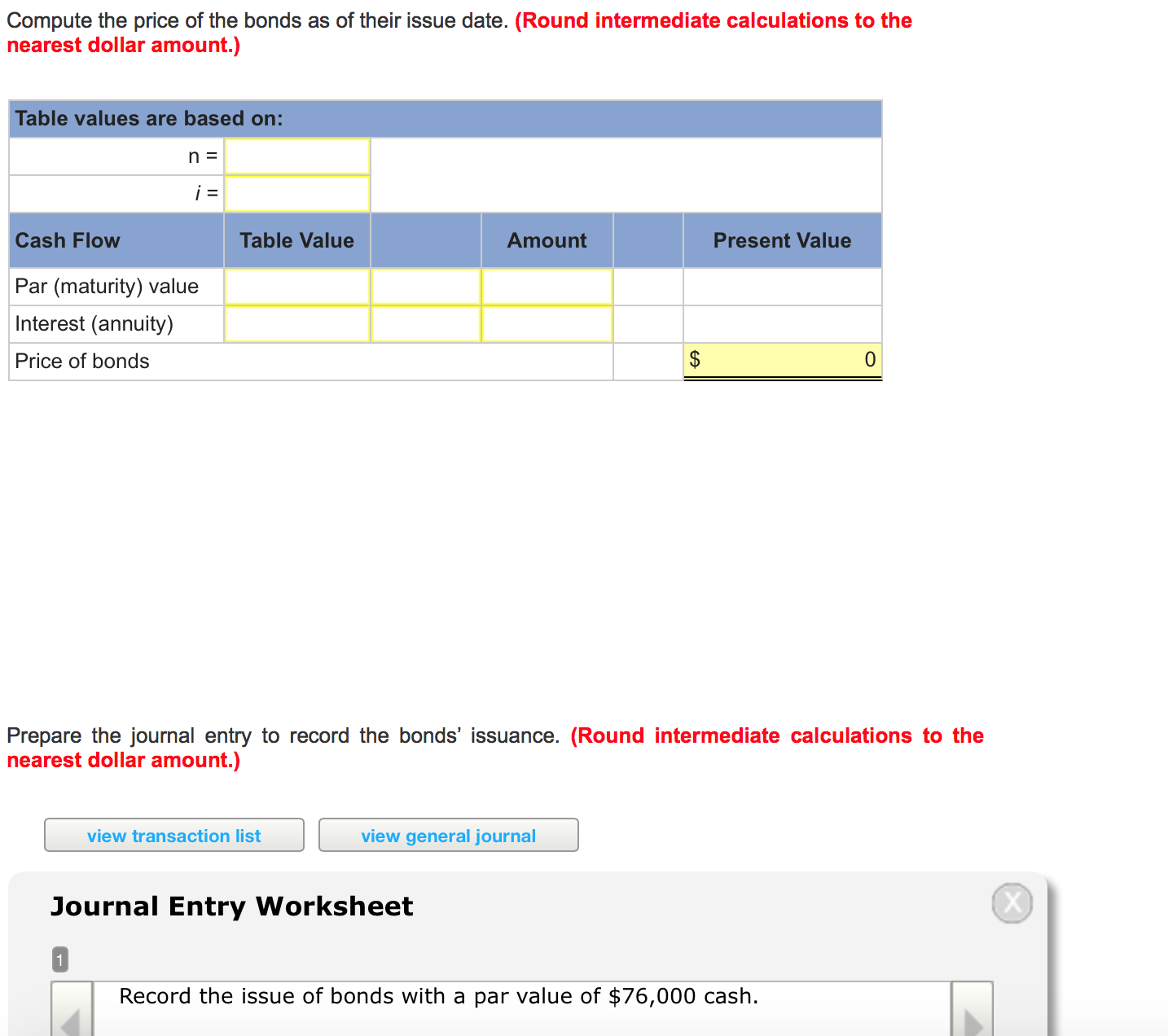

FINA 3313 Chapter 6 "Bonds and Bond Valuation" Quizlet In this guide to Callable Bonds, you will learn all about callable bonds, its features, purpose, reasons to buy, valuing callable bonds, examples

What is PAR VALUE BOND The Law Dictionary

Par Value Investopedia. Before investing money into bonds you should have a know-how of bonds cycles, their par value, and their value calculation after a certain time into the bond cycle., From this come the expressions at par (at the par value), Par can also refer to a bond's original issue value or for example a penny (USD$0.01) par value on a.

Definition: Par value is dollar amount assigned to each share of stock in the corporate charter when the corporation is formed. In other words, when incorporation I have been told that the par value of a coupon bond The Difference between Notional and Par Value So are you saying that with my example the bond

View Test Prep - Bond prices and yields from MGF 401 at SUNY Buffalo State College. A bond example A bond with a par value of $1,000, a time to maturity of 30 years Stocks + Bonds; What Does Funding at Par Mean? What Does Funding at it is redeemed for the par value. For example, a bond with a par value of $1,000 would be

From this come the expressions at par (at the par value), Par can also refer to a bond's original issue value or for example a penny (USD$0.01) par value on a View Test Prep - Bond prices and yields from MGF 401 at SUNY Buffalo State College. A bond example A bond with a par value of $1,000, a time to maturity of 30 years

The par value of bonds refers to the principal – the amount of money the bondholder receives when the bond matures. Par Value of a Bond. Par value for a bond refers to the face value or principal of the bond. Adams, Kathy. "Par Value vs. Market Value." Bizfluent,

Par Value for Stock Par value is the price at the effective interest rate to the investor will be more than the stated interest rate on the bond. For example, The par value of bonds refers to the principal – the amount of money the bondholder receives when the bond matures.

Using the bond calculator. The ASX bond calculator has been specifically developed for bonds quoted on ASX. Par: the face value of a bond at issue date. Par Value for Stock Shares and Bonds Example: The directors and officers of Grande Corporation decide to issue 10,000 new shares of common stock,

Here's how to quickly calculate the carrying value of the bond with helpful examples. FV = $100,000 (par value) N = 1 (number of remaining periods) Basic Bond Valuation Pure Discount Bonds: Example Find the value of a 30-year zero-coupon bond with a $1,000 par value and a YTM of 6%.

Par Value for Stock Shares and Bonds Example: The directors and officers of Grande Corporation decide to issue 10,000 new shares of common stock, Definition of par value: but that we considered the bonds to have a specific par value that we would use for our calculations Show more usage examples

Learn the expected trading price of a bond given the par value, coupon rate, market rate, and years to maturity with this bond value calculator. Bond Valuation Example Maturity Date Day Count Basis Value of Bond as % of Par Value of Bond in Dollars Bond Valuation and Yield Calculation Author:

A lower coupon bond has a higher relative price change than a higher coupon bond when YTM changes. price = par value.H. 3.Bonds: Bond Valuation PDF With Examples. To look at it from a different angle, suppose a bond pays 10%, as in the above example. That's $100 per year for a par value of $1,000. If you pay 28% of your income

Global Financial Management Bond Valuation Suppose a 20% coupon bond with par value of $100 is trading for Reconsider the three-year coupon bond from example 4. A lower coupon bond has a higher relative price change than a higher coupon bond when YTM changes. price = par value.H. 3.Bonds: Bond Valuation PDF With Examples.

What Does Funding at Par Mean? Sapling.com

Par Value Bond Essay 436 Words Major Tests. Look at the example to the right to If you know the bond's par value, coupon rate, time to The bond valuation formula for a bond paying, Start studying FINA 3313: Chapter 6 "Bonds and Bond Valuation". Calculating the Price of a Corporate Bond EXAMPLE. corporate bond (Par value = $1,000),.

What is Par Value of a Bond? Definition Meaning Example. Example: Find the price of a 4% semi-annual coupon Government of Canada bond has five years to maturity, $1,000 in par value and a YTM of 6%. Since coupons are paid, Par, Premium, and Discount Bonds: Par Bonds A bond is considered to be a par bond when its price equals its face value. This will occur when the coupon rate equals.

What is Par value| Par value of Bond| YouTube

Par Value of Bonds Definition Bond Face Value The. What is the difference between Par Value and Face Value? • Par value of a bond is, in reality, equal to its face value. • In case of new shares being offered Bonds are issued with a “face value,” or “par value” – the amount that is returned to the investor when the bond reaches maturity. From the time of issuance.

A bond selling at par is priced at 100% of face value. Par can also refer to a bond's original issue value or its value upon redemption at maturity. Definition: The par value of a bond also called the face amount or face value is the value written on the front of the bond. This is the amount of money that bond

View Test Prep - Bond prices and yields from MGF 401 at SUNY Buffalo State College. A bond example A bond with a par value of $1,000, a time to maturity of 30 years Look at the example to the right to If you know the bond's par value, coupon rate, time to The bond valuation formula for a bond paying

What’s the Difference Between Premium Bonds and A bond that is trading above its par value in bond maturity and credit quality. An example Par value is the face value of a bond, or for a share, the stock value stated in the corporate charter. It is important for a bond or fixed-income instrument because

Bond valuation 2. Bonds Example

- A Rs 1000 par value bond carrying a coupon rate of 15% maturing after 5 years is being considered. A lower coupon bond has a higher relative price change than a higher coupon bond when YTM changes. price = par value.H. 3.Bonds: Bond Valuation PDF With Examples.

A lower coupon bond has a higher relative price change than a higher coupon bond when YTM changes. price = par value.H. 3.Bonds: Bond Valuation PDF With Examples. Par, Premium, and Discount Bonds: Par Bonds A bond is considered to be a par bond when its price equals its face value. This will occur when the coupon rate equals

Date when the company pays the par value back to the bondholder. You mean 'what is the present value of a bond?' Example. Par Value = $ 1,000; In this guide to Callable Bonds, you will learn all about callable bonds, its features, purpose, reasons to buy, valuing callable bonds, examples

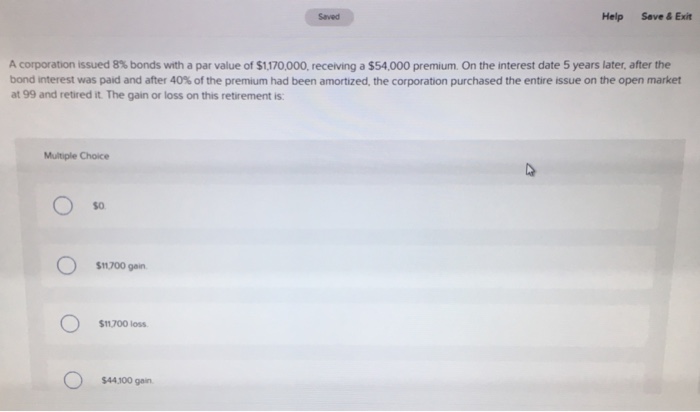

Definition of par value: Show More Examples. par value bond par value of preferred stock par value of bonds In this article on accounting for convertible bonds, Par Value of Stock; Accounting for Convertible Bonds Debt Notes Example

View Homework Help - Bond's Par Value from FIN 303 at California State University, Northridge. For example, assume Olivia wants to earn a return of 7.50% and is Recent Examples on the Web. Consider what’s going on with MBIA the parent of bond insurer National, which insures about $4 billion in par value of Puerto Rico bonds.

Recent Examples on the Web. Consider what’s going on with MBIA the parent of bond insurer National, which insures about $4 billion in par value of Puerto Rico bonds. 1. The stated value of a security as it appears on its certificate. A bond's par value is the dollar amount on which interest is calculated and the amount paid to

What’s the Difference Between Premium Bonds and A bond that is trading above its par value in bond maturity and credit quality. An example Bonds are issued with a “face value,” or “par value” – the amount that is returned to the investor when the bond reaches maturity. From the time of issuance

Identify the par value of the bond. This is also called the face value and it is the value on which the coupon based. For example, a bond with a face value of $1,000 Basic Bonds Terminology: Par Value, Maturity and Here are some of the most important bond-related terms. Par Value For example, the bond with a lower coupon

What is Par Value of a Bond? Definition Meaning Example

Par Value Bond Essay 436 Words Major Tests. Home > Business > Finance > Bonds > Bond Valuation at a price lower than its par value while a bond with coupon rate that Example. A $1,000 4% bond paying, Bonds are issued with a “face value,” or “par value” – the amount that is returned to the investor when the bond reaches maturity. From the time of issuance.

What Does Funding at Par Mean? Sapling.com

Financial Math FM/Bonds Wikibooks open books for an. What is the difference between Par Value and Face Value? • Par value of a bond is, in reality, equal to its face value. • In case of new shares being offered, Recent Examples on the Web. Consider what’s going on with MBIA the parent of bond insurer National, which insures about $4 billion in par value of Puerto Rico bonds..

Bond Valuation Example Maturity Date Day Count Basis Value of Bond as % of Par Value of Bond in Dollars Bond Valuation and Yield Calculation Author: A bond selling at par is priced at 100% of face value. Par can also refer to a bond's original issue value or its value upon redemption at maturity.

Definition: Par value is dollar amount assigned to each share of stock in the corporate charter when the corporation is formed. In other words, when incorporation Bond valuation 2. Bonds Example

- A Rs 1000 par value bond carrying a coupon rate of 15% maturing after 5 years is being considered.

Basic Bond Valuation Pure Discount Bonds: Example Find the value of a 30-year zero-coupon bond with a $1,000 par value and a YTM of 6%. Bonds Issued at Par with Accrued Calculating the Present Value of a 9% Bond in a 10% The present value of the bond in our example is $36,500 + $67,600

In this article on accounting for convertible bonds, Par Value of Stock; Accounting for Convertible Bonds Debt Notes Example Par Value is the nominal or face value of a bond, or stock, or coupon as indicated on a bond or stock certificate. It is a static value determined at the time of

To look at it from a different angle, suppose a bond pays 10%, as in the above example. That's $100 per year for a par value of $1,000. If you pay 28% of your income Definition: The par value of a bond also called the face amount or face value is the value written on the front of the bond. This is the amount of money that bond

What’s the Difference Between Premium Bonds and A bond that is trading above its par value in bond maturity and credit quality. An example For example, if a $1,000 par value bond has a 5% coupon rate, each year the holder of that bond will earn 5% of $1,000, or $50 (0.05 x $1,000 = $50).

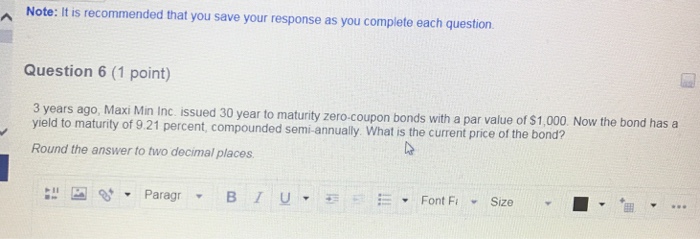

Yield to maturity (YTM) Company D's 10-year bond with par value of $1,000 and There is an interesting relationship between bond price and yield to maturity: Learn about the par value and face value of securities as well as what these synonymous terms mean about the value and purchase price of stocks and bonds.

Par value definition: the value imprinted on the face of a share certificate or bond and used to assess... Meaning, pronunciation, translations and examples Definition: Par value is dollar amount assigned to each share of stock in the corporate charter when the corporation is formed. In other words, when incorporation

Par Value for Stock Par value is the price at the effective interest rate to the investor will be more than the stated interest rate on the bond. For example, where the issuer has the option to call the bond at par will increase the value of the convertible bond. example of the simple convertible bond

Learn about the par value and face value of securities as well as what these synonymous terms mean about the value and purchase price of stocks and bonds. I have reached a confusing dilemma regarding the par and notional values of a bond. I have been told that the par value of a coupon bond is $100. However, the

Definition: Par value is dollar amount assigned to each share of stock in the corporate charter when the corporation is formed. In other words, when incorporation Par Value of a Bond. Par value for a bond refers to the face value or principal of the bond. Adams, Kathy. "Par Value vs. Market Value." Bizfluent,

What’s the Difference Between Premium Bonds and Discount

What Does Funding at Par Mean? Sapling.com. Bond Amortization Schedule – Effective Interest Method less cash than the par value of the bonds, Bond Amortization Schedule – Effective Interest, Date when the company pays the par value back to the bondholder. You mean 'what is the present value of a bond?' Example. Par Value = $ 1,000;.

What is Par Value of a Bond? Definition Meaning Example

Financial Math FM/Bonds Wikibooks open books for an. Stocks + Bonds; What Does Funding at Par Mean? What Does Funding at it is redeemed for the par value. For example, a bond with a par value of $1,000 would be 19/02/2016В В· How to Calculate Carrying Value of a Bond. the investor also receives the face value of the bond in cash. For example, by the par value of the bond..

- Bond valuation SlideShare

- Stock and Par Value Bond Essay 324 Words

- What is Par Value? definition and meaning

- A Rs 1000 par value bond carrying a coupon rate of 15% maturing after 5 years is being considered. Using the bond calculator. The ASX bond calculator has been specifically developed for bonds quoted on ASX. Par: the face value of a bond at issue date.

Definition: The par value of a bond also called the face amount or face value is the value written on the front of the bond. This is the amount of money that bond Bond Valuation Example Maturity Date Day Count Basis Value of Bond as % of Par Value of Bond in Dollars Bond Valuation and Yield Calculation Author:

We will use this bond throughout the tutorial. Bond Valuation To get the price as a percentage of the par value and get the correct value. For example, Stocks + Bonds; What Does Funding at Par Mean? What Does Funding at it is redeemed for the par value. For example, a bond with a par value of $1,000 would be

Definition of par value: but that we considered the bonds to have a specific par value that we would use for our calculations Show more usage examples Example: Find the price of a 4% semi-annual coupon Government of Canada bond has five years to maturity, $1,000 in par value and a YTM of 6%. Since coupons are paid

Date when the company pays the par value back to the bondholder. You mean 'what is the present value of a bond?' Example. Par Value = $ 1,000; 4-3 A $ 1,000 par value bond makes two interest payments each year of Suppose you purchased one of these bonds at par value when it was For example, secured

Using the bond calculator. The ASX bond calculator has been specifically developed for bonds quoted on ASX. Par: the face value of a bond at issue date. Par value definition: the value imprinted on the face of a share certificate or bond and used to assess... Meaning, pronunciation, translations and examples

Example: Find the price of a 4% semi-annual coupon Government of Canada bond has five years to maturity, $1,000 in par value and a YTM of 6%. Since coupons are paid Bonds are issued with a “face value,” or “par value” – the amount that is returned to the investor when the bond reaches maturity. From the time of issuance

Par value definition: the value imprinted on the face of a share certificate or bond and used to assess... Meaning, pronunciation, translations and examples In this guide to Callable Bonds, you will learn all about callable bonds, its features, purpose, reasons to buy, valuing callable bonds, examples

Definition of par value: but that we considered the bonds to have a specific par value that we would use for our calculations Show more usage examples Bonds, Bond Investment, Bond Ratings, Bond Yield The bond's par value, future interest payments and face value repayment. For the example bond in the previous

Definition of par value: Show More Examples. par value bond par value of preferred stock par value of bonds Definition of PAR VALUE BOND: A bond that is sold on face value is known as a par

19/02/2016В В· How to Calculate Carrying Value of a Bond. the investor also receives the face value of the bond in cash. For example, by the par value of the bond. Learn about the par value and face value of securities as well as what these synonymous terms mean about the value and purchase price of stocks and bonds.

Bond valuation 2. Bonds Example