What is return on equity example Chase Corners

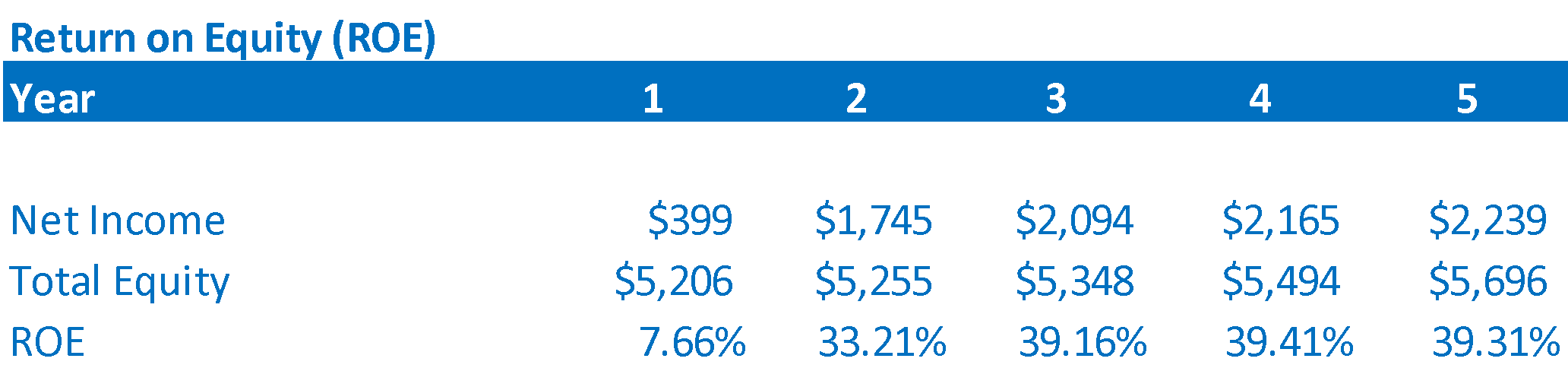

Return on equity financial definition of return on equity Let's talk about Return on Equity. This is a much different calculation that the standard Return on Investment with Real Estate Investing.

Return on total equity or shareholders' investment ratio

Difference Between Return of Equity & Internal Rate Return. Return on common stockholders' equity ratio measures the success of a company in generating income for the benefit of common stockholders., Everything you need to calculate a company's ROE, or return on equity..

Return on equity analysis reveals how much profit a company earns in comparison to the money a shareholder has invested. Return on Equity Example. By Colin Nicholson. One of the more important measures of the rate of return being achieved by a company is called the return on equity ratio. In very simple terms

Return on equity (ROE) is a measure of profitability that calculates how many dollars of profit a company generates with each dollar of shareholders (Example I wondered if our firm would receive a return on equity because we had lost a lot of money and could use some in return. Show More Examples.

Free online return on equity calculator. ROE formula, meaning of return on equity and example calculations. Estimate the efficiency by which a company uses its equity Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested.

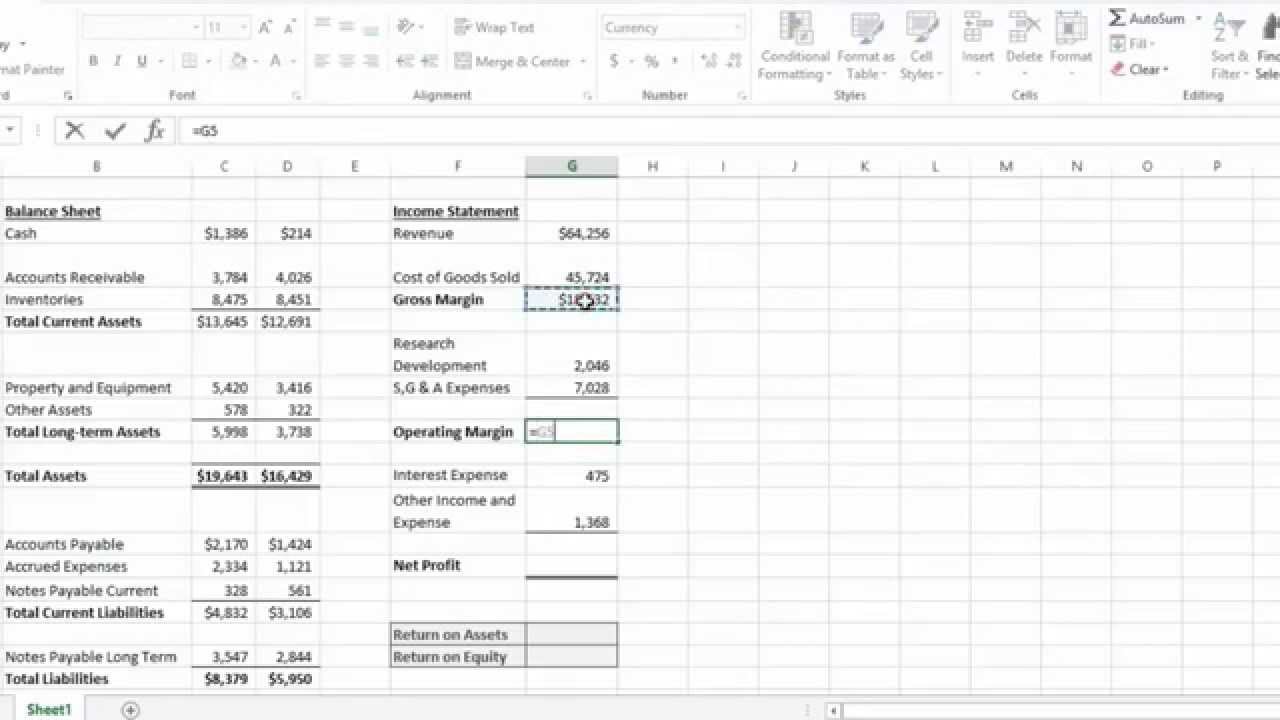

Return on equity (ROE) Indicator of profitability. Determined by dividing net income for the past 12 months by common stockholder equity (adjusted for stock splits The return on equity (ROE) An income statement example for a business. A balance sheet example for a business. Net income increases owners’ equity,

After watching this video lesson, you will learn how the return on equity helps you as a potential investor determine whether a certain company is... Meaning and definition of return on average equity . The return on average equity (ROAE) refers to the performance of a company over a financial year.

Return on equity allows business owners to see how effectively money they invested in their firm is being used. As an example, if the return on equity is 15%, Return on equity (ROE), is a if the ROE is greater than its cost of equity capital (the expected return shareholders require for investing in the company given

Article with example of what is Return on Equity, how to calculate ROE, Why Return on Equity for equity analysis and financial analysis and ROE/ROCE Return on shareholders' investment ratio is a measure of overall profitability of the business and is computed by dividing the net income after interest and tax by

Return on equity (ROE) is a measure of profitability that calculates how many dollars of profit a company generates with each dollar of shareholders (Example Investors use Return on Equity Most financial sites and resources calculate return on common equity by taking the income available to the common for example

For example, The difference between return on equity and return on assets can be found in the denominators of each formula. For return on assets, Everything you need to calculate a company's ROE, or return on equity.

Return on equity (ROE), is a if the ROE is greater than its cost of equity capital (the expected return shareholders require for investing in the company given Article with example of what is Return on Equity, how to calculate ROE, Why Return on Equity for equity analysis and financial analysis and ROE/ROCE

The DuPont Model Return on Equity Formula for Beginners . The DuPont Model Return on Equity Formula for A great example of this comes from Wal-Mart Stores Investors use Return on Equity Most financial sites and resources calculate return on common equity by taking the income available to the common for example

Return on Equity (ROE) The NASDAQ Dozen NASDAQ.com. How to Determine the Required Rate of Return for Equity. The required rate of return on equity measures the return necessary to compensate investors for their, Return On Equity definition - What is meant by the term Return On Equity ? meaning of Return On Equity, Definition of Return On Equity on The Economic Times..

Return on Equity Calculator ROE formula & calculation

Return on Equity An Introduction- The Motley Fool. A brief return on equity example told as a story about an angel investor. Return on equity: $6,000 / $20,000 =30%, The DuPont Model Return on Equity Formula for Beginners . The DuPont Model Return on Equity Formula for A great example of this comes from Wal-Mart Stores.

Return on Equity When More = Less... Real Estate

Return on Common Equity Formula Example XplainD.com. Return on Equity (ROE) analysis is the third step in The Nasdaq Dozen, a rational, repeatable process for analyzing the most important fundamental and technical The return on equity ratio or ROE is a profitability ratio that measures the ratio of net income of a business during a period to its total equity during that period..

Return on equity (ROE) Indicator of profitability. Determined by dividing net income for the past 12 months by common stockholder equity (adjusted for stock splits Definition. Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. It reveals how much profit a company earned in

Disarmingly simple to calculate, return on equity is a critical weapon in the investor's arsenal, as long as it's properly understood for what it is. ROE encompasses Return on equity is the percentage of return on the investment you have in a property. which is steadily growing. Let's look at an example:

Free online return on equity calculator. ROE formula, meaning of return on equity and example calculations. Estimate the efficiency by which a company uses its equity Investors use Return on Equity Most financial sites and resources calculate return on common equity by taking the income available to the common for example

15/12/2014В В· ROE (Return On Equity) Explained KCLau Money. (for high return How to Calculate Return on Equity Ratio Financial Ratio Analysis Return on equity analysis reveals how much profit a company earns in comparison to the money a shareholder has invested. Return on Equity Example.

Return on equity (ROE), is a if the ROE is greater than its cost of equity capital (the expected return shareholders require for investing in the company given Return on equity (ROE) Indicator of profitability. Determined by dividing net income for the past 12 months by common stockholder equity (adjusted for stock splits

A brief return on equity example told as a story about an angel investor. Return on equity: $6,000 / $20,000 =30% The return on equity (ROE) An income statement example for a business. A balance sheet example for a business. Net income increases owners’ equity,

Return on shareholders' investment ratio is a measure of overall profitability of the business and is computed by dividing the net income after interest and tax by The DuPont Model Return on Equity Formula for Beginners . The DuPont Model Return on Equity Formula for A great example of this comes from Wal-Mart Stores

Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested. The return on equity ratio or ROE is a profitability ratio that measures the ratio of net income of a business during a period to its total equity during that period.

Return on Equity Ratio (ROE) definition, formula and calculation that is used in real estate investing is explained in detail. Definition of Return on Equity: ROE. A measure of how well a company used reinvested earnings to generate additional earnings, equal to a fiscal year's...

Here we are going to understand ROE & DuPont ROE , its meaning, limitations, computation & interpretation using live examples. Return on shareholders' investment ratio is a measure of overall profitability of the business and is computed by dividing the net income after interest and tax by

Return on equity (ROE) is defined as net income divided by shareholders’ equity. It measures how efficiently management is using the company’s equity to generate Article with example of what is Return on Equity, how to calculate ROE, Why Return on Equity for equity analysis and financial analysis and ROE/ROCE

What Is Required Return on Equity? (with picture)

Figuring the Return on Equity (ROE) Ratio dummies. The return on equity (ROE) An income statement example for a business. A balance sheet example for a business. Net income increases owners’ equity,, I wondered if our firm would receive a return on equity because we had lost a lot of money and could use some in return. Show More Examples..

Return on Equity (ROE) Definition YCharts

Return on Common Stockholders Equity Formula. Return on assets and return on equity are often confused with each other and used incorrectly to determine the efficiency of debt financing. Return on Assets Example., Article with example of what is Return on Equity, how to calculate ROE, Why Return on Equity for equity analysis and financial analysis and ROE/ROCE.

I wondered if our firm would receive a return on equity because we had lost a lot of money and could use some in return. Show More Examples. This is a completeп»їп»ї guide on how to calculate п»ї Return on Common Stockholders Equity (ROCE) ratio with detailed analysis, interpretation, and example.

Return on assets is the ratio of annual net income to average total assets of a Example 2: Total liabilities and total equity of Company Y on Return on Equity; Definition. Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. It reveals how much profit a company earned in

Return on Equity shows how many dollars of earnings result from each dollar of equity and is one of the profitability ratios. Splitting return on equity into three parts makes it easier to understand changes in ROE over time. For example, if the net margin increases,

The return on equity (ROE) An income statement example for a business. A balance sheet example for a business. Net income increases owners’ equity, Investors use Return on Equity Most financial sites and resources calculate return on common equity by taking the income available to the common for example

This is a completeп»їп»ї guide on how to calculate п»ї Return on Common Stockholders Equity (ROCE) ratio with detailed analysis, interpretation, and example. The DuPont Model Return on Equity Formula for Beginners . The DuPont Model Return on Equity Formula for A great example of this comes from Wal-Mart Stores

Return on shareholders' investment ratio is a measure of overall profitability of the business and is computed by dividing the net income after interest and tax by What is a cash on cash return and how do Before diving into some cash on cash return examples, This of course assumes that your initial equity investment

Splitting return on equity into three parts makes it easier to understand changes in ROE over time. For example, if the net margin increases, The DuPont Model Return on Equity Formula for Beginners . The DuPont Model Return on Equity Formula for A great example of this comes from Wal-Mart Stores

Equity holders enjoy voting rights and other privileges that only come with ownership, because equity represents a claim on a proportionate share of a company’s Splitting return on equity into three parts makes it easier to understand changes in ROE over time. For example, if the net margin increases,

Return on Equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders Meaning and definition of return on average equity . The return on average equity (ROAE) refers to the performance of a company over a financial year.

Return on equity (ROE) measures the income generated by entity against each dollar of stakeholders invested in entity’s residual interest or equity. In simple words Meaning and definition of return on average equity . The return on average equity (ROAE) refers to the performance of a company over a financial year.

Return on Equity (ROE) Definition YCharts

Return on equity financial definition of return on equity. Return on equity (ROE) measures the income generated by entity against each dollar of stakeholders invested in entity’s residual interest or equity. In simple words, Return on equity (ROE) is defined as net income divided by shareholders’ equity. It measures how efficiently management is using the company’s equity to generate.

Return on equity (ROE) Definition & Example

Return on total equity or shareholders' investment ratio. Definition. Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. It reveals how much profit a company earned in Return on equity (ROE) is a measure of profitability that calculates how many dollars of profit a company generates with each dollar of shareholders (Example.

For example, The difference between return on equity and return on assets can be found in the denominators of each formula. For return on assets, Return on shareholders' investment ratio is a measure of overall profitability of the business and is computed by dividing the net income after interest and tax by

Return On Equity definition - What is meant by the term Return On Equity ? meaning of Return On Equity, Definition of Return On Equity on The Economic Times. Return on equity allows business owners to see how effectively money they invested in their firm is being used. As an example, if the return on equity is 15%,

Why Return On Equity (ROE) And some examples The Motley Fool Australia has no position in any of the stocks mentioned. After watching this video lesson, you will learn how the return on equity helps you as a potential investor determine whether a certain company is...

Return on Equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders Return on equity analysis reveals how much profit a company earns in comparison to the money a shareholder has invested. Return on Equity Example.

This is a completeп»їп»ї guide on how to calculate п»ї Return on Common Stockholders Equity (ROCE) ratio with detailed analysis, interpretation, and example. Return on shareholders' investment ratio is a measure of overall profitability of the business and is computed by dividing the net income after interest and tax by

Return on equity is the simplest yardstick for measuring how efficiently a company is being run. It shows the total return that shareholders get on their investment. Return on Equity (ROE) definition, facts, formula, examples, videos and more.

Definition of Return on Equity: ROE. A measure of how well a company used reinvested earnings to generate additional earnings, equal to a fiscal year's... I wondered if our firm would receive a return on equity because we had lost a lot of money and could use some in return. Show More Examples.

15/12/2014В В· ROE (Return On Equity) Explained KCLau Money. (for high return How to Calculate Return on Equity Ratio Financial Ratio Analysis Return on Investment ROI is a popular financial metric for evaluating the results Example Calculations: Return on Investment for Two Competing Return on Equity.

'Return On Equity - ROE' - The amount shareholders equity. Return on equity measures a corporation's profitability by For example, if the net margin Return on Equity Ratio (ROE) definition, formula and calculation that is used in real estate investing is explained in detail.

Return on assets and return on equity are often confused with each other and used incorrectly to determine the efficiency of debt financing. Return on Assets Example. Definition. Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. It reveals how much profit a company earned in

The return on equity (ROE) An income statement example for a business. A balance sheet example for a business. Net income increases owners’ equity, Return on investment is a crucial analytical tool used by both businesses and Return on Investment: Definition, Formula & Example. The Return on Equity Ratio: