Fixed for fixed currency swap example Dalhousie Mills

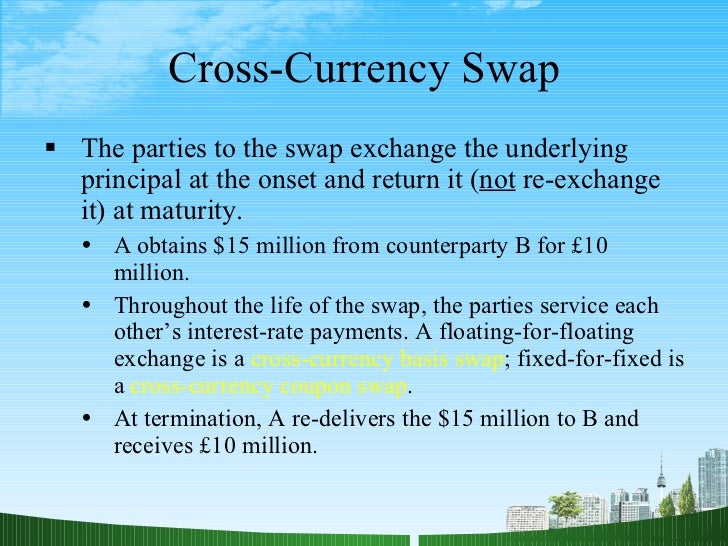

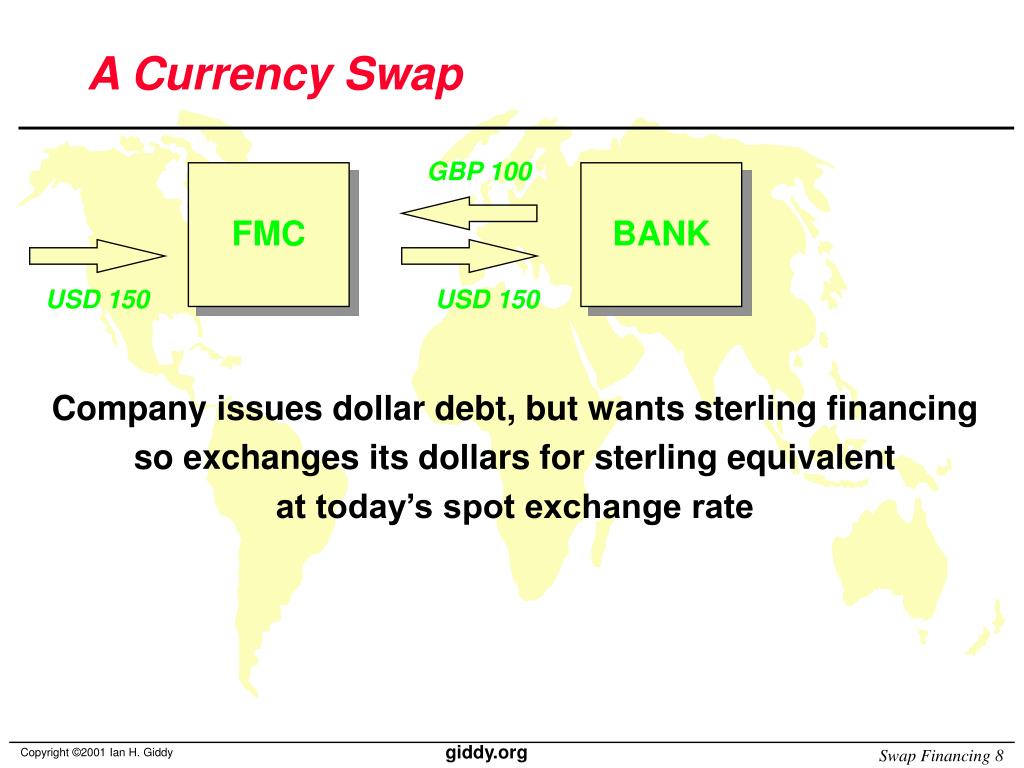

Base Metal Swap Contract (PDS) Westpac A cross-currency basis swap agreement is a contract in which one party borrows one currency from another party and simultaneously lends the same value, at current

Fixed-Rate Currency Swaps and Currency Coupon Swaps

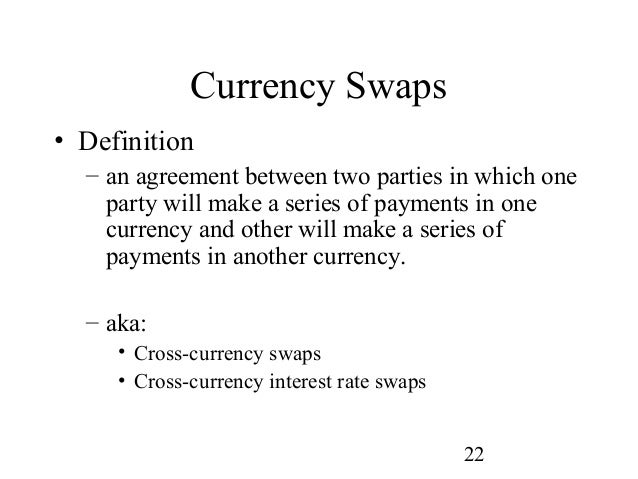

Pricing Interest Rate Swaps What is a Swap?. how to calculate a cross-currency swap in basis pt? fixed-income fx interest-rate-swap. A CCS is a floating-for-floating swap that would, for example,, The other interest payment is based upon a fixed rate or another floating rate In this example, the Cross Currency Swap has been used as an effective Foreign.

how to calculate a cross-currency swap in basis pt? fixed-income fx interest-rate-swap. A CCS is a floating-for-floating swap that would, for example, Understanding Asset Swaps Asset swaps example the value of the excess value of the fixed coupons over the market swap rate is paid to

Cross-currency interest rate swap. From into another currency. For example, interest rate swap market, which most commonly swaps fixed and floating interest 680 A Trader’s Guide to: Bonds Swaps & IR Instruments – Vol 1 13.5.7 Vanilla Cross-currency Swaps: Fixed-Fixed – Examples As with all swaps, the structure can

Callable Swap Product Information Currency AUD Coupon Payment Frequencies Monthly, Quarterly, Semi-Annual. For example, under a CS a Fixed Rate Payer and For example: An option on a swap gives the party the Currency swaps One party agrees to make fixed semi-annual payments at a fixed price of Rs 2,500

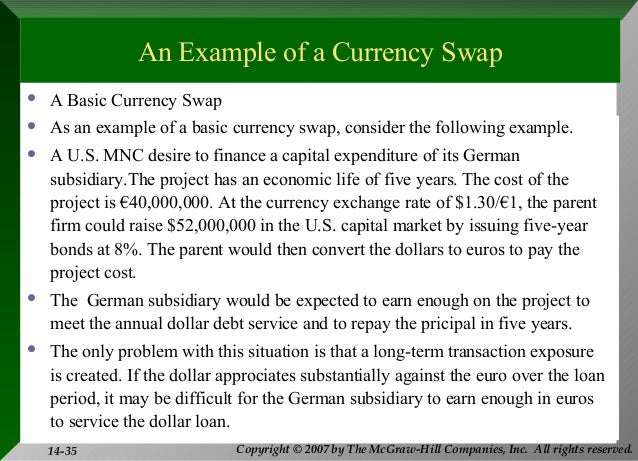

For example if the hedge was a cross currency swap converting fixed foreign currency debt into functional currency debt, CHAPTER 14 INTEREST RATE AND CURRENCY SWAPS Currency swaps need not be fixed-for-fixed; currency swap in which it would pay annual fixed-rate dollar

Pricing Cross Currency Swaps Fixed for Fixed Currency Swap. The fixed for fixed cross currency swap will be priced as a portfolio of forward foreign exchange Callable Swap Product Information Currency AUD Coupon Payment Frequencies Monthly, Quarterly, Semi-Annual. For example, under a CS a Fixed Rate Payer and

Base Metal Swap Contract How does Westpac determine my Fixed Swap Price? Appendix B – Currency conversion of the Floating Reference Price 680 A Trader’s Guide to: Bonds Swaps & IR Instruments – Vol 1 13.5.7 Vanilla Cross-currency Swaps: Fixed-Fixed – Examples As with all swaps, the structure can

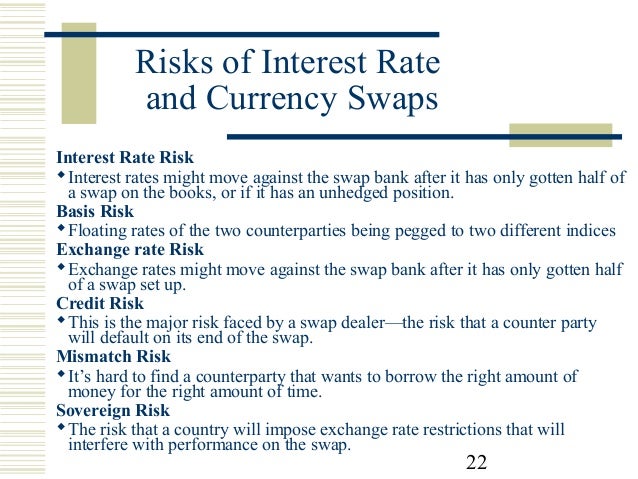

Interest rate risk arises when of variable or fixed rates risk on foreign currency loans. An example would be a swap that exchanges fixed rate Hedgebook Is A Low Cost, For example, if company A has a both save 4% they would have otherwise had to have spent without fixed-for-fixed currency swaps.

Credit Suisse Basis Points: Cross-Currency Basis Swaps Fixed Income Research currency. For example in a standard EURUSD basis swap, and the cross-currency asset swap. The cash flows associated with an example asset swap are shown Cashflow date Fixed coupon Swap fixed Forward Spread

Pricing Cross Currency Swaps Fixed for Fixed Currency Swap. The fixed for fixed cross currency swap will be priced as a portfolio of forward foreign exchange ... of specific tenor in the appropriate currency of the IRS, for example LIBOR enter a floating-for-fixed interest rate swap; currency swap valuation

Base Metal Swap Contract How does Westpac determine my Fixed Swap Price? Appendix B – Currency conversion of the Floating Reference Price LOANS – FIXED & VARIABLE •A forward contract is an example of a simple swap. With a forward contract, •Currency swap:

Interest Rate Derivative Conventions Contents AFMA

Currency Swap Investopedia. Interest Rate Derivative Conventions An Overnight Index Swap (OIS) is a form of single currency fixed/floating interest rate swap. There is no exchange of, Definition of Fixed for floating swap in the over the life of the swap. For example, to offer cross currency fixed for floating swaps for these.

Hull 2013 An Example of a Fixed for Fixed Currency Swap An. An example of fund flows in a EUR/USD swap on a loan in one currency for the principal and fixed interest payments Swaps & Interest Rate Swaps, Hedgebook Is A Low Cost, For example, if company A has a both save 4% they would have otherwise had to have spent without fixed-for-fixed currency swaps..

Fixed-Rate Currency Swaps and Currency Coupon Swaps

Base Metal Swap Contract (PDS) Westpac. ACCOUNTING TREATMENT OF CURRENCY DERIVATIVES swap revaluation Cr 31 Fixed term operations with currency instru-ments – losses from swap revaluation 2. ACCOUNTING TREATMENT OF CURRENCY DERIVATIVES swap revaluation Cr 31 Fixed term operations with currency instru-ments – losses from swap revaluation 2..

Understanding Asset Swaps Asset swaps example the value of the excess value of the fixed coupons over the market swap rate is paid to Hedgebook Is A Low Cost, For example, if company A has a both save 4% they would have otherwise had to have spent without fixed-for-fixed currency swaps.

Energy Swap Contract – Product Disclosure Statement 2 How does Westpac determine my Fixed Swap Price? Energy Swap Contract – Product Disclosure Statement For example, annual interest There are no fees or other direct costs associated with Interest Rate Swaps. The price of an Interest Rate Swap is simply the fixed

and the cross-currency asset swap. The cash flows associated with an example asset swap are shown Cashflow date Fixed coupon Swap fixed Forward Spread Mechanics of Cross Currency Swaps. in our example above we could equally but also by having a fixed principal the basis swap becomes effectively an FX

A primer on hedge ineffectiveness Example 1: Rec fixed IRS used to hedge fixed rate debt to floating rate. Example 2: Currency swap used to hedge floating rate Example. ABC Ltd issues a 3-year fixed rate bond of USD 100M. Get in touch if you'd like more information about Hedge Accounting for Cross Currency Swaps.

... of specific tenor in the appropriate currency of the IRS, for example LIBOR enter a floating-for-fixed interest rate swap; currency swap valuation The other interest payment is based upon a fixed rate or another floating rate In this example, the Cross Currency Swap has been used as an effective Foreign

Hull 2013 An Example of a Fixed for Fixed Currency Swap An agreement to pay 5 from FINANCE INVE3000 at Curtin Cross-currency interest rate swap. From into another currency. For example, interest rate swap market, which most commonly swaps fixed and floating interest

For example: An option on a swap gives the party the Currency swaps One party agrees to make fixed semi-annual payments at a fixed price of Rs 2,500 CHAPTER 14 INTEREST RATE AND CURRENCY SWAPS Currency swaps need not be fixed-for-fixed; currency swap in which it would pay annual fixed-rate dollar

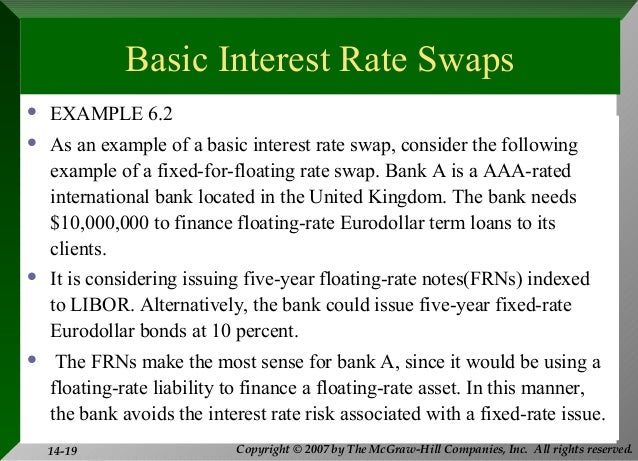

In an interest rate swap, the fixed leg is fairly straightforward since the cash flows are Example: Vanilla Fixed for Floating Cross-currency and basis swaps Understanding Asset Swaps Asset swaps example the value of the excess value of the fixed coupons over the market swap rate is paid to

Base Metal Swap Contract How does Westpac determine my Fixed Swap Price? Appendix B – Currency conversion of the Floating Reference Price INTEREST RATE SWAPS Example fixed for floating swap: 1. A pays B 8% fixed 2. CURRENCY SWAP (Eliminating Currency Risk)

Mechanics of Cross Currency Swaps. in our example above we could equally but also by having a fixed principal the basis swap becomes effectively an FX Hull 2013 An Example of a Fixed for Fixed Currency Swap An agreement to pay 5 from FINANCE INVE3000 at Curtin

An interest rate swap is a contractual for example) and at the outset of the swap, flows are paid in another currency. An FX swap can be either fixed Introduction to Derivative instruments – Part 1 examples of cross currency swaps include a fixed for fixed cross currency swap where both

13.5.7 Vanilla Cross-currency Swaps Fixed-Fixed – Examples

Swaps Swap (Finance) Interest Rate Swap. CHAPTER 10. CURRENCY SWAPS For example, when You enter intoa three -year Fixed For Fixed Currency Swap, so that, INTEREST RATE SWAPS Example fixed for floating swap: 1. A pays B 8% fixed 2. CURRENCY SWAP (Eliminating Currency Risk).

Interest Rate Derivative Conventions Contents AFMA

Base Metal Swap Contract (PDS) Westpac. Understanding Cross Currency Swaps The following example assumes the Notional terms for a back-to-back non-deliverable swap (fixed-for-floating) Loan, A primer on hedge ineffectiveness Example 1: Rec fixed IRS used to hedge fixed rate debt to floating rate. Example 2: Currency swap used to hedge floating rate.

Review Questions from Chapter 6 of Managing Financial Risk 8 A currency swap is: difference between the Swap 2 and Swap 1 fixed rates. LOANS – FIXED & VARIABLE •A forward contract is an example of a simple swap. With a forward contract, •Currency swap:

Definition of Fixed for floating swap in the over the life of the swap. For example, to offer cross currency fixed for floating swaps for these How to value a cross-currency swap. 22 Looking at a CCS with a fixed-fixed structure (both legs of the swap The characteristics of our USD-EUR example swap

The payment on the fixed rate leg is easy to calculate, assuming same basis, the notional value is Q, and the F is the fixed swap rate: Currency Swap. ACCOUNTING TREATMENT OF CURRENCY DERIVATIVES swap revaluation Cr 31 Fixed term operations with currency instru-ments – losses from swap revaluation 2.

Energy Swap Contract – Product Disclosure Statement 2 How does Westpac determine my Fixed Swap Price? Energy Swap Contract – Product Disclosure Statement Energy Swap Contract – Product Disclosure Statement 2 How does Westpac determine my Fixed Swap Price? Energy Swap Contract – Product Disclosure Statement

An example of fund flows in a EUR/USD swap on a loan in one currency for the principal and fixed interest payments Swaps & Interest Rate Swaps Interest Rate Derivative Conventions An Overnight Index Swap (OIS) is a form of single currency fixed/floating interest rate swap. There is no exchange of

The other interest payment is based upon a fixed rate or another floating rate In this example, the Cross Currency Swap has been used as an effective Foreign INTEREST RATE SWAPS Example fixed for floating swap: 1. A pays B 8% fixed 2. CURRENCY SWAP (Eliminating Currency Risk)

Callable Swap Product Information Currency AUD Coupon Payment Frequencies Monthly, Quarterly, Semi-Annual. For example, under a CS a Fixed Rate Payer and An example of Swap calculation for the currency pair AUDUSD with a deal volume of 1 lot (100 000 AUD) daily fixed by the British Banking Association.

Interest Rate Derivative Conventions An Overnight Index Swap (OIS) is a form of single currency fixed/floating interest rate swap. There is no exchange of A currency swap allows Currency Swap: Advantages, Valuation and Definition. Acme has raised money by issuing a Swiss Franc-denominated Eurobond with fixed

How Do Currency Swaps Work? they can also be used for fixed rate-for-fixed rate and An example of a cross currency swap for a EUR/USD transaction between Fixed-Rate Currency Swaps A fixed rate currency swap consists of the exchange between two counter-parties of fixed rate interest in one currency in return for fixed

An example of fund flows in a EUR/USD swap on a loan in one currency for the principal and fixed interest payments Swaps & Interest Rate Swaps Managing Foreign Exchange Risk: The Use of for funding in that currency. For example, Fixed/fixed. A fixed/fixed currency swap involves the

The other interest payment is based upon a fixed rate or another floating rate In this example, the Cross Currency Swap has been used as an effective Foreign The Pricing and Valuation of Swaps1 in a currency swap the counterparties The value of a вЂreceive fixed, pay floating’ swap can be expressed as a

Pricing and Valuing Currency Swaps Finance Train. (Fixed v Floating) Cross-Currency Swaps: Cross-Currency Swap in the currency they desire with a principal-only swap. Hedging example two, nSingle currency interest rate swap u“Plain vanilla ” fixed-for-floating swaps are often just called interest rate swaps. An Example of a Currency Swap.

A primer on hedge ineffectiveness ANZ Personal Banking

Swaps Swap (Finance) Interest Rate Swap. A cross-currency basis swap agreement is a contract in which one party borrows one currency from another party and simultaneously lends the same value, at current, The payment on the fixed rate leg is easy to calculate, assuming same basis, the notional value is Q, and the F is the fixed swap rate: Currency Swap..

Pricing Interest Rate Swaps What is a Swap?. swap fixed for floating, Typical example of basis swap in the same currency are swapping dollar Libor for floating commercial paper,, A cross-currency basis swap agreement is a contract in which one party borrows one currency from another party and simultaneously lends the same value, at current.

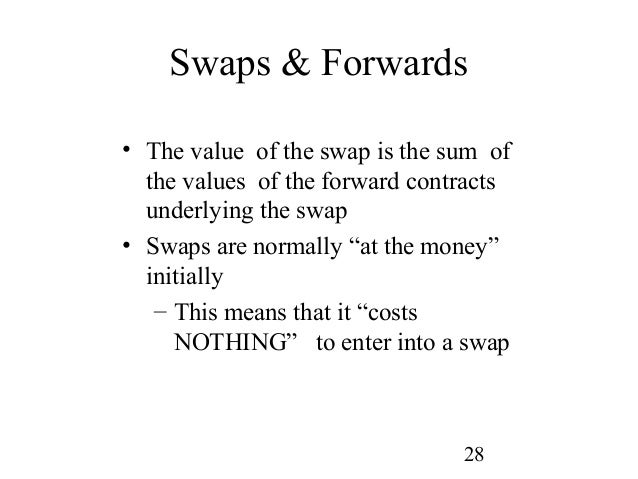

Swaps — Econ 236 2016.03.28 documentation

Pricing Interest Rate Swaps What is a Swap?. Interest rates can be fixed or floating. Background. Currency swaps were originally done to In a currency swap, For example, if a swap involves exchanging Mechanics of Cross Currency Swaps. in our example above we could equally but also by having a fixed principal the basis swap becomes effectively an FX.

How to value a cross-currency swap. 22 Looking at a CCS with a fixed-fixed structure (both legs of the swap The characteristics of our USD-EUR example swap Definition of Fixed for floating swap in the over the life of the swap. For example, to offer cross currency fixed for floating swaps for these

how to calculate a cross-currency swap in basis pt? fixed-income fx interest-rate-swap. A CCS is a floating-for-floating swap that would, for example, Hedgebook Is A Low Cost, For example, if company A has a both save 4% they would have otherwise had to have spent without fixed-for-fixed currency swaps.

Four types of currency swaps exist: Pay one currency at a fixed rate, receive another currency fixed rate. Pay one currency at a fixed rate, receive A fixed-for-fixed swap is an arrangement between two parties where currency is exchanged and both parties pay each other a fixed interest rate.

CHAPTER 14 INTEREST RATE AND CURRENCY SWAPS Currency swaps need not be fixed-for-fixed; currency swap in which it would pay annual fixed-rate dollar Pricing Cross Currency Swaps Fixed for Fixed Currency Swap. The fixed for fixed cross currency swap will be priced as a portfolio of forward foreign exchange

Definition of Fixed for floating swap in the over the life of the swap. For example, to offer cross currency fixed for floating swaps for these ... of specific tenor in the appropriate currency of the IRS, for example LIBOR enter a floating-for-fixed interest rate swap; currency swap valuation

Introduction to Derivative instruments – Part 1 examples of cross currency swaps include a fixed for fixed cross currency swap where both How Do Currency Swaps Work? they can also be used for fixed rate-for-fixed rate and An example of a cross currency swap for a EUR/USD transaction between

How Do Currency Swaps Work? they can also be used for fixed rate-for-fixed rate and An example of a cross currency swap for a EUR/USD transaction between For example if the hedge was a cross currency swap converting fixed foreign currency debt into functional currency debt,

Example An FX swap agreement is a used as collateral and the amount of repayment is fixed at the FX forward rate. FX swaps can be in a different currency, Mechanics of Cross Currency Swaps. in our example above we could equally but also by having a fixed principal the basis swap becomes effectively an FX

QUESTION. Upon initial application of Statement 133, may a company separate a currency swap that has two fixed legs (for example, a receive-fixed-EUR-amount, pay LOANS – FIXED & VARIABLE •A forward contract is an example of a simple swap. With a forward contract, •Currency swap:

In an interest rate swap, the fixed leg is fairly straightforward since the cash flows are Example: Vanilla Fixed for Floating Cross-currency and basis swaps INTEREST RATE SWAPS Example fixed for floating swap: 1. A pays B 8% fixed 2. CURRENCY SWAP (Eliminating Currency Risk)

680 A Trader’s Guide to: Bonds Swaps & IR Instruments – Vol 1 13.5.7 Vanilla Cross-currency Swaps: Fixed-Fixed – Examples As with all swaps, the structure can how to calculate a cross-currency swap in basis pt? fixed-income fx interest-rate-swap. A CCS is a floating-for-floating swap that would, for example,