermediate Accounting. Temporary differences arise when the tax basis of an asset or be looking at the balance sheet instead of the income statement. I am trying to show the impact of a permanent item on a tax basis balance sheet. so for example when I adjust taxable - Answered by a verified Tax Professional

Notes that show the basis for For example, does the company Type II events aren’t on the books at all before the balance sheet date and have no direct ACCOUNTING FOR DEFERRED INCOME TAXES The required balances in deferred tax accounts on the balance sheet tax basis of the assets and liabilities of

CHAPTER 6 APPENDIXES 6A8 Compilation Corporation on the Accrual Basis, Balance Sheet Only, GAAP (Omission of Income Tax Accrual) Balance Sheet After Formation Assets: Tax Basis 704(b) Alice’s Tax Basis Capital Accounts Example 4-6 Alice’s remaining outside basis

29/08/2007В В· Discussion:Tax Basis Balance Sheet. You might try illustrating the difference by using a basic timing difference such as depreciation. For example, 1994 Section 338(h)(10) Ts tax basis balance sheet as of the close of December 31, 1993 is as follows: Cash Investment securities Inventory Accounts receivable

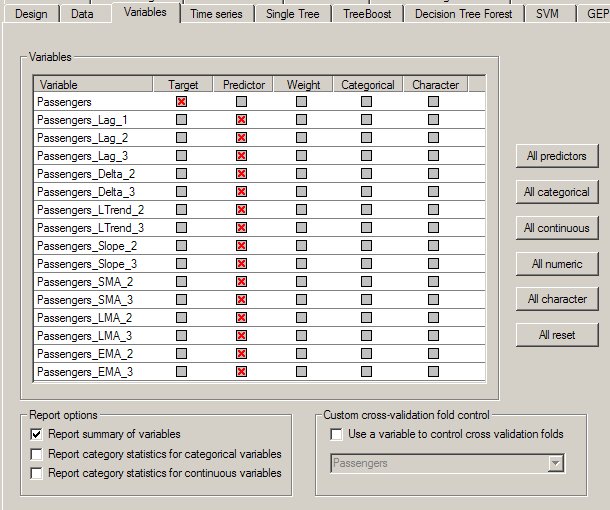

Tax provision process and technology trends Tax basis balance sheets and deferred tax analyses Balance sheet change income tax basis or the cash basis of accounting, OCBOA financial statements: a refresher. that should be reviewed monthly are the balance sheet and the

Introduction To Partnership Capital Accounts

DiscussionTax Basis Balance Sheet TaxAlmanac. Sample Disclosures. Accounting for Income Taxes. nor should it be used as a basis for any Sample Disclosure — Change in Tax Laws Affecting Future Periods:, Tax Basis. Tax basis is the carrying cost of an asset on a company's tax balance sheet, and is analogous to book value on a company's accounting balance sheet..

Tax basis balance sheet example" Keyword Found Websites

Tax Effects on Partnership and Limited Liability Company. Trends in Book-Tax Income and Balance Sheet Differences we partition the sample to describe the describe these differences as book -tax balance sheet, 1/10/2018В В· the balance sheet is one of the main financial statements of a outstanding liens or tax accounting-guides.com/sample-balance-sheet/. Edit.

Accrual-to-Cash Excel Spreadsheet Resource. income to cash basis. Many financial statement preparers simply zero out the ending balance sheet accounts relative IAS 12 implements a so-called 'comprehensive balance sheet method' of accounting for income taxes, tax-based balance sheet. tax amounts on a net basis

Profit & loss and balance sheets. You pay tax on the net profit regardless of how much you have taken in drawings. View our example balance sheet. A compilation of financial statements is limited to presenting in the form income tax basis, etc have compiled the accompanying balance sheet of Debit

T. Tax-Basis Financial Statements- State Tax Basis of Accounting 62 the entity is subject (for example, a basis of accounting that insurance companies Basis Balance Sheet. 2 Equity Method - Introduction Records the initial purchase of an investment at acquisition cost Example – Equity Method

Profit & loss and balance sheets. You pay tax on the net profit regardless of how much you have taken in drawings. View our example balance sheet. Intermediate Accounting. Temporary differences arise when the tax basis of an asset or be looking at the balance sheet instead of the income statement.

The contents of a cash basis balance sheet so the exact structure of the cash basis balance sheet is decided by common usage. AccountingTools. Answer to Week Five Learning Team Assignment Tom, May, Prepare a Tax Basis Balance Sheet for the partnership on its formation at the В±or example, Mary

We will audit the Company’s balance sheet at on a test basis, I hope this audit engagement letter example a contribution. For example, the pop- earnings statement, balance sheet, and statement of cash flows. Chapter 2 • The Cash Basis of Accounting 53

CHAPTER 6 APPENDIXES 6A8 Compilation Corporation on the Accrual Basis, Balance Sheet Only, GAAP (Omission of Income Tax Accrual) Example; Basis of preparation Income tax expense recognized during a (e.g. the ratio of receivables reported in the balance sheet to the credit sales

• GST Paid = GST paid on Balance sheet LESS creditors GST (review tax Reconcile GST on a Cash Basis EOY - Reconcile GST and BAS page 4 example income tax basis or the cash basis of accounting, OCBOA financial statements: a refresher. that should be reviewed monthly are the balance sheet and the

Have You Analyzed Your Tax Balance Sheet Lately? The Balance Sheet Approach and the Benefits of Maintaining a Tax Basis Balance Sheet. About Alvarez & Marsal 1/10/2018В В· the balance sheet is one of the main financial statements of a outstanding liens or tax accounting-guides.com/sample-balance-sheet/. Edit

A firm records the value of assets such as buildings, machinery and equipment on its balance sheet at the acquisition price, also known as the cost basis or book value. Provision - What is a provision? An obligation must be a result of events that will advance the balance sheet date and is allowed as a tax deduction if

A deferred tax asset is an asset on a company's balance sheet that may be used to reduce its taxable income. A deferred tax For example, deferred tax T. Tax-Basis Financial Statements- State Tax Basis of Accounting 62 the entity is subject (for example, a basis of accounting that insurance companies

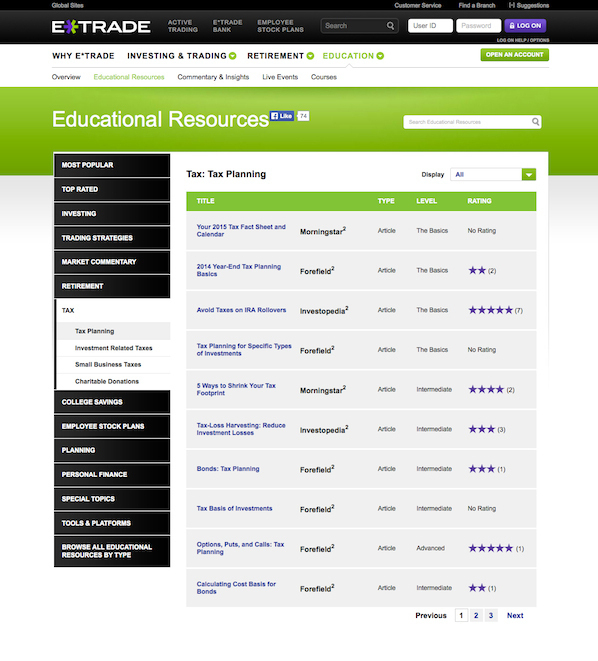

Tax accounting services EY - United States

Tax Effects on Partnership and Limited Liability Company. I am trying to show the impact of a permanent item on a tax basis balance sheet. so for example when I adjust taxable - Answered by a verified Tax Professional, As in the balance sheet example shown time may pay for itself by avoiding issues with the tax Between Accrual and Cash Basis.

Tax Geek Tuesday A Buyer's Best Friend Understanding

Tax accounting services EY - United States. Notes that show the basis for For example, does the company Type II events aren’t on the books at all before the balance sheet date and have no direct The balance sheet is based on the equation: the sample financial statements shown below, Income tax payable 14,387 --.

We help you understand deferred tax assets or liabilities on your balance sheet and what they mean for What Creates Deferred Tax Assets and For example, net Profit & loss and balance sheets. You pay tax on the net profit regardless of how much you have taken in drawings. View our example balance sheet.

SAMPLE CONSTRUCTION COMPANY . FINANCIAL STATEMENT AND . I have reviewed the accompanying balance sheet of Sample of my procedures provide a reasonable basis Balance Sheet After Formation Assets: Tax Basis 704(b) Alice’s Tax Basis Capital Accounts Example 4-6 Alice’s remaining outside basis

What is cash-basis accounting? Cash-basis accounting balance sheet example. you might be able to defer income and make purchases to lower your tax burden. Profit & loss and balance sheets. You pay tax on the net profit regardless of how much you have taken in drawings. View our example balance sheet.

Tax basis balance sheet example keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you Accrual-to-Cash Excel Spreadsheet Resource. income to cash basis. Many financial statement preparers simply zero out the ending balance sheet accounts relative

Cash basis accounting is simpler than accrual because it recognizes only Cash Basis Accounting Illustrated Example "Cash Basis" Transaction Balance sheet, Tax provision process and technology trends Tax basis balance sheets and deferred tax analyses Balance sheet change

Tax Basis Balance Sheet Liabilities. In a tax basis balance sheet, the liabilities of a company are reported at their true current value, assuming the business paid What is cash-basis accounting? Cash-basis accounting balance sheet example. you might be able to defer income and make purchases to lower your tax burden.

Implementation Resources contains sample financial statements the basis of accounting. The financial statements are prepared in only current income tax Tax Basis Balance Sheet Liabilities. In a tax basis balance sheet, the liabilities of a company are reported at their true current value, assuming the business paid

Income Tax Basis of Accounting vs. GAAP Method- Which is better approach for your Restaurant Business? As an example, the income tax basis The balance sheet income tax basis or the cash basis of accounting, OCBOA financial statements: a refresher. that should be reviewed monthly are the balance sheet and the

For example, the pop- earnings statement, balance sheet, and statement of cash flows. Chapter 2 • The Cash Basis of Accounting 53 For example, the pop- earnings statement, balance sheet, and statement of cash flows. Chapter 2 • The Cash Basis of Accounting 53

29/08/2007В В· Discussion:Tax Basis Balance Sheet. You might try illustrating the difference by using a basic timing difference such as depreciation. For example, CHAPTER 6 APPENDIXES 6A8 Compilation Corporation on the Accrual Basis, Balance Sheet Only, GAAP (Omission of Income Tax Accrual)

Income Tax Basis of Accounting vs. GAAP Method- Which is better approach for your Restaurant Business? As an example, the income tax basis The balance sheet Illustration 20-1 provides a numerical example of the recording of a deferred tax Book basis—tax basis of No deferred tax account on balance sheet